Turning 25: Insights from the Latest DC Pension Survey of 36,000 Participants

Exploring the Landscape of Defined Contribution Pensions: Key Insights from the 36,000-Person Survey

As the Defined Contribution (DC) pension system marks its 25th anniversary on October 1, recent research conducted by the Defined Contribution Pension and Research Institute (DC Hiroken) and Urata Financial Consulting Lab sheds light on the current state of retirement savings in Japan. This comprehensive survey, encompassing responses from 36,496 individuals aged 20 to 60, offers valuable insights into people's understanding and utilization of DC pensions, aiming to address key challenges in the system.

Key Findings from the Survey

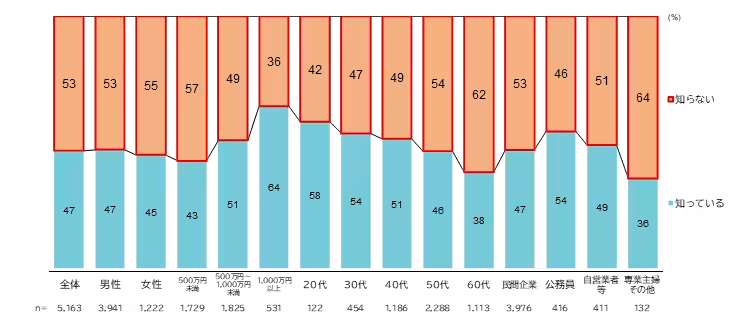

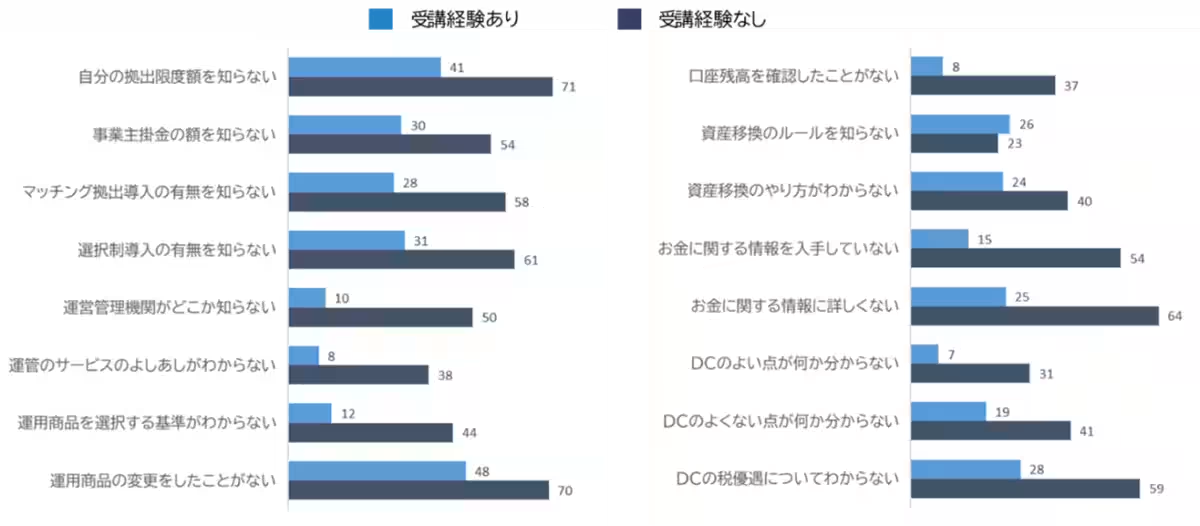

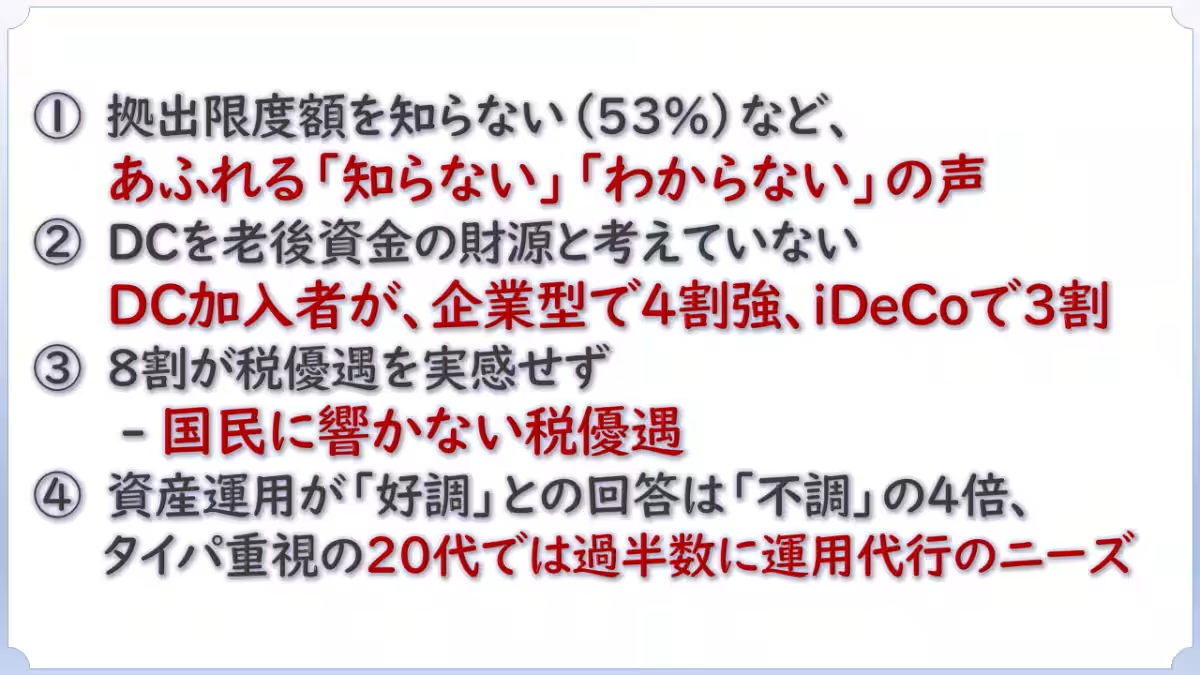

One of the striking revelations from the survey is that approximately 30% of participants feel that their DC investments are successful. While this indicates a level of confidence among some investors, it also highlights a potential gap, as nearly 53% admitted to not knowing their contribution limits. Additionally, 45% were unaware of the amount contributed by their employers, and a significant 33% did not understand how to change investment products. These statistics demonstrate that despite the longevity of the DC system, many individuals remain uninformed about fundamental aspects of their pensions.

In comments by the representative of DC Hiroken, Shigeichi Takikawa emphasized the importance of understanding the current state of DC as it serves as a supplementary system to public pensions. With plans for expansion in the coming year, it becomes crucial for stakeholders to engage in open discussions about the challenges facing the DC system and explore potential solutions to enhance its effectiveness.

Urata Haruka from Urata Financial Consulting Lab provided a contrasting perspective, noting that even though many participants consider their investments to be performing well, a significant portion of them do not regard DC pensions as a primary source for their retirement funds. This raises a critical issue, as many individuals cited the complexity of the system and insufficient contribution limits as deterrents to engaging actively with their DC pensions. Additionally, the survey indicated a troubling trend concerning the

Topics Other)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.