Upcoming Law to Promote Business Financing: Implications and Challenges

Introduction

In May 2026, the 'Law Concerning the Promotion of Business Financing' will come into effect. This legislation aims to encourage lenders to base their financing decisions on a company's future potential and business activities, rather than relying heavily on collateral, guarantees, and past performance. However, this shift in perspective may not be as straightforward as anticipated for many small and medium-sized enterprises (SMEs).

Current Landscape of SME Financing

A recent survey conducted by Financing Support Professional Co., Ltd. (FSP), a financial consulting firm based in Minato, Tokyo, revealed a troubling sentiment among SME leaders regarding financing evaluations. Many entrepreneurs expressed feelings of uncertainty, stating they often lack a clear understanding of how their future potential is weighed during loan assessments. This survey included responses from 306 business owners who secured funding in the last three years and highlights a significant gap between the intended goals of the new law and the current lending practices.

1. Feeling Undervalued in Loan Reviews

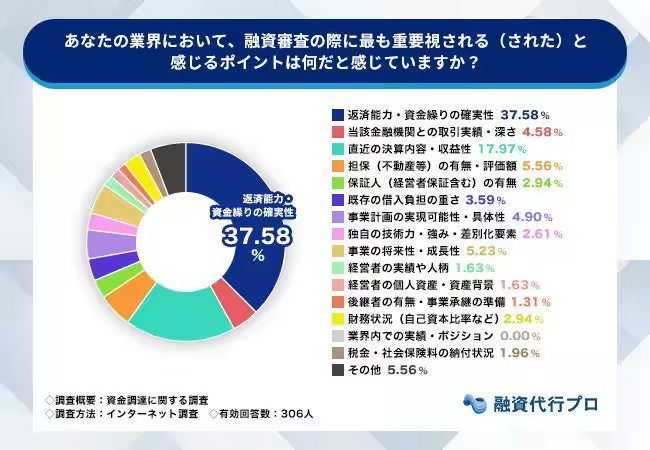

The survey revealed that a staggering 37.6% of SME leaders believe that repayment ability and liquidity are the most critical factors in loan assessments. In contrast, only 4.9% felt that the feasibility and specificity of their business plans were considered, while just 5.2% thought future growth potential was recognized. This suggests that despite the forthcoming legal changes promoting business-based evaluations, the reality is that many SMEs still feel their future potential is not being adequately acknowledged.

2. Confusion Over Evaluation Criteria

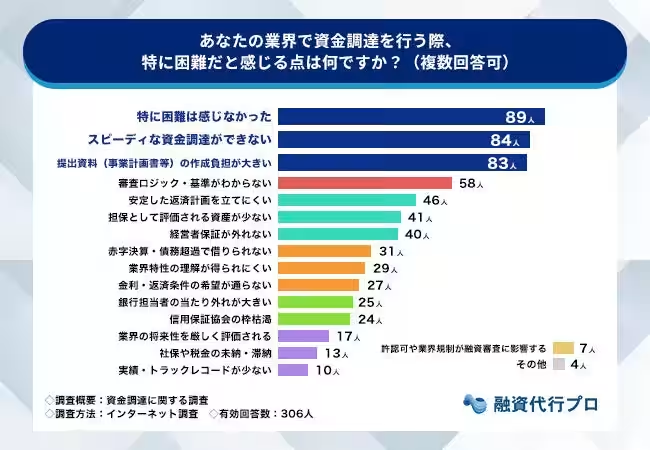

Among those surveyed, 19.2% reported difficulty in understanding the evaluation criteria used during the loan application process. Additionally, over 21% stated that negotiating favorable interest and repayment terms is challenging due to the lack of clarity in how they are assessed, while 19.6% expressed difficulty in accurately determining the appropriate loan amount. This confusion leads to a situation where business leaders must face evaluation processes without fully understanding the underlying standards.

3. Limited Opportunities for Learning About Financing

Most SME leaders typically engage with financing only once every two to three years, making it difficult to keep abreast of the specific evaluative methods used by various financial institutions. Given the demands of running their businesses, many owners struggle to find time to study financing and financial management thoroughly. This lack of experience can foster a sense of anxiety when dealing with lenders and financing processes.

Moreover, in the financing discussions, obstacles such as the inability to secure rapid funding (27.5%) and a substantial burden of preparing necessary documents (27.1%) frequently arise. It appears that the lengthy and complex nature of the current loan procedures, combined with an unclear understanding of the evaluation criteria, amplifies the stress associated with acquiring financing.

4. Challenges Faced by Financial Institutions

In conversations with financial institutions, the team at FSP perceives a dual challenge: these organizations find it increasingly difficult to understand a business's operational viability in their evaluations. The pressures from branch consolidations and staff reductions increase the workload on individual loan officers, limiting their capacity to assess and provide tailored support to businesses.

Additionally, as the interest rates rise, many financial institutions are diversifying their services beyond just lending, seeking to secure revenue through various financial products, thus detracting from their core mission of supporting businesses.

Conclusion

The survey findings illustrate that SMEs struggle with significant obstacles in their financing efforts, including feelings of undervaluation and a lack of clarity in the evaluation process. As the new law promoting business financing approaches, it is vital for organizations like FSP to guide SMEs in understanding how they are assessed and prepared for financing discussions. "Determining how evaluations are conducted and what criteria are prioritized is crucial because many business owners find themselves navigating loan processes without a clear understanding of what evaluators are looking for," remarks Kotaro Okajima, President of FSP.

About Financing Support Professional Co., Ltd.

FSP has assisted over 5,500 clients in securing funds and improving financial health. By leveraging its extensive network and financial insights, FSP supports clients through the loan application process, from document preparation to negotiations with financial institutions. Companies struggling with financing complexities can benefit from FSP’s consulting services, which include free consultations for hesitant business owners seeking clarity on loan conditions and fundraising strategies.

Contact Information: For inquiries regarding interviews or consultations, please reach out through our contact form.

Topics Financial Services & Investing)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.