Tokyo Metropolitan Area New Detached Housing Prices Trend Analysis for March 2025

Trends in New Detached Housing Prices in Tokyo Metropolitan Area - March 2025

The real estate landscape in the Tokyo metropolitan area continues to show significant upward movement in the prices of newly constructed detached homes, according to a recent analysis commissioned by AtHome Corporation from AtHome Lab Inc. This study explores the price trends and offers insights into the current market dynamics as of March 2025.

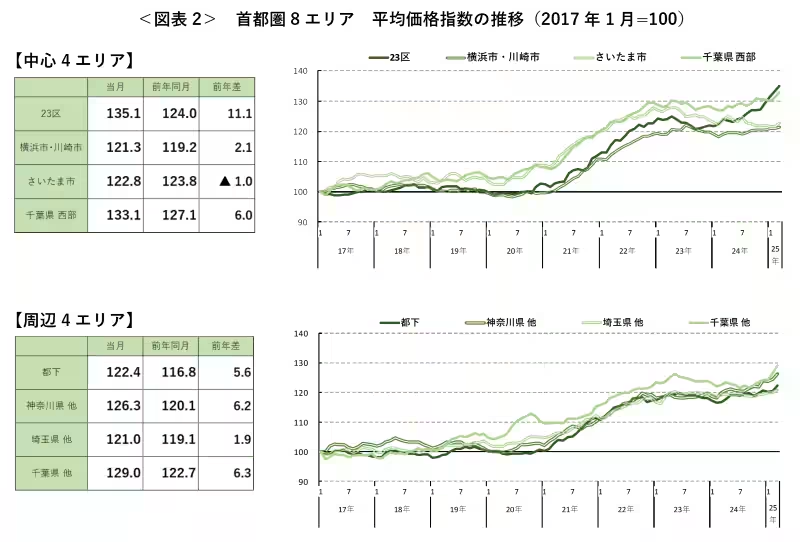

Overview of Price Trends

As of March 2025, the average price of newly built detached houses in the Tokyo metropolitan area reached 47.24 million yen. This marks a 1.4% increase compared to the previous month and represents a 4.0% rise from the same month last year. Notably, this is the second consecutive month of price growth, indicating a steady recovery and increase in demand for housing.

Regionally Significant Increases

Among the regions analyzed, six areas of Tokyo, Kanagawa, Saitama, and western Chiba have recorded the highest prices since January 2017. In particular, the Tokyo 23 wards have continued to experience a remarkable price surge, with the average price increasing for eight consecutive months, outpacing increases seen in other metropolitan regions.

Broader Trends Beyond the Capital

In addition to the Tokyo metropolitan area, other prefectures, including Miyagi, Aichi, Osaka, Hyogo, Hiroshima, and Fukuoka, have also observed rising prices, achieving their highest levels since early 2017. Excluding Hokkaido and Kyoto, all other areas have seen price increases when compared to the same period last year, with six areas recording notable growth.

Monthly Public Price Data

Areas Covered Monthly

The analysis includes data from the following areas:

- - Tokyo (23 wards and surrounding areas)

- - Kanagawa (Yokohama and Kawasaki)

- - Saitama (Saitama City and surrounding areas)

- - Chiba (Western region including cities like Kashiwa and Matsudo)

Quarterly Reported Areas

For areas reported quarterly, the list includes:

- - Hokkaido

- - Miyagi

- - Aichi

- - Kyoto

- - Osaka

- - Hyogo

- - Hiroshima

- - Fukuoka

Methodology

The findings reflect average listing prices (sale expectations) for detached homes registered by consumers on the AtHome real estate platform. This study uniquely identifies overlapping properties to ensure accurate price representation and reporting.

Conclusion

In summary, the Japanese housing market, particularly in the Tokyo metropolitan area, is witnessing a robust price increase that seems to point towards sustained consumer interest and investment potential. The consistent growth over multiple months suggests a strong market recovery as demand continues to outweigh supply. Individuals looking to invest in real estate should consider these trends when making their purchasing decisions. For further detailed insights and statistical breakdowns, readers are encouraged to download the full report from the AtHome website here.

Topics Consumer Products & Retail)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.