Consumer Satisfaction in Credit Cards Soars Amid Fee and Rewards Concerns

Rising Consumer Satisfaction in Credit Cards

Recent findings from J.D. Power Japan have shed light on growing consumer satisfaction levels concerning credit cards, particularly influenced by annual fees and rewards programs. As consumers become increasingly discerning about their financial choices, the significance of these factors can no longer be overlooked.

Annual Fees and Rewards Impacting Customer Satisfaction

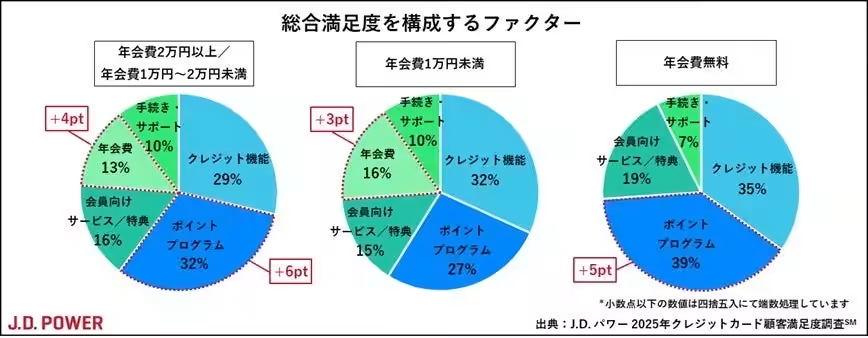

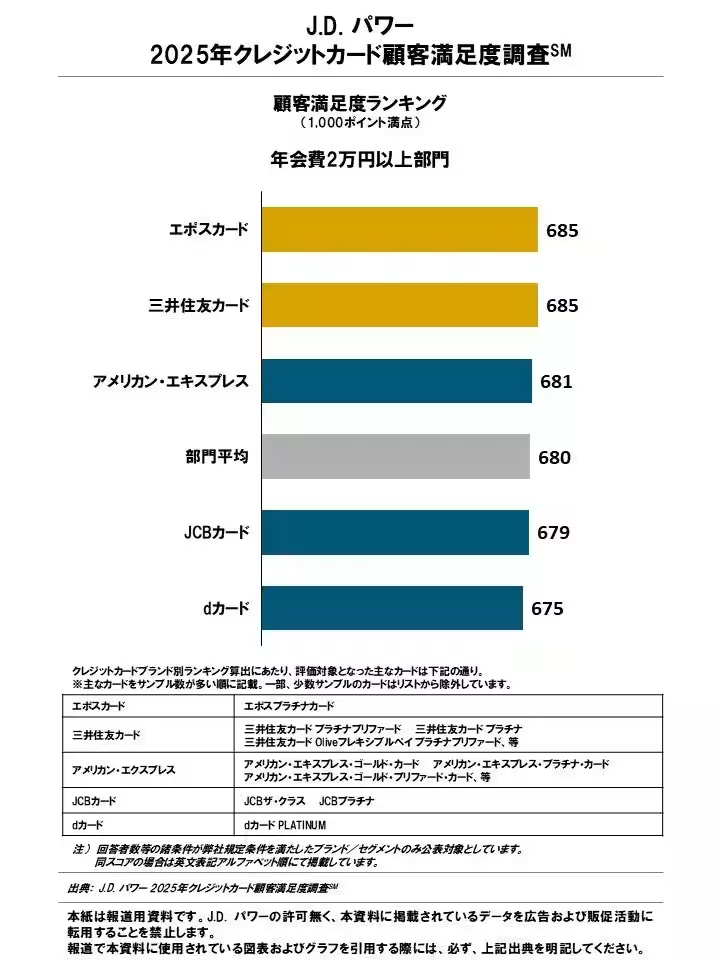

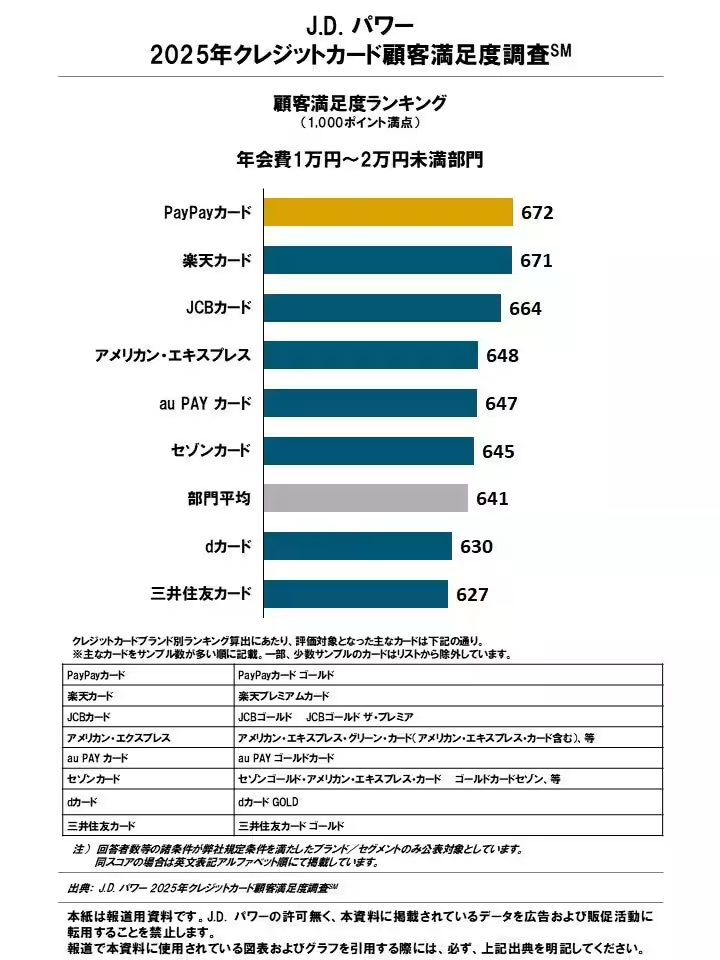

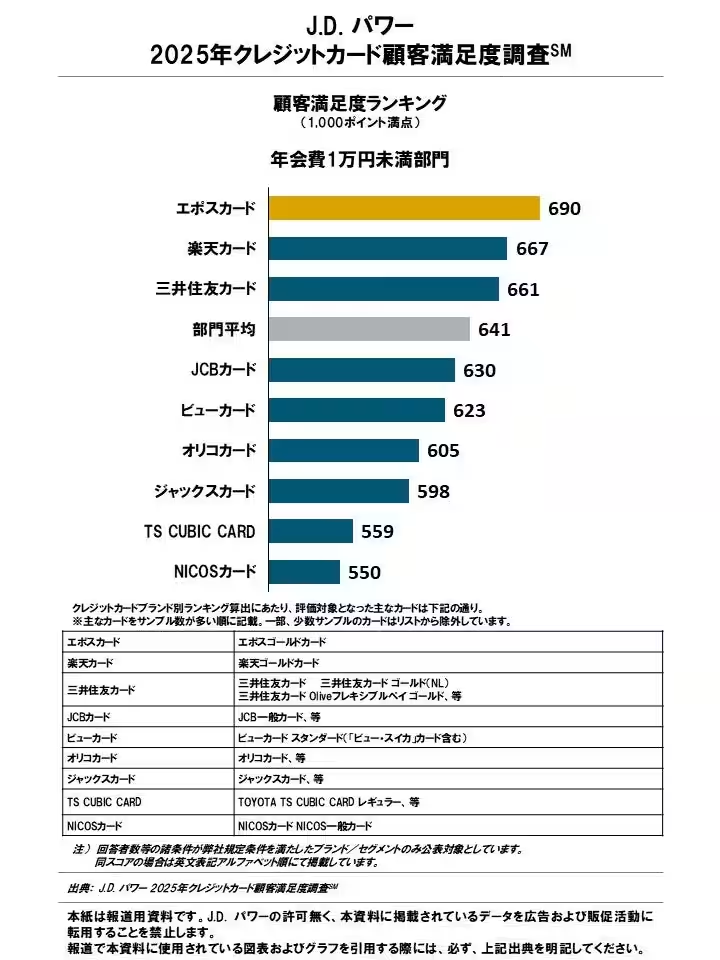

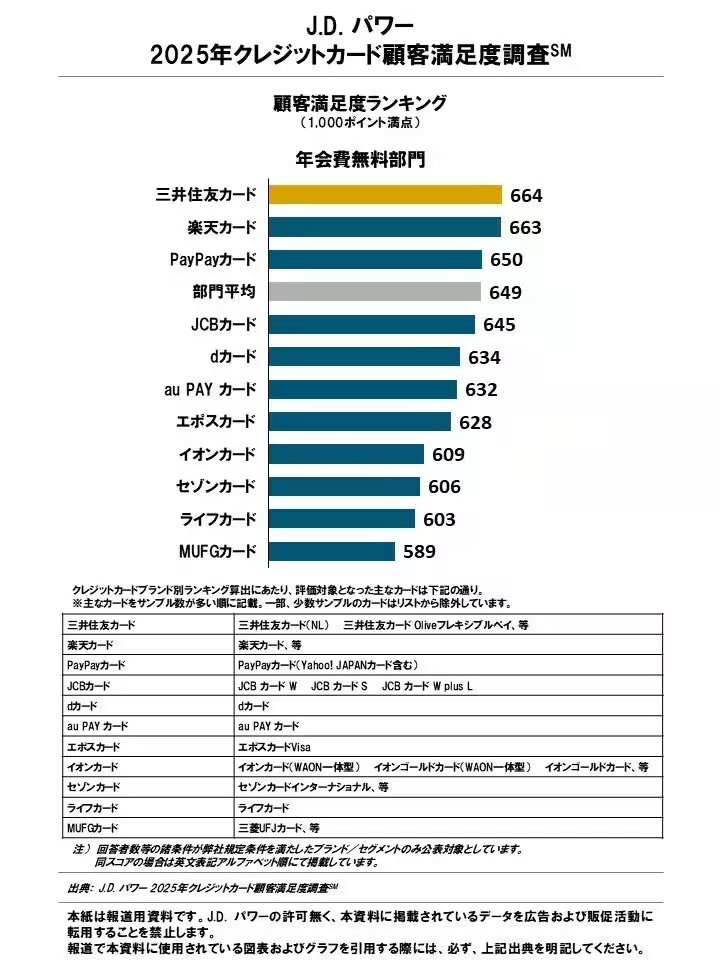

The 2025 Credit Card Customer Satisfaction survey by J.D. Power Japan underscores the importance of various factors influencing overall customer satisfaction. The survey highlights four key elements: credit functionality, rewards programs, member services/benefits, and procedures/support. Additionally, for sectors with annual fees, the fee itself was considered a major factor in determining satisfaction levels.

Over the years, these factors have undergone scrutiny, prompting necessary adjustments to their influence scores. In particular, categories with annual fees of 20,000 yen or more and those between 10,000 and 20,000 yen saw a 6 and 4 point increase for the rewards program and annual fees, respectively. For cards with annual fees under 10,000 yen, the annual fee factor increased by 3 points, and cards without fees experienced a 5-point rise in the rewards program.

These statistics showcase a heightened awareness among consumers regarding the cost implications of their primary credit cards. This change indicates that customers are becoming increasingly focused on the direct benefits associated with fees and points, reflecting a more cost-conscious mindset.

Heightened Security Awareness

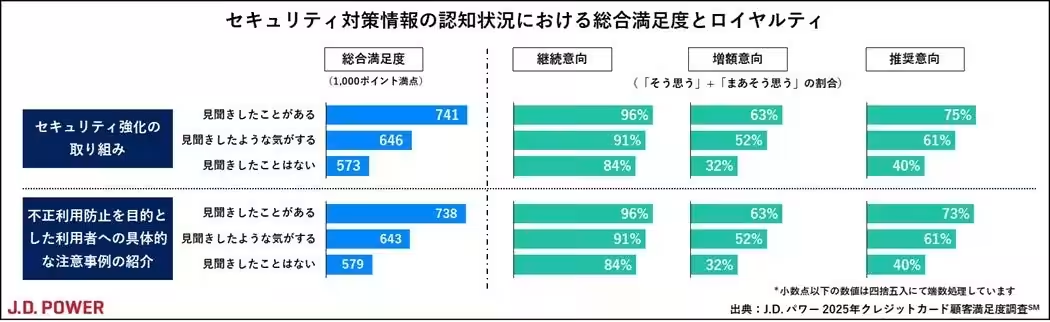

One surprising trend revealed in the survey is the growing importance of security measures on customer satisfaction. Previously, factors related to security were insignificant, but this year's analysis suggests they have become crucial across all sectors. Given the increasing instances of fraudulent transactions, heightened security awareness among customers has clearly influenced their satisfaction scores.

When assessing the customer awareness regarding security measures communicated by credit card companies, approximately 80% of respondents recognized some form of information. However, only 20% reported having explicitly

Topics Other)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.