MOL Group Secures Long-term Financing for LBC Tank Terminals Acquisition

MOL Group's Strategic Acquisition of LBC Tank Terminals

Mitsui O.S.K. Lines, Ltd. (MOL), under the leadership of President Tsuyoshi Hashimoto, has officially entered into a long-term financing agreement aimed at securing funds necessary for the acquisition of LBC Tank Terminals. This deal is a strategic move to bolster MOL's position in the chemical logistics sector not only within Japan but on a global scale.

Financing Details

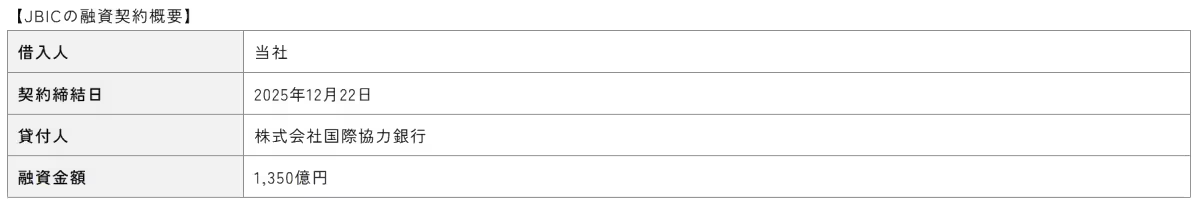

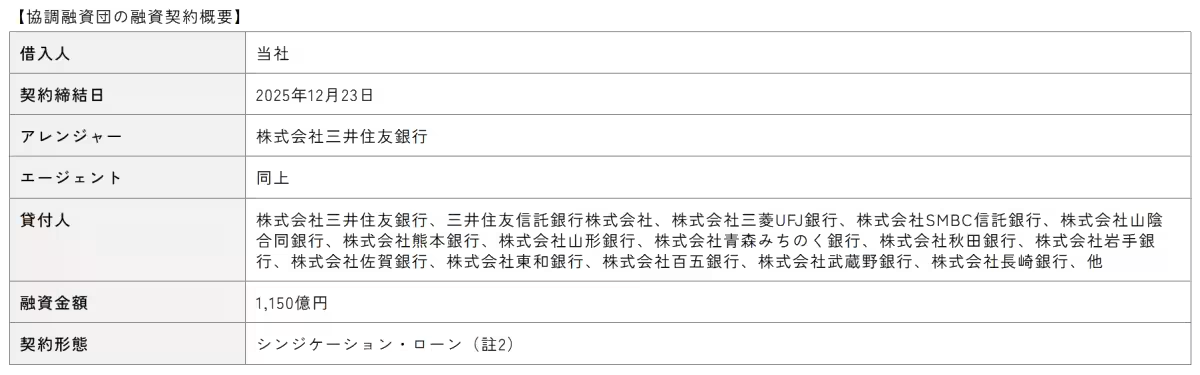

The long-term financing arrangement was made in collaboration with the Japan Bank for International Cooperation (JBIC), led by President Nobumichi Hayashi, and Sumitomo Mitsui Banking Corporation (SMBC), under CEO Akihiro Fukudome. This consortium aims to provide stable and long-term funding necessary for the financial commitments associated with the acquisition of LBC Tank Terminals Group Holding Netherlands Coöperatief U.A., headed by Frank Erkelens and headquartered in Rotterdam.

This financing aligns with JBIC’s mission of supporting Japanese enterprises in expanding their overseas operations. It also reflects SMBC's initiatives to foster globally expansive networks. The consistency in their objectives has facilitated this crucial financial arrangement for MOL.

Strengthening Chemical Logistics

MOL Group recognizes chemical logistics as a vital growth sector and has strategically positioned the LBC acquisition to enhance its business offerings. The inclusion of LBC’s operations into MOL's portfolio will not only expand marine transport capabilities but will also integrate land-based storage services into its logistics framework, thereby fortifying its chemical logistics service structure.

By ensuring a diverse and adaptable service portfolio, MOL will be well-equipped to meet the varying demands of its clientele. Moreover, the tank terminal operations, characterized by low volatility, align with MOL’s management strategy designed to ensure stable revenue streams as outlined in the “BLUE ACTION 2035” framework. This acquisition is expected to serve as a core component of their portfolio strategy, facilitating consistent growth and stability in financial performance.

Future Outlook

Looking ahead, MOL plans to leverage this acquisition to optimize its financial strategy and capitalize on favorable market trends while adhering to the objectives set forth in its group management plan. The focus will be on sustainable management practices that elevate operational efficiencies in the chemical logistics market.

In summary, the financing agreement signifies a pivotal step for MOL Group in its quest for growth and stability. The acquisition of LBC Tank Terminals is poised to not only expand MOL’s operational reach but also enhance its capability to serve a wider array of customer needs in the increasingly complex field of chemical logistics.

For further details, refer to the press releases dated March 10, 2025, and July 1, 2025, regarding the acquisition of the tank terminal company LBC Tank Terminals.

Topics Business Technology)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.