Survey Reveals Real Estate Investors' Strategies Amid Rising Interest Rates and Property Costs

Understanding the Current Landscape of Real Estate Investment Strategies Amid Rising Interest Rates

In light of escalating interest rates and increasing property and material costs, Kenbiya, a subsidiary of LIFULL focused on real estate investment information, has conducted a comprehensive survey. Targeting 350 experienced real estate investors, the survey sought insights into the prevailing strategies amidst these challenging market conditions.

Key Findings of the Survey

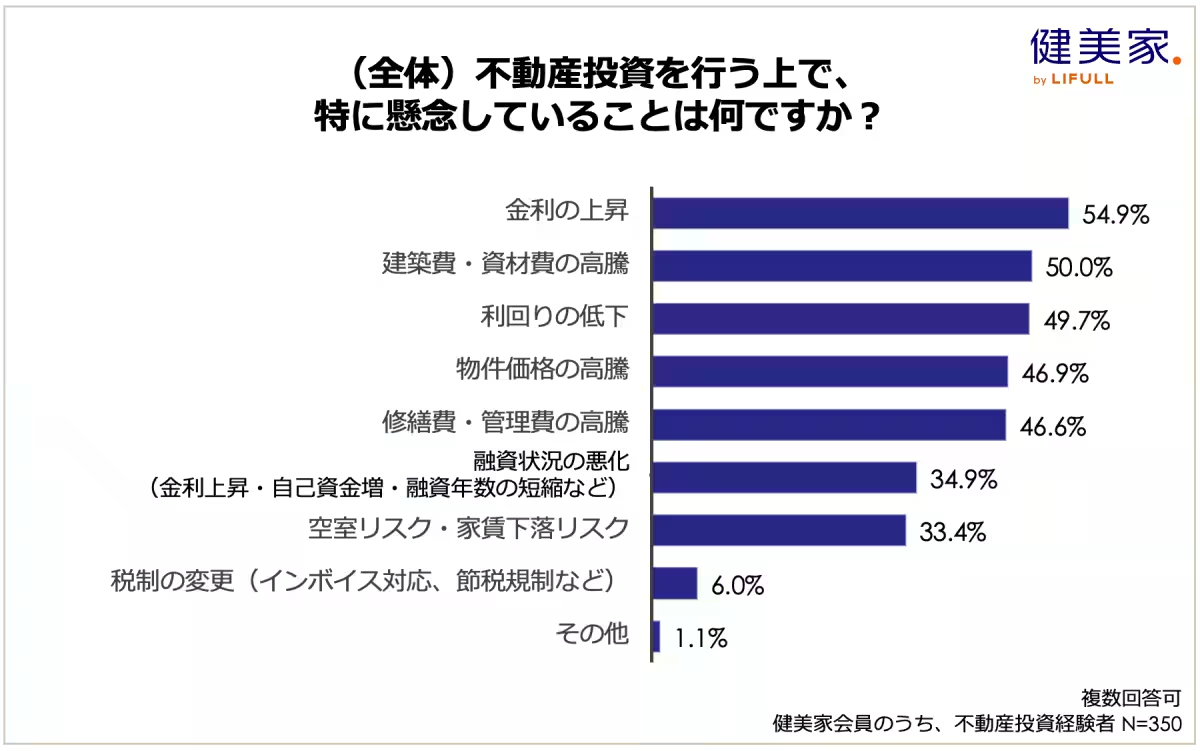

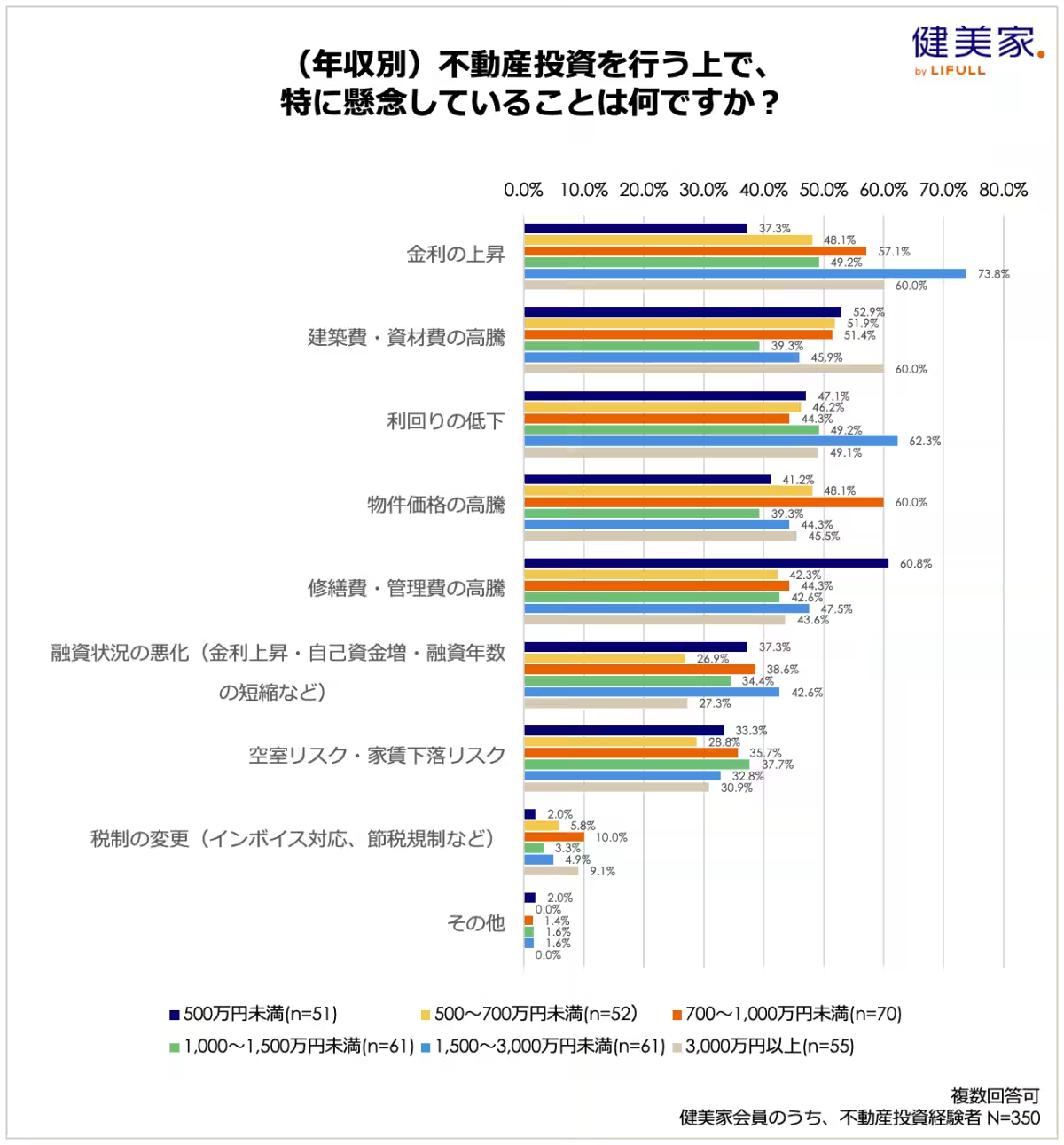

1. Major Concerns

The survey revealed that the primary concerns for investors revolve around interest rate hikes (54.9%) and surging construction and material costs (50.0%). A significant portion of investors expressed anxiety over declining yields (49.7%) and rising property prices (46.9%).

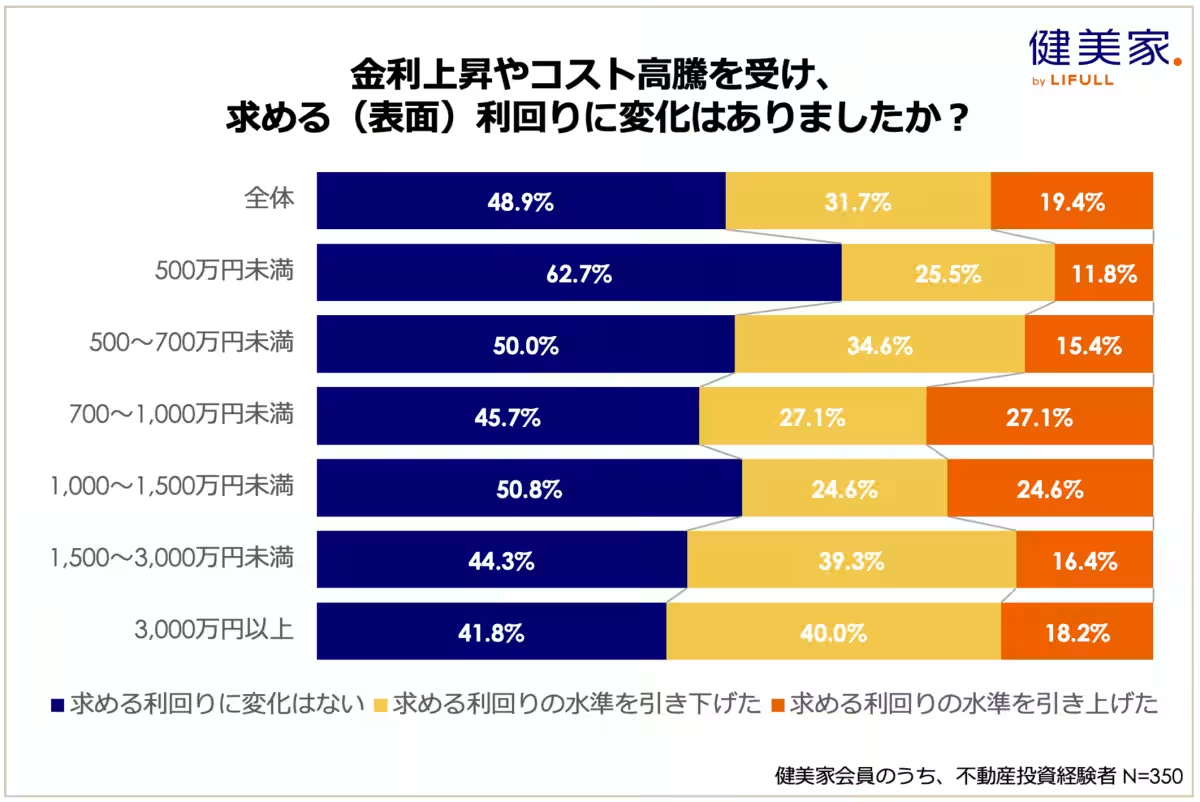

2. Yield Expectations

Interestingly, nearly half of the respondents (48.9%) indicated no change in their yield expectations. However, 31.7% reported a decrease in the yields they hope to achieve, while 19.4% aimed for higher returns.

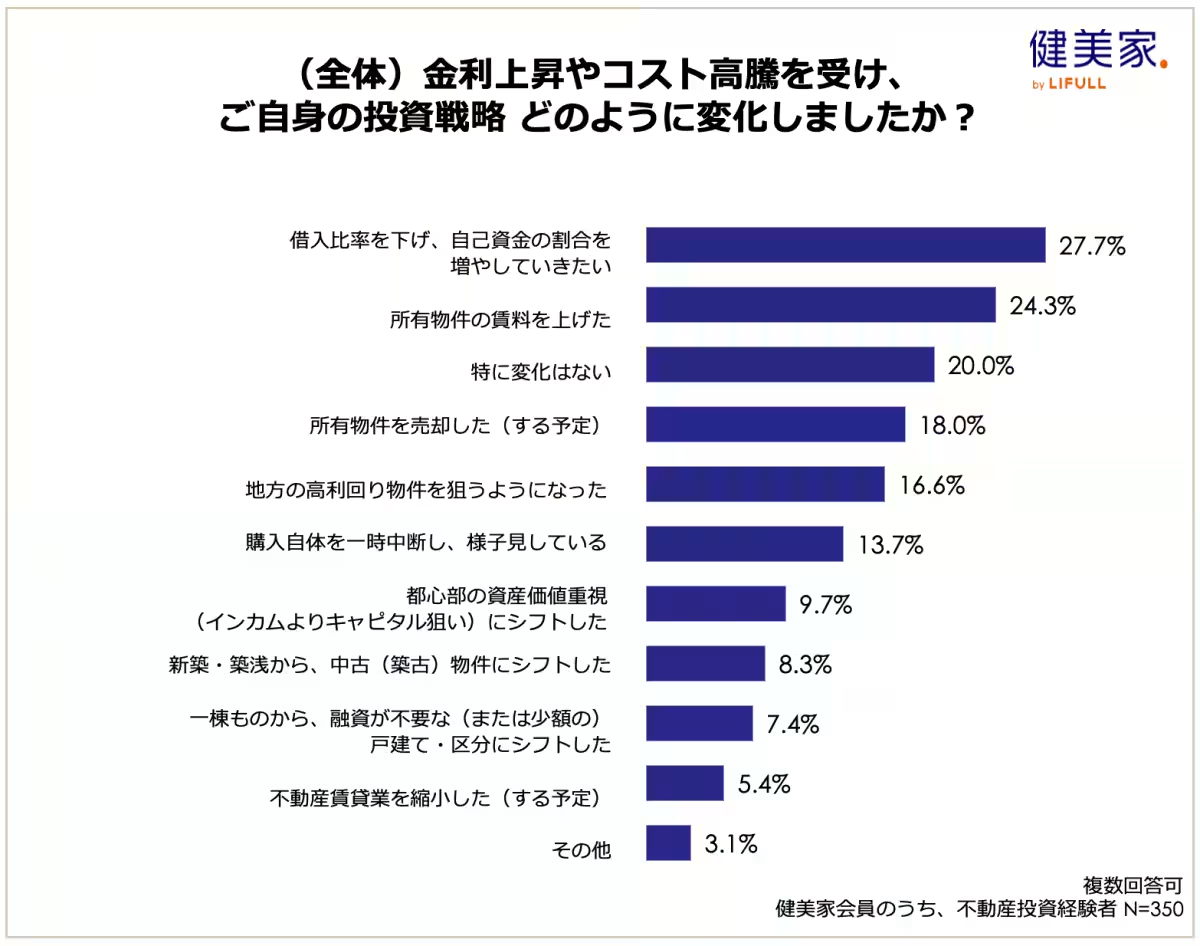

3. Strategic Adjustments

When it comes to strategic shifts in investment, the most common response (27.7%) was a desire to lower borrowing ratios and enhance personal funding. Following that, 24.3% raised the rents of their owned properties as a means of adjusting to the current economic climate.

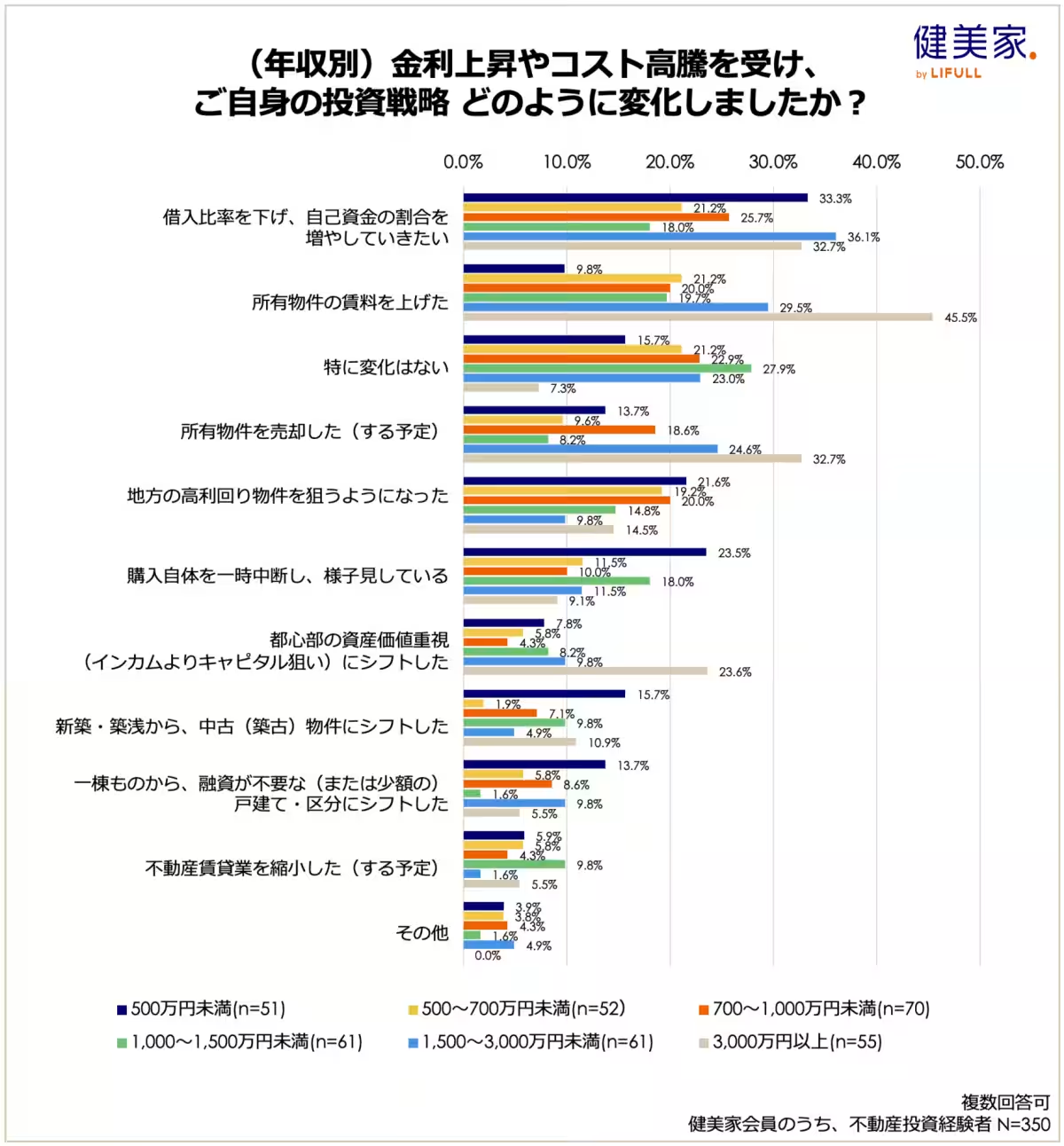

Analysis by Income Bracket

The survey further highlighted distinct strategies based on income levels, illustrating a polarization in approaches to tackling the ongoing economic challenges.

Investors Earning Below 10 Million Yen

For those earning less than 10 million yen annually, concerns primarily revolved around repair and management cost increases. Specifically, 60.8% of those earning less than 5 million yen noted rising management costs as their primary concern, with only 37.3% citing interest rates as significant. For respondents in the 7 to 10 million yen bracket, 60.0% expressed worries about property price hikes.

This group displayed a noticeable trend towards seeking lower-priced properties, with some suspending purchases entirely to reassess the market. Notably, 62.7% of those earning less than 5 million yen reported no changes to their yield expectations, focusing instead on waiting for more favorable conditions.

Investors Earning Above 15 Million Yen

Conversely, those in the higher income brackets, particularly those earning between 15 and 30 million yen, demonstrated substantial concern over interest rates (73.8%) and yield declines (62.3%). The strategies here skewed towards lowering yield expectations while securing more personal equity, aiming for properties with stronger urban asset values. For instance, 36.1% mentioned a desire to decrease borrowing ratios while increasing personal funding.

Divergence in Investors’ Strategies

The survey results indicate a clear divergence in approaches among different income groups. Investors earning beneath 10 million yen tended to focus on lowering costs and adjusting to market conditions through lower-priced, more manageable assets. In contrast, their wealthier counterparts were more inclined to adapt their strategies to continue investing in premium urban properties despite increasing costs and changing financial conditions.

In summary, this survey illuminates how rising interest rates and property prices impact real estate investors differently, prompting distinct strategies that reflect their financial realities. The stark contrast between lower and higher-income investors illustrates the nuanced landscape of real estate investment today, necessitating tailored responses to the evolving market dynamics.

Conclusion

Overall, as the terrain of real estate investment transforms under economic pressures, investors find themselves at a crossroads, making critical decisions that could define their financial futures in the face of uncertainty.

About the Survey

- - Survey Period: October 29, 2023 - November 12, 2023

- - Methodology: Internet-based questionnaire

- - Participants: 350 registered members with real estate investment experience from Kenbiya

For more detailed information about Kenbiya and its services in real estate investment, visit Kenbiya and LIFULL HOME'S.

Company Overview

- - Company Name: Kenbiya Co., Ltd.

- - Headquarters: Chiyoda-ku, Tokyo, Japan

- - CEO: Ryosuke Naruse

- - Established: April 2004

LIFULL, a parent company listed under the TSE Prime market (2120), aims to address diverse social issues to enhance the lives of individuals through its various real estate and living service initiatives.

Topics Other)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.