Learn How to Invest in Profitable Minpaku Properties on December 10

Unlocking the Future of Minpaku Investments

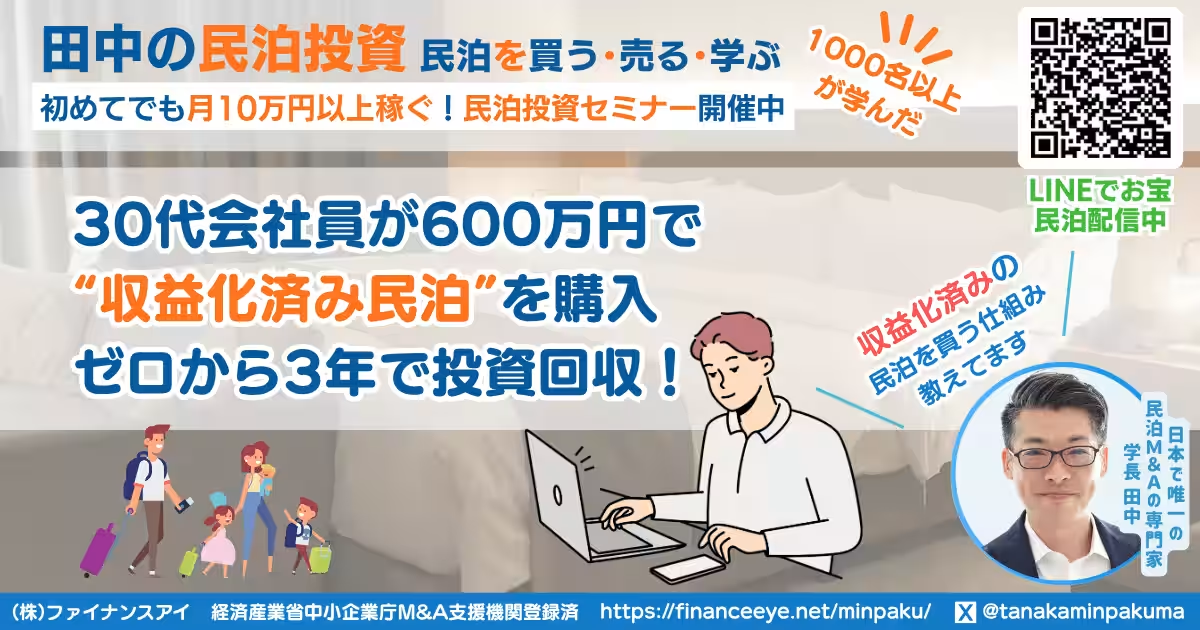

As the real estate prices continue to soar and financing becomes stricter, a new investment approach is gaining traction—acquiring already profitable minpaku (short-term rental) businesses through mergers and acquisitions (M&A). On December 10, 2025, Finance Eye Inc., led by CEO Takuro Tanaka, will host an engaging seminar titled "Master the God Skills of Tanaka's Minpaku Investment: Live Property Evaluation Event," designed to empower participants with the tools to identify treasure and risky minpaku properties.

Seminar Overview

- - Host: Finance Eye Inc. (Tanaka’s Minpaku Investment)

- - Date: December 10, 2025

- - Time: 19:00 - 20:00 (JST)

- - Format: Online via ZOOM, applicable nationwide

- - Capacity: 50 participants (Free participation)

- - Registration: Available through the official website

This seminar offers an interactive experience where attendees can send URLs of minpaku investment properties they’re interested in. Expert evaluations will be provided live, analyzing aspects such as profitability, risks, and operational difficulties. With over 1,000 participants who have previously attended, an impressive satisfaction score exceeding 90 has been reported.

Understanding the Trend of Minpaku M&A Investing

So, what exactly is minpaku M&A investing? Unlike traditional methods of starting a minpaku operation by purchasing or renting property, minpaku M&A allows investors to buy existing, operational minpaku ventures that are already generating revenue. Initial investments can start as low as several hundred thousand yen, making this approach particularly appealing to individual investors and corporate entities alike. Leveraging this method, investors can expect to see returns almost immediately upon acquisition, without the need for substantial loans or capital reserves.

Live Property Evaluations by Experts

During the event, Takuro Tanaka, a seasoned expert in minpaku M&A, will conduct live evaluations of properties submitted by participants. By scrutinizing various attributes, he will offer insights into:

- - Identifying high-quality minpaku properties

- - Recognizing red flags associated with risky investments

- - Understanding the revenue structures of minpaku operations

- - Evaluating the potential for both income and capital gains

- - Assessing the replicability of successful investment models.

What Participants Say

Feedback from past attendees highlights the quality of the insights provided:

- - "I found it incredibly straightforward and now I know exactly how to start."

- - "Far more practical than any other seminar I’ve attended."

- - "I was amazed to learn about this investment method!"

- - "This offers a new path amidst the challenges of real estate investment financing."

These testimonials underscore the seminar's effectiveness and the growing interest in minpaku M&A as an entry point for potential investors.

About Takuro Tanaka

Takuro Tanaka, CEO of Finance Eye Inc., comes with a robust background in financial services, having worked at major banks and the M&A division of a listed company before declaring independence in 2014. He has supported over 1,000 investors, specializing in minpaku M&A and small-scale mergers. With nearly 30 years of experience in financing, Tanaka continues to develop and provide innovative wealth-building strategies for investors seeking efficiency and reliability in their asset management.

Conclusion

Now, more than ever, with soaring real estate prices and higher loan requirements, the pathway to successful property investment lies not in depleting cash reserves on acquisitions, but rather in initially investing in profitable minpaku properties. Join us on December 10 to open the door to the future of lucrative minpaku investments, and learn the necessary tools to build your asset portfolio confidently.

For more information, visit our official website or participate in our seminar via Rakumachi.

Topics Business Technology)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.