Survey Report Unveils Insights on Insurance and End-of-Life Planning Practices

Insights from the Survey on Insurance and End-of-Life Planning

The recent survey conducted focuses on the intersection of insurance enrollment and end-of-life planning, known as 'shukatsu' in Japanese. The aim was to gain insights into the actual enrollment situation, the timing of policy reviews, and how families share information about insurance. The findings highlight the role of insurance as a critical component not only for comfort during life but also for supporting families after death, serving as essential preparatory measures.

Key Survey Questions

This survey posed a variety of questions aimed at understanding the landscape of insurance in relation to end-of-life planning:

- - What type of insurance do you prioritize the most?

- - When was the last time you reviewed your insurance policy?

- - What is the biggest motivation for reviewing your insurance?

- - Whose opinions do you trust the most when choosing your insurance?

- - Have you recognized insurance as essential in your end-of-life planning?

- - Are you enrolled in any policies that cover funeral expenses or posthumous procedures?

- - To what extent do you communicate about your insurance with your family?

- - How are your insurance documents stored?

- - What concerns you the most about insurance at your current stage in life?

- - What information do you believe would be helpful from an end-of-life planning perspective?

Key Findings

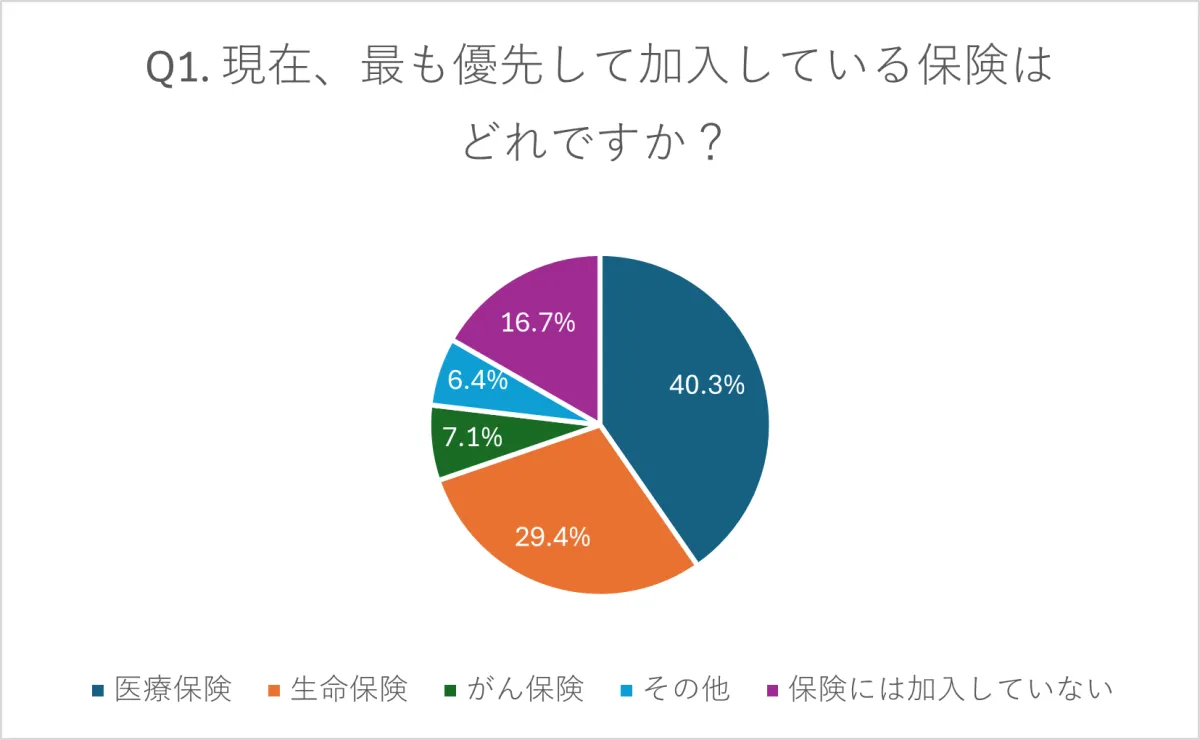

1. Insurance Prioritization

The survey revealed that 40.3% of respondents prioritize health insurance, followed by life insurance at 29.4% and cancer insurance at 7.1%. Notably, 16.7% of participants do not hold any insurance, indicating potential gaps in coverage or economic constraints.

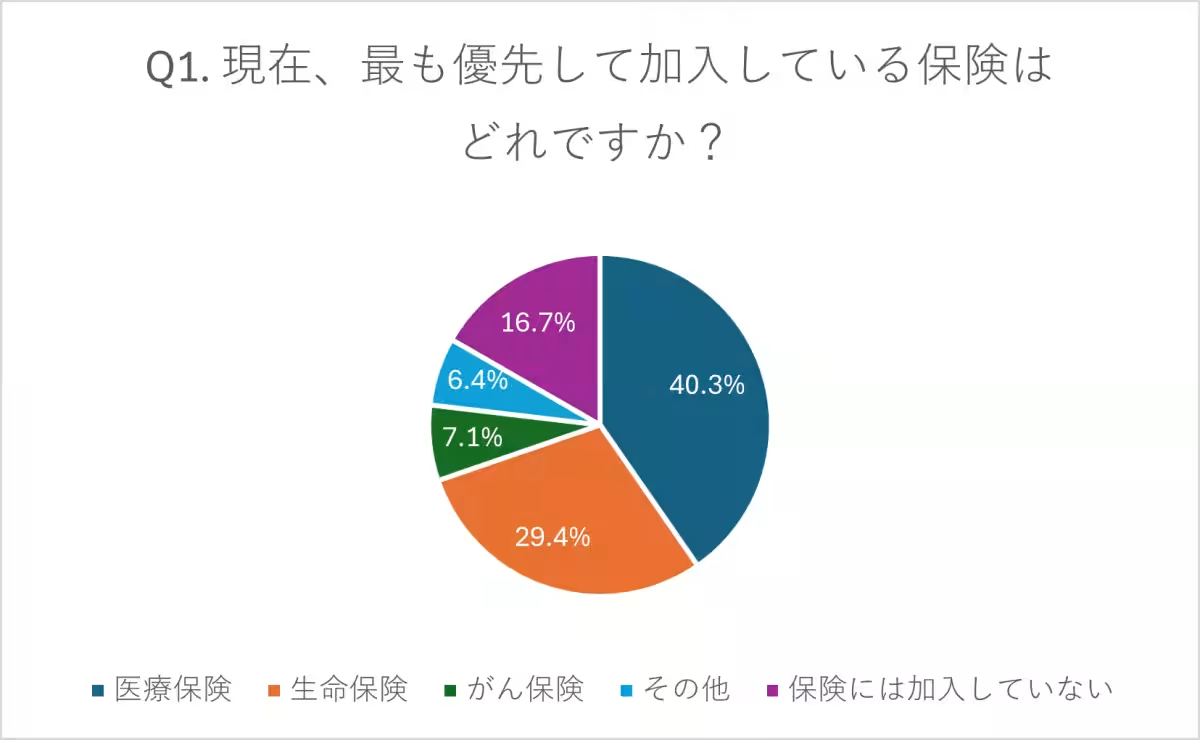

2. Policy Review Status

Approximately 31.9% of respondents had reviewed their policies within the last year, while another 22.7% had done so within the past three years. This suggests that close to half of insurance holders are regularly assessing their coverage. However, 18.6% have not reviewed their policies in over three years, which raises concerns about the relevance of their coverage.

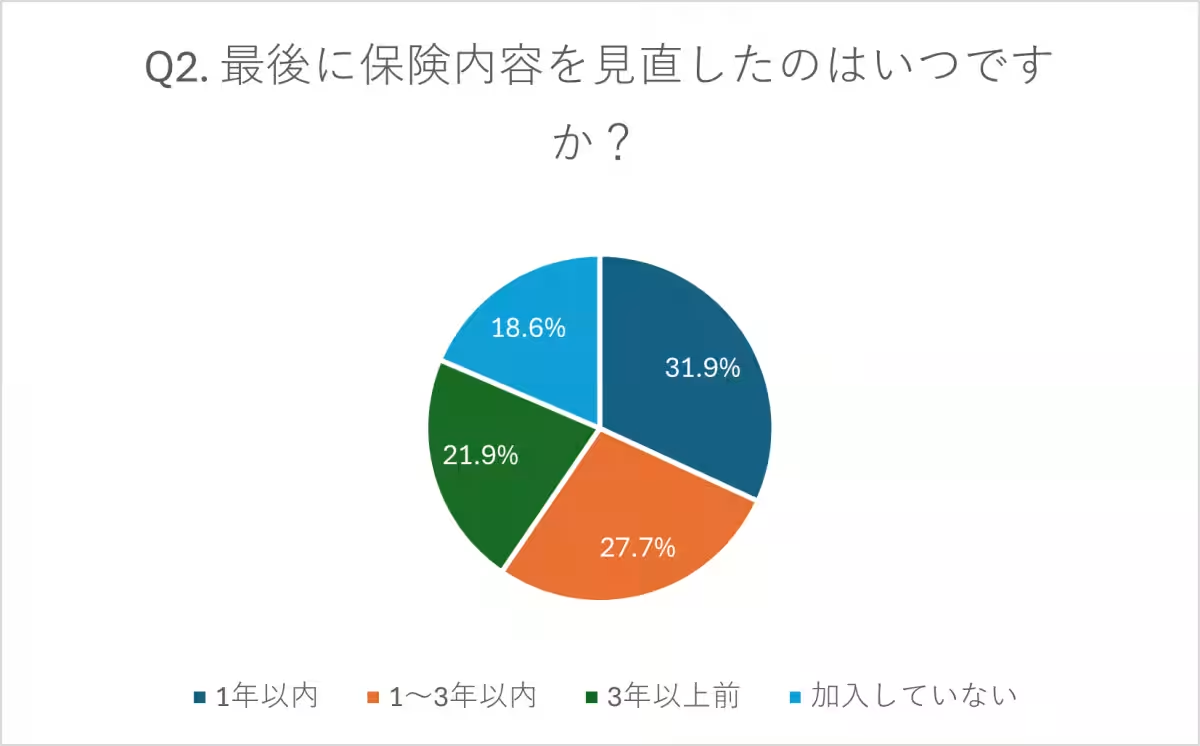

3. Motivation for Policy Review

When asked about motivations for reviewing insurance policies, 42.4% cited high premium costs, and 25.8% felt the need to reassess due to aging or health concerns. The desire for organized information as part of end-of-life planning accounted for 10.7% of responses.

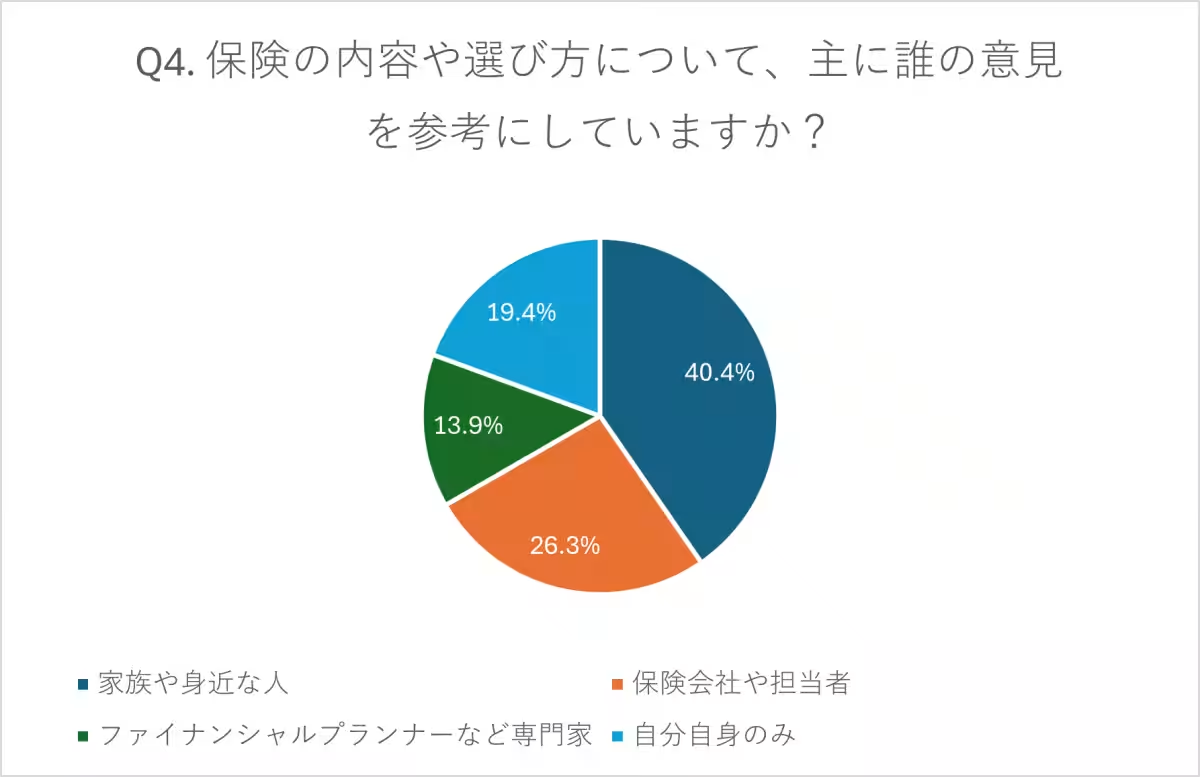

4. Source of Insurance Advice

40.4% of participants consulted family or close friends when selecting insurance, while 26.3% turned to insurance companies or agents. This highlights a reliance on personal networks over formal financial advice, as only 13.9% consulted financial experts.

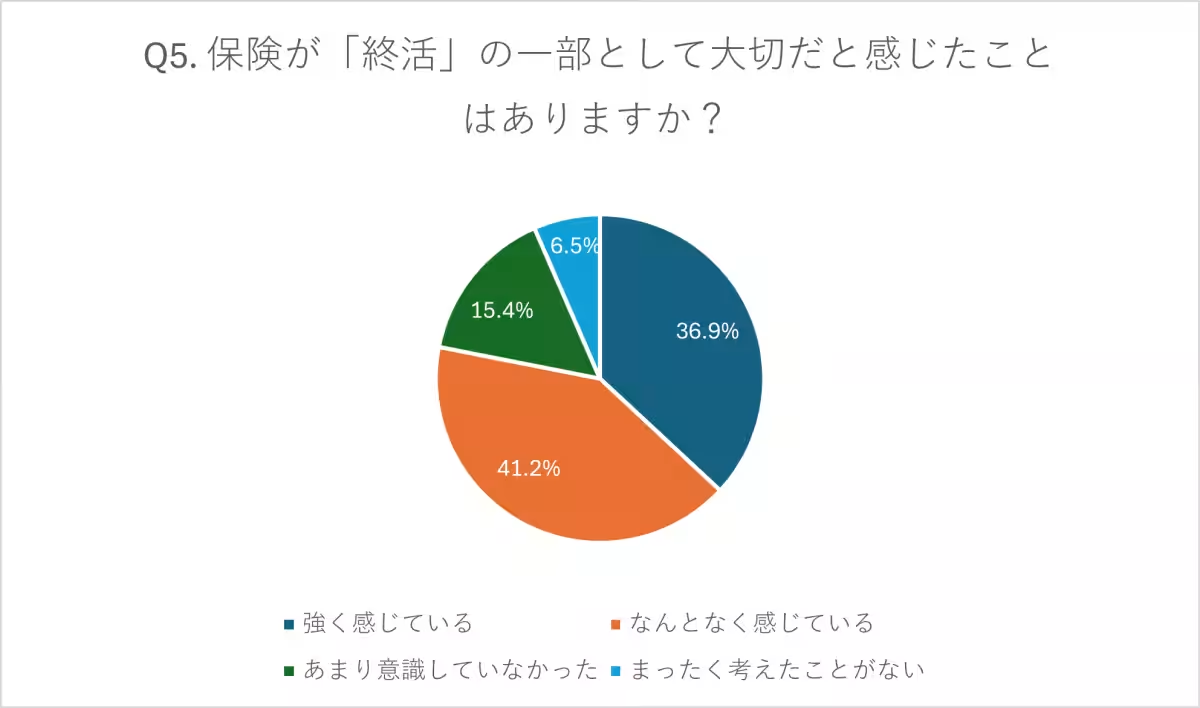

5. Recognition of Insurance in End-of-Life Planning

A significant 78.1% of respondents acknowledged the importance of insurance in end-of-life planning, with 36.9% expressing strong recognition. These statistics indicate a growing awareness of the need to consider insurance as a vital part of end-of-life arrangements.

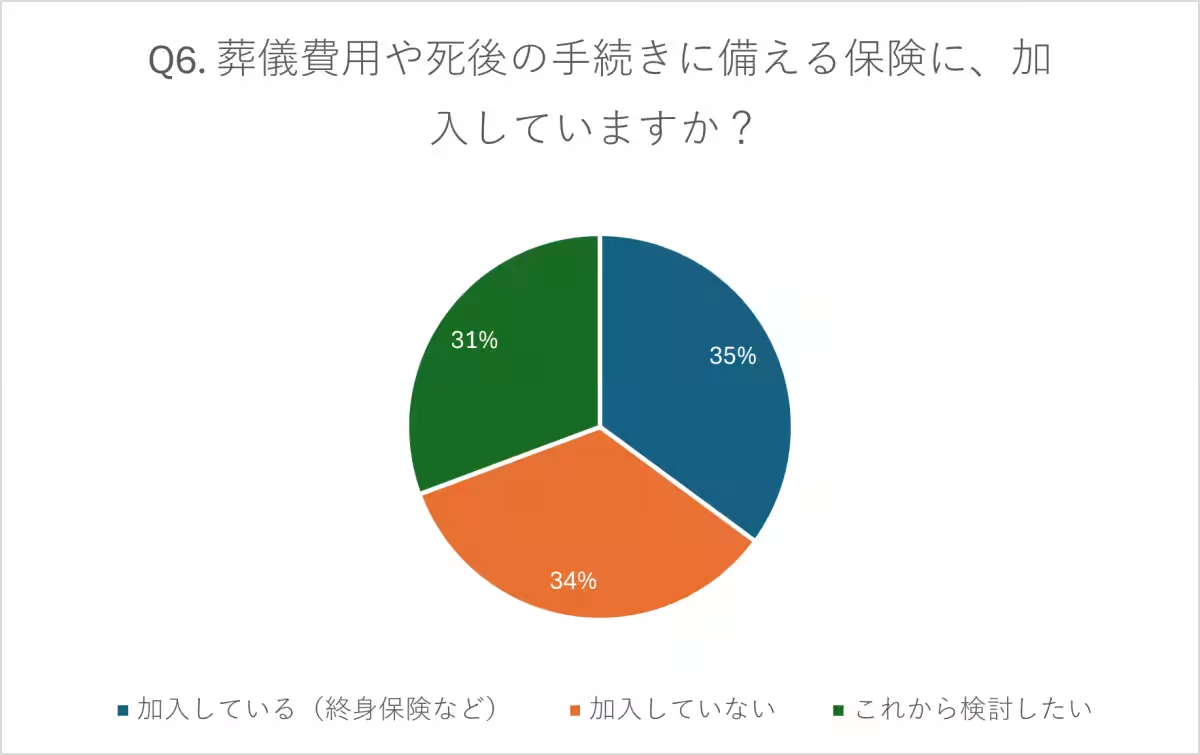

6. Coverage for End-of-Life Expenses

The survey indicates that 35% of respondents are enrolled in policies that prepare for funeral costs or posthumous processes. Meanwhile, 34% do not have such insurance, and 31% are considering it, demonstrating a clear interest in planning for these significant expenses.

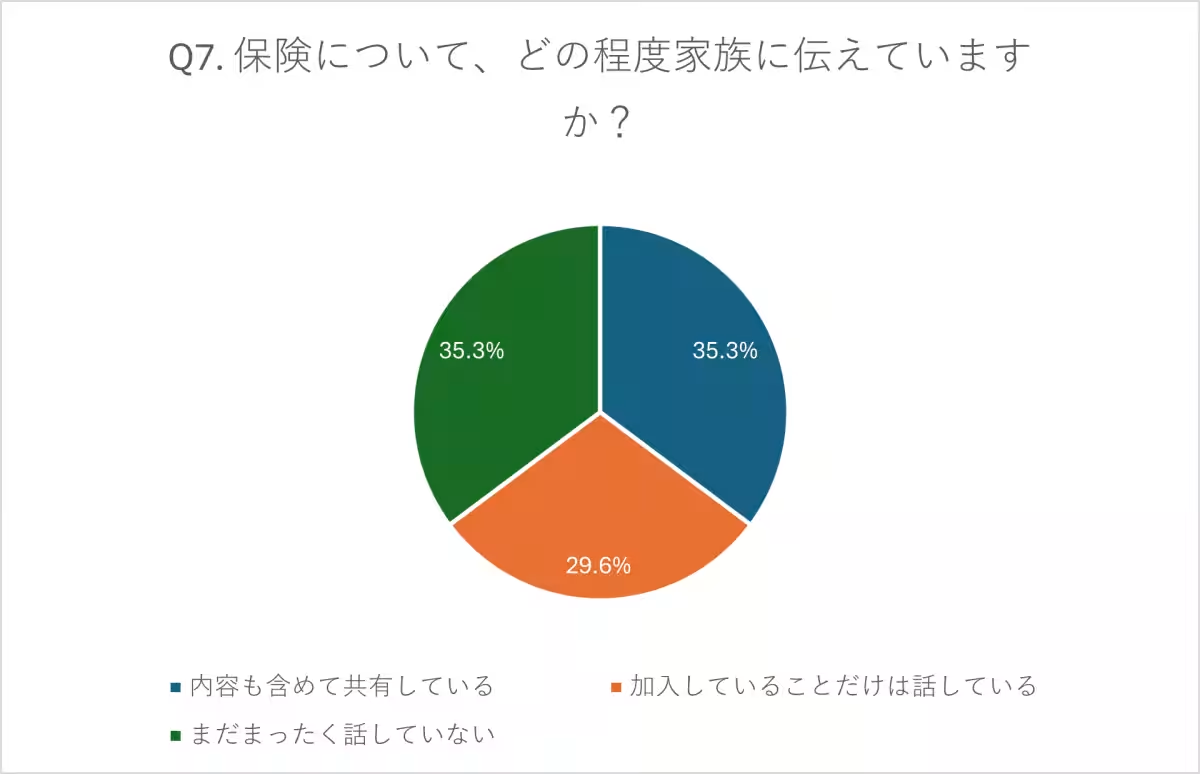

7. Family Communication

When it comes to discussing insurance, 35.3% of respondents openly share their policy details with family, whereas another 35.3% do not discuss it at all, revealing a stark contrast in communication practices.

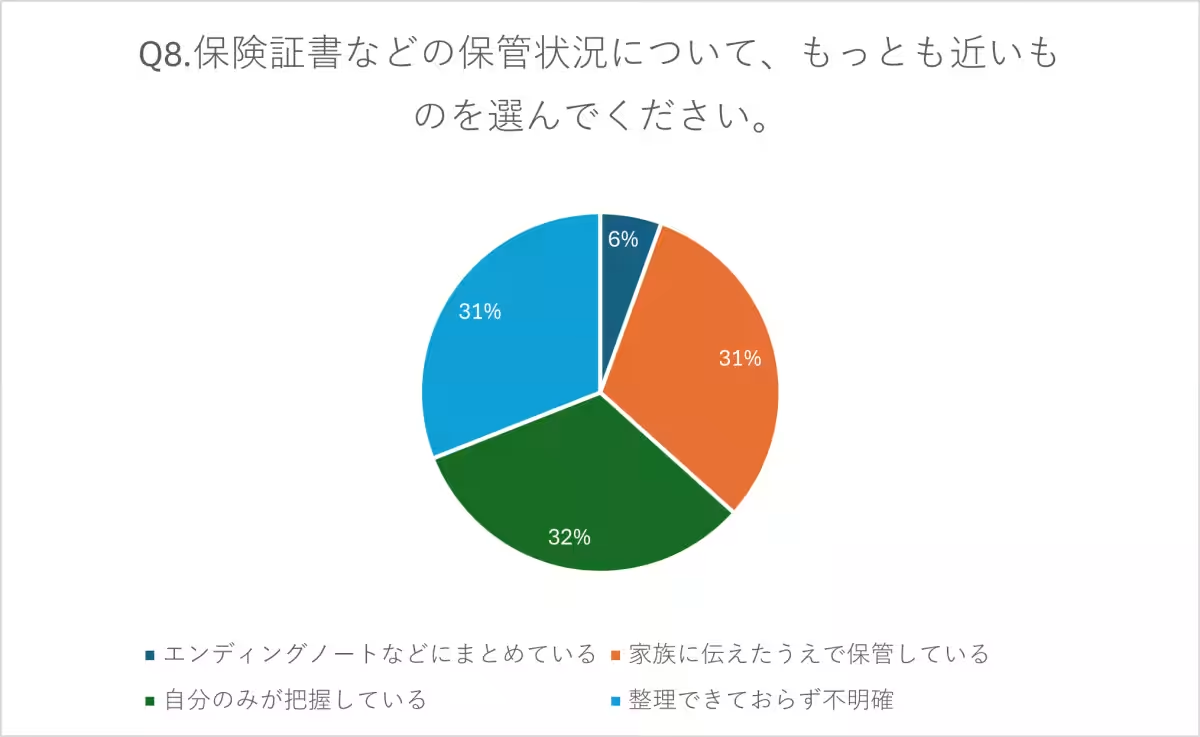

8. Document Storage Practices

Only 6% of respondents maintain organized end-of-life notes, while 32% store insurance documents solely for themselves. This implies that a better system of resource sharing may be needed, with only 31% of participants communicating their storage methods with family members.

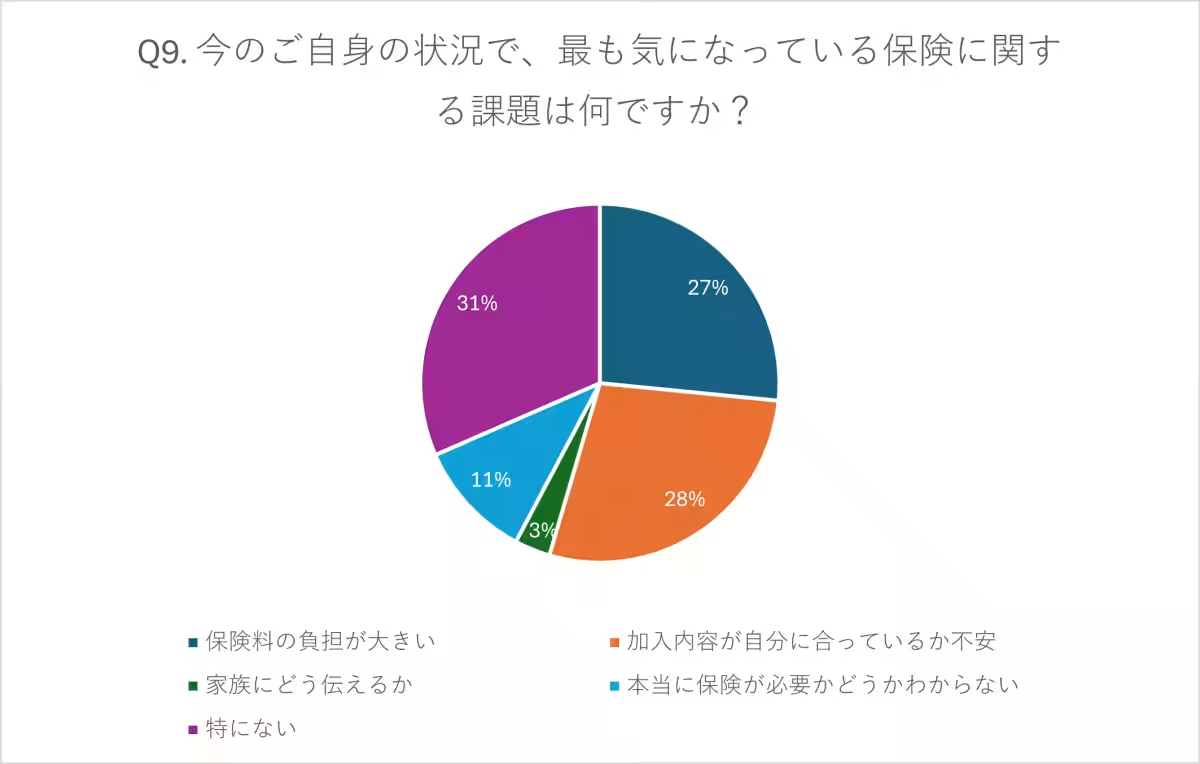

9. Current Concerns Related to Insurance

About 28% of respondents express concern regarding the adequacy of their insurance coverage, while 27% are worried about the financial burden.

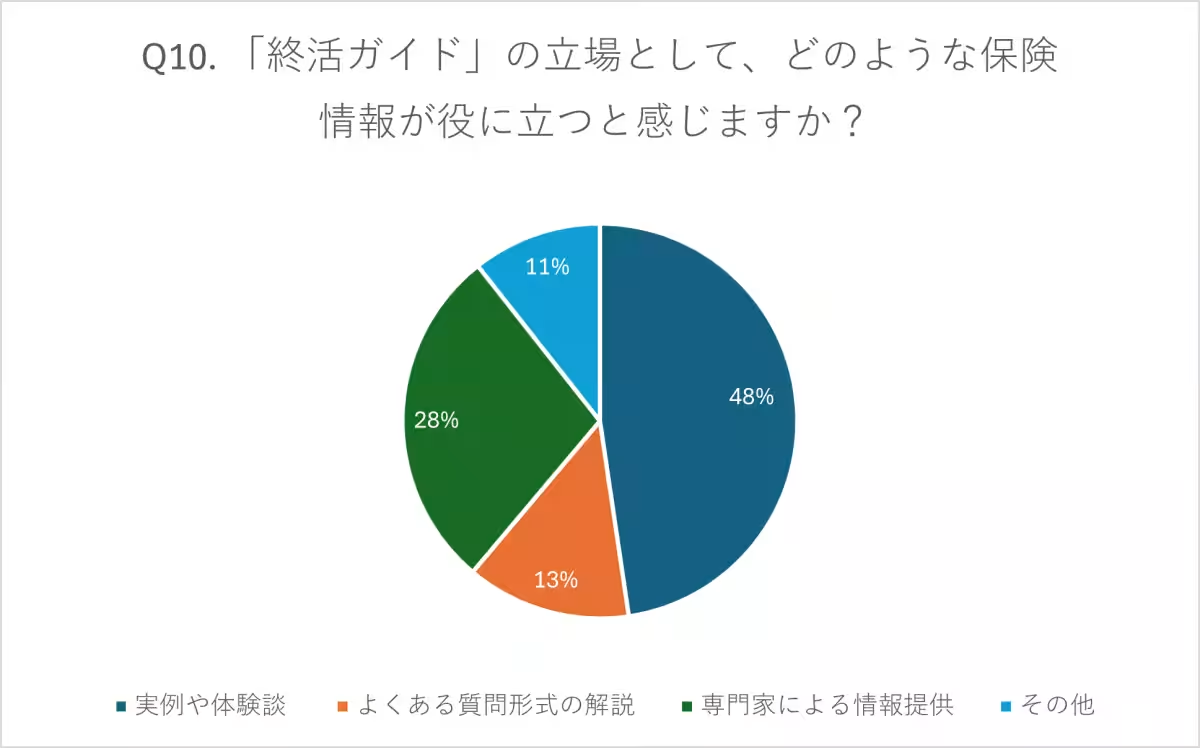

10. Information Needs for Effective Planning

Respondents indicated that 48% find real-life examples and experiences the most helpful in understanding insurance, showcasing a demand for relatable and practical advice.

Conclusion

Given these insights, it’s clear that insurance serves as a crucial element of end-of-life planning for many. The survey's findings will guide the development of resources and support necessary to assist individuals in their planning journeys. The General Incorporated Association Shukatsu Council and the Omoi Group are committed to providing comprehensive support and enriching information for individuals navigating these important decisions.

Research Overview

- - Participants: 556 (individuals with qualifications in end-of-life planning)

- - Duration: June 5 - June 30, 2025

- - Methodology: Online survey

About the Organization

Founded in 2015, the General Incorporated Association Shukatsu Council focuses on helping those facing challenges related to end-of-life planning, providing a range of services from consultations to qualifications in shukatsu guidance.

Topics People & Culture)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.