Siiibo Securities Launches Underwriting Services to Boost Bond Issuance

Enhancing Startup Financing: Siiibo Securities' New Underwriting Initiative

Siiibo Securities Co., Ltd., based in Tokyo, has unveiled an exciting development in its bond issuance platform, Siiibo. The company has commenced underwriting services that allow securities firms to acquire a portion of the issued securities, effectively increasing the amount of bonds that can be issued through its financing services.

This initiative is a game changer for issuing companies, enabling them to easily gather substantial funds, especially for amounts exceeding 100 million yen. Siiibo Securities aims to boost flexible financing for unlisted companies, particularly startups, as they grapple with the increasing capital required for growth.

As businesses progress, especially during the latter part of their early stages and into middle stages, the necessity for funding rises. Startups need to invest wisely in resources to build a customer base and accelerate their operations while focusing on product validation, user growth, and revenue expansion. However, many startups often opt for operating at a loss to facilitate future growth, creating high barriers when seeking significant loans from a single financial institution for a set period. This issue has emerged as a key hurdle in discussions around funding, emphasizing the need for flexible, mid-to-long-term investment avenues.

With the initiation of underwriting by Siiibo Securities, companies can now issue larger bonds, which facilitates raising amounts over 100 million yen more effectively than before. This fund amount is a critical benchmark for startups striving to advance their operations. This enhanced capability allows startups to secure funds without diluting their equity through stock options, making the bond issuance process more appealing.

Benefits of Issuing Bonds through Siiibo

Utilizing Siiibo for bond issuance offers significant advantages. Firstly, it provides a pure debt financing method that does not require stock options, ensuring no dilution of shares. The average redemption period of 2 to 4 years allows for substantial flexibility in the allocation of funds, enabling investments in new businesses, M&A, and inorganic growth that maintain lower capital costs compared to equity financing. Moreover, there are no requirements for personal guarantees from management or financial covenants.

Even companies operating at a loss can leverage this opportunity with no industry restrictions. By taking advantage of the longer redemption period, businesses can defer their next equity funding rounds, aiming to reach profitability in the meantime. This flexibility is crucial for many entrepreneurs looking to navigate the financial landscape amidst growth challenges.

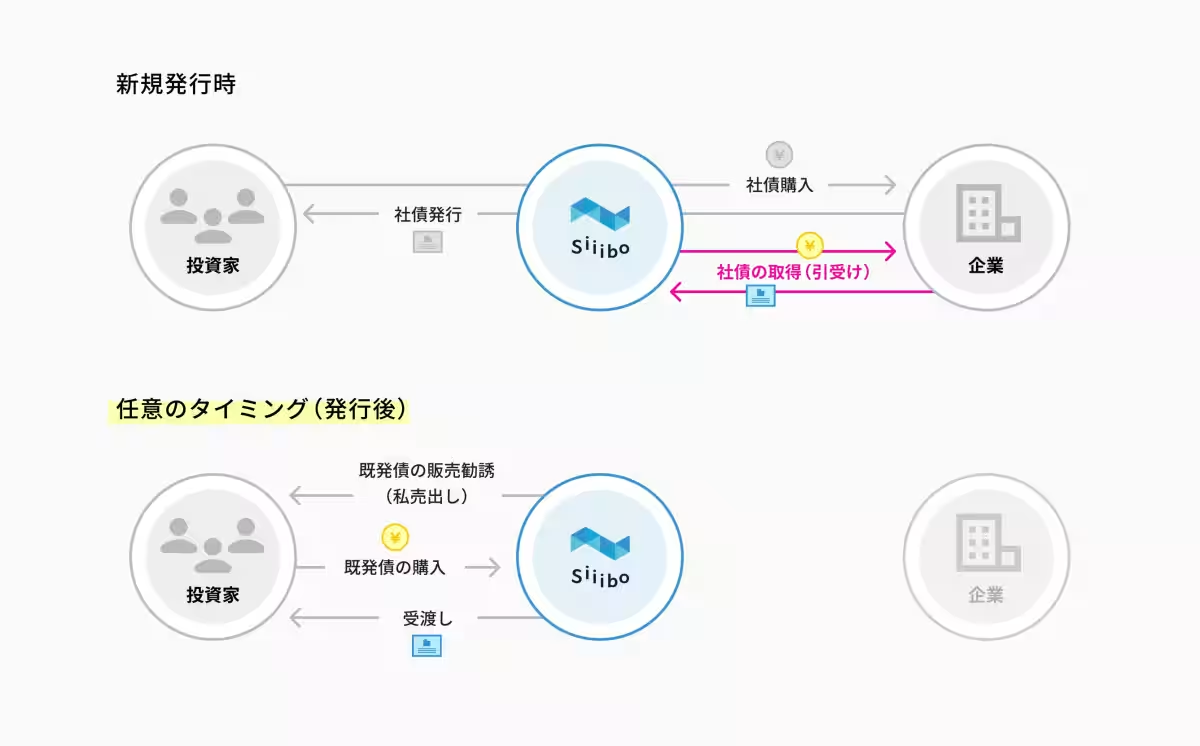

About the Underwriting Service

Underwriting involves securities firms acquiring all or part of the issued securities with the goal of selling them to investors. This practice is subject to stringent financial foundation requirements as well as certain standards in operational structure, personnel, and internal management. Recently, Siiibo Securities has strengthened its capital to 500 million yen and successfully completed registration for its underwriting services as of April 14, 2025.

With this new capability, Siiibo Securities provides faster and larger bond issuance opportunities for companies, while also enhancing purchasing opportunities for investors irrespective of issuance timing, thereby simplifying fundraising and asset management.

About Siiibo Securities Co., Ltd.

Siiibo Securities is dedicated to

Topics Other)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.