Analysis of Employment Trends in Japan: July 2025 Wage Growth Rate Ranking by Prefecture

Analysis of Employment Trends in Japan: July 2025 Wage Growth Rate Ranking by Prefecture

In July 2025, a detailed analysis of employment trends across Japan has revealed insightful statistics regarding wage growth from nine major job listing platforms. Frogg Inc., located in Chiyoda, Tokyo, provided critical insights into changes across various employment types including part-time, temporary, and full-time jobs. Let's delve deeper into these statistics and understand the prevailing trends in wages.

Wage Growth Overview

This recent analysis utilized big data gathered from the leading job platforms:

- - Part-Time: "Ei-adem", "Baitoru", and "Mynavi Baito"

- - Temporary Employment: "Hatarako.net" and "En Haken"

- - Full-Time: "Doda", "Type", "En Ten Shoku", and "Mynavi Ten Shoku"

According to the Japan Economic Newspaper, the Central Minimum Wage Council set forth recommendations for the minimum wage threshold on July 24, with discussions surrounding adjustments intensifying as the deadline in October approaches. This report provides an insightful look into how wages have shifted across different prefectures in Japan. Here’s a breakdown of the current wage trends by employment type.

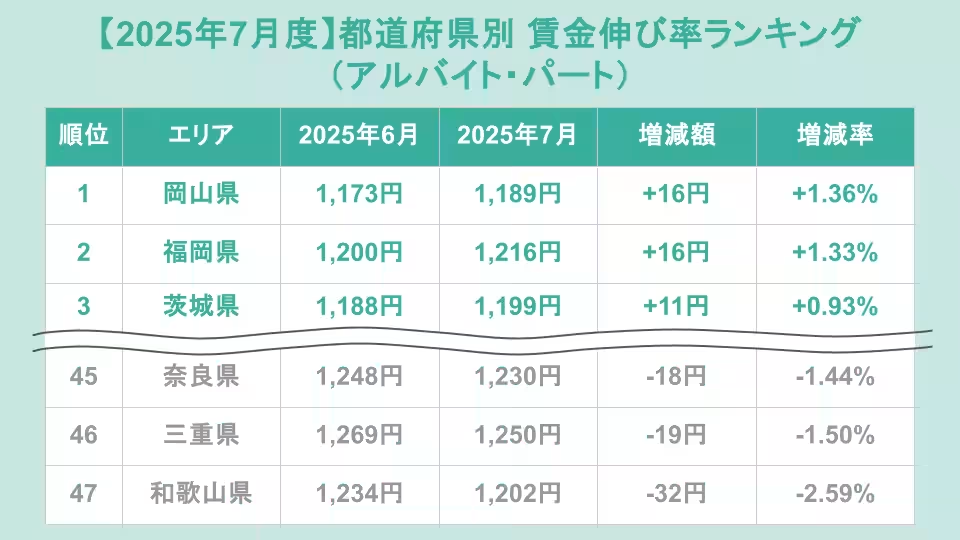

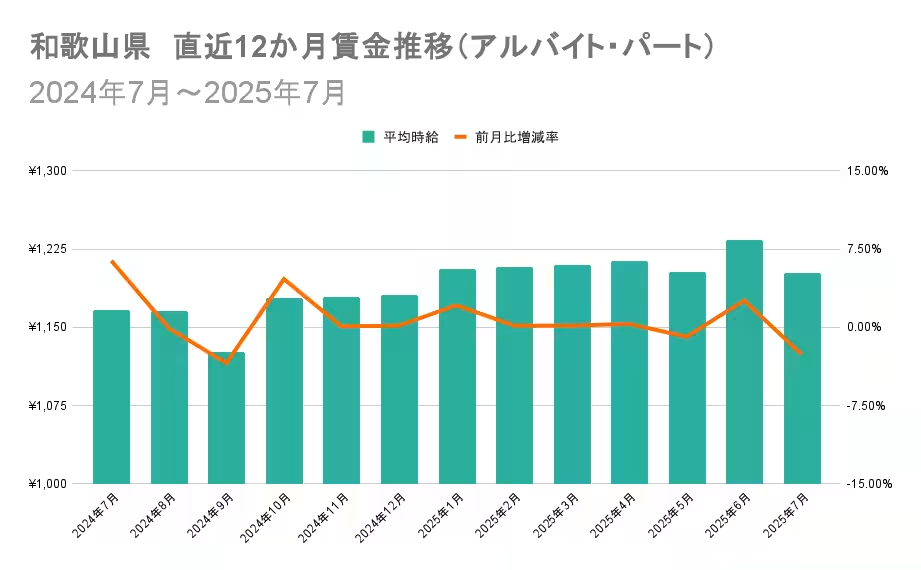

Part-Time Wage Trends

In the part-time wage category, the top three prefectures exhibiting increases in July compared to the previous month were:

1. Okayama with a growth of +1.36%

2. Fukuoka with an increase of +1.33%

3. Ibaraki with a rise of +0.93%

Conversely, the three prefectures that showcased wage decreases were:

1. Nara (-1.44%)

2. Mie (-1.50%)

3. Wakayama (-2.59%)

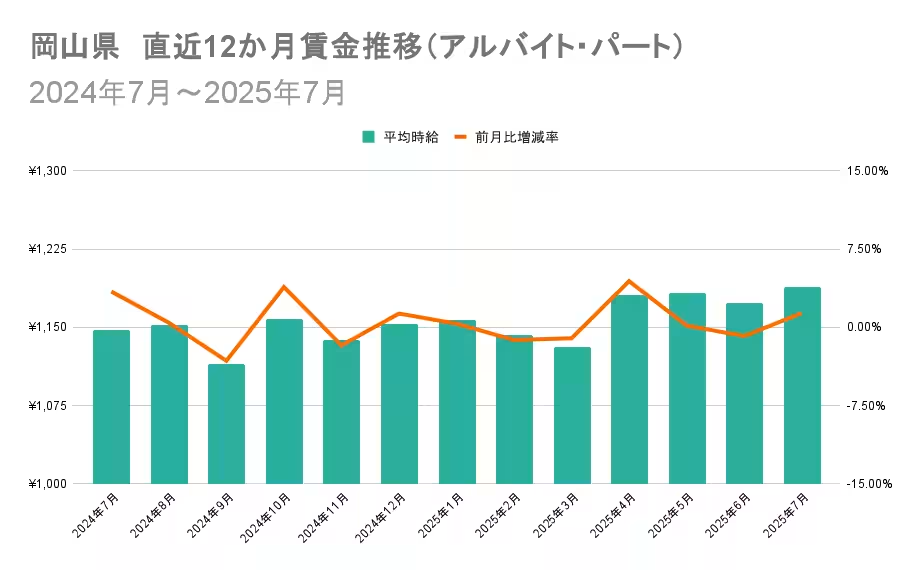

A comparison of wage trends over the past 12 months indicates that Okayama, peaking at 1,180 yen in April 2025, has maintained this stability, whereas Wakayama’s average wage has fluctuated around 1,200 yen, peaking at a record 1,234 yen in June before sliding to 1,202 yen in July.

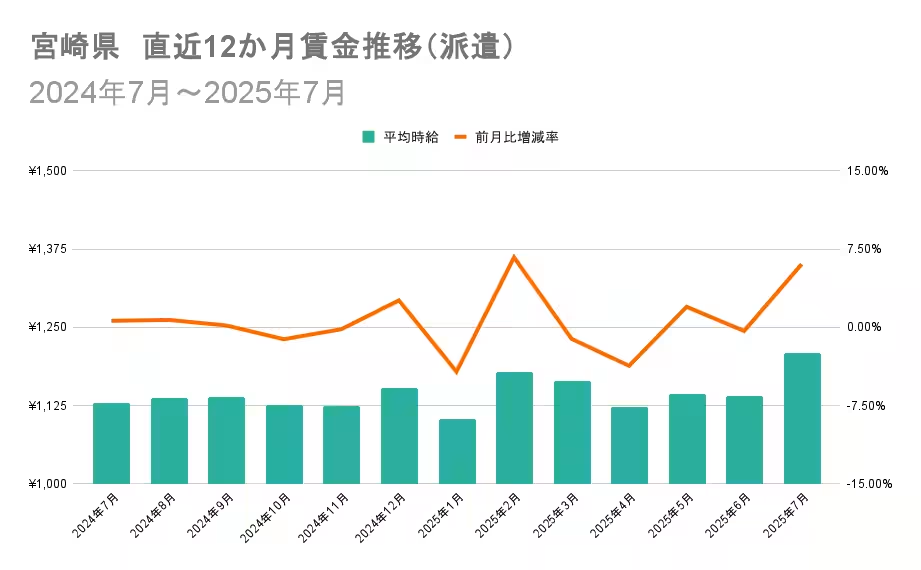

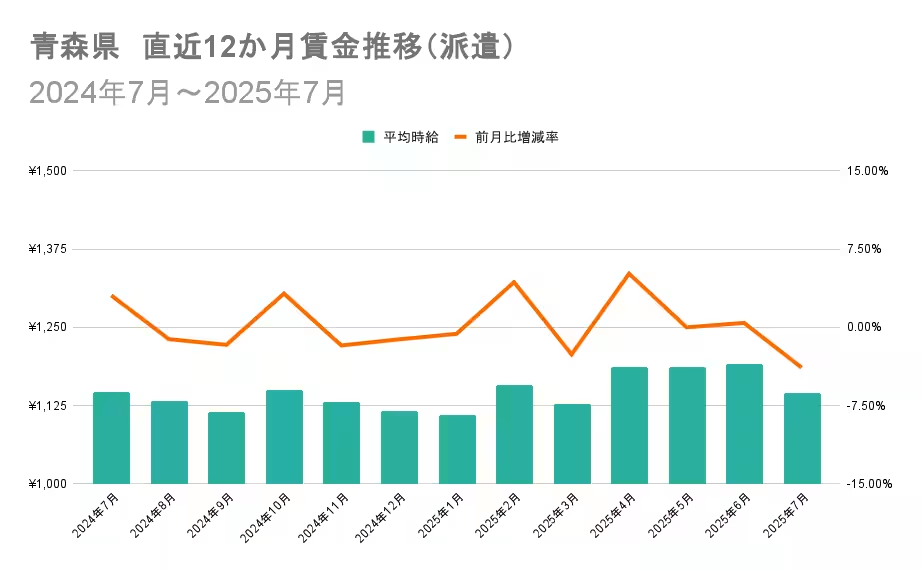

Temporary Employment Wage Trends

For temporary employment, the strongest growth was observed in:

1. Miyazaki with a substantial increase of +6.05%

2. Wakayama at +2.33%

3. Nara at +1.99%

The bottom three performers were:

1. Okayama (-2.13%)

2. Nagasaki (-2.17%)

3. Aomori (-3.86%)

A detailed examination showed that Miyazaki benefited from the influx of high-paying listings, which significantly boosted average wages. Aomori, on the other hand, showed a more erratic growth, hovering around 1,125 yen.

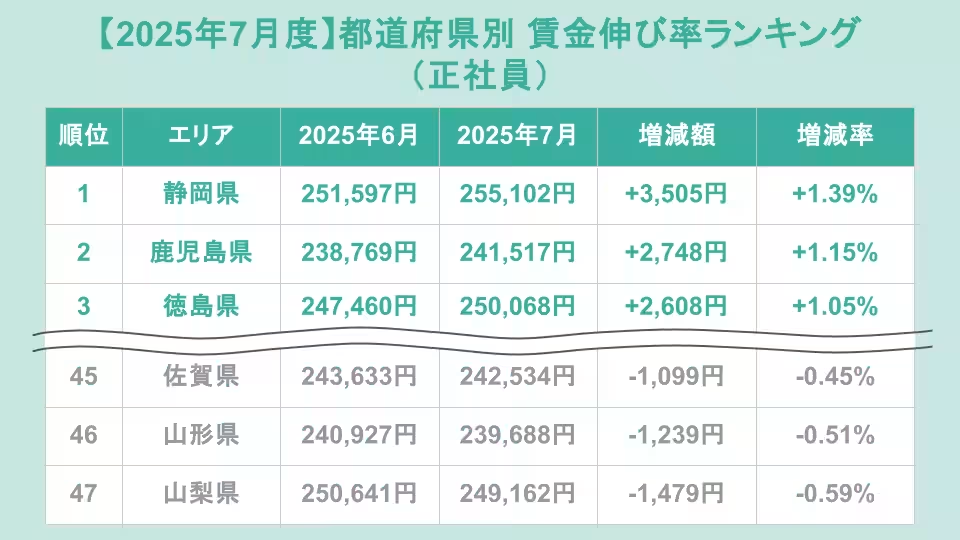

Full-Time Employment Wage Trends

Lastly, the rankings for full-time employment revealed:

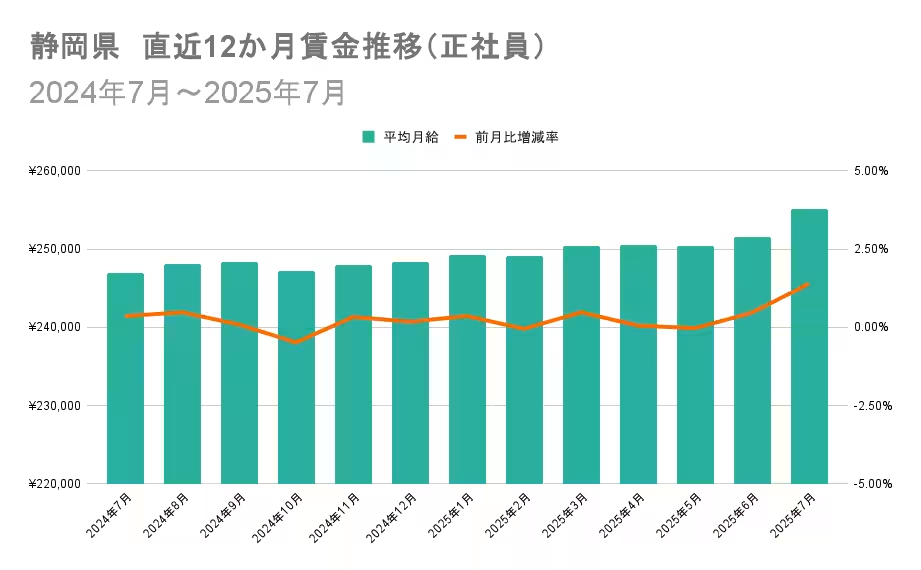

1. Shizuoka leading with a jump of +1.39%

2. Kagoshima at +1.15%

3. Tokushima with +1.05%

The most significant declines were in:

1. Saga (-0.45%)

2. Yamagata (-0.51%)

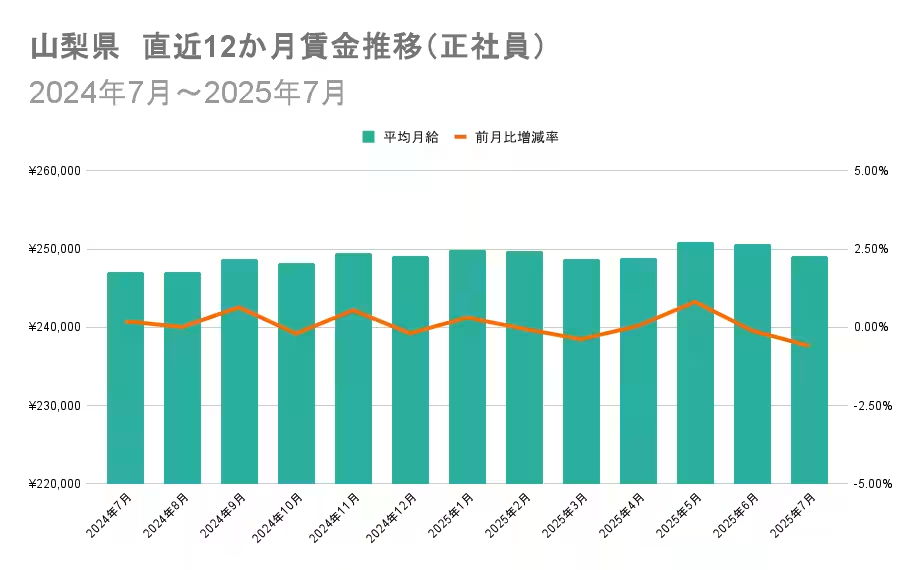

3. Yamanashi (-0.59%)

Shizuoka’s wages surged owing to competitive listings from key manufacturing companies, while Yamanashi has shown only modest fluctuations in wages, escalating by approximately 1%.

Conclusion

The analysis highlights how different prefectures have responded to the labor market's demand and how overall economic conditions translate into wage changes across employment types. With the ongoing discussions regarding minimum wage at the forefront, these insights are invaluable for stakeholders aiming to comprehend the evolving job market.

This wage trend analysis serves as a reference to understand how wages in various prefectures have changed and can assist job seekers in making informed decisions regarding employment opportunities in Japan's dynamic job market.

For more comprehensive insights, please refer to employment big data analyses provided by Frogg Inc., a company that began aggregating job listings in 2014, amassing over 40 billion job entries from various platforms across Japan.

Company Overview

Frogg Inc.

Location: Urban Square Kanda Building, 1-18 Kanda Sudachou, Chiyoda, Tokyo 101-0041

Established: January 5, 2021

Capital: 10 million yen

Website: hrog.co.jp

Frogg Inc. continues to provide valuable resources to human resources departments, municipal bodies, and media outlets, ensuring that stakeholders are equipped with relevant labor market intelligence.

Topics Business Technology)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.