Money Forward's Survey Reveals Mental Burden of Tax Returns and AI's Role

New Insights from Money Forward’s Recent Survey on Tax Returns and AI

In a recent effort to understand the dynamics of tax filing in Japan, Money Forward conducted a comprehensive survey from November 25-26, 2025. This research focused on over 1,000 individuals aged 20 and older who are engaged in the tax reporting process. The findings revealed significant insights into the mental strain associated with tax return submissions and the potential role artificial intelligence (AI) could play in alleviating these pressures.

Key Findings: Mental Burden of Tax Filing

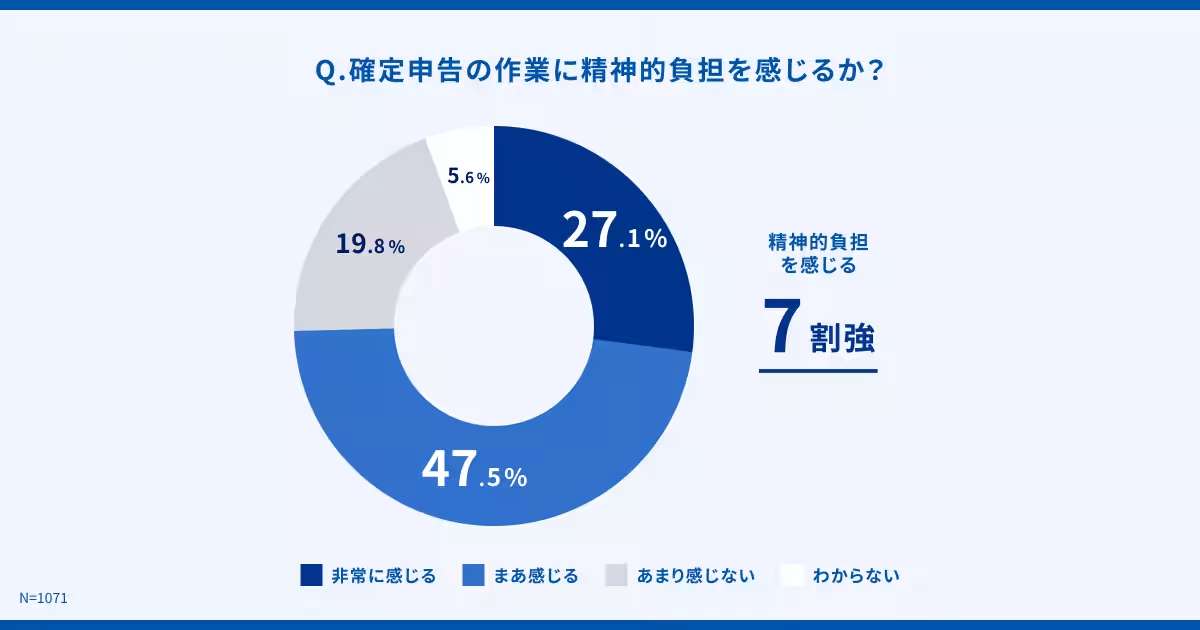

One of the most noteworthy results from the survey indicated that more than 70% of participants felt a considerable amount of mental stress concerning their tax filing responsibilities. This sentiment was evident as 27.1% reported feeling “extremely burdened”, and an additional 47.5% indicated they were “somewhat burdened” by the process. Clearly, the act of filing taxes carries a substantial mental load for many individuals.

The Root Cause of Psychological Stress

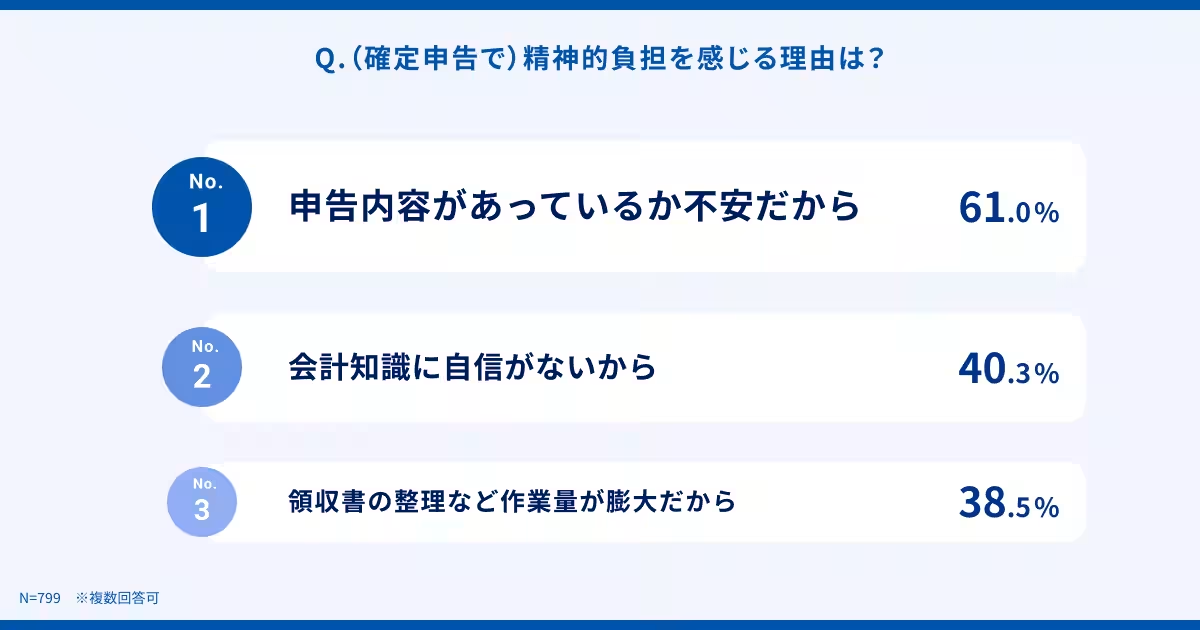

When delving deeper into the reasons behind this mental burden, survey respondents highlighted the significant concern regarding the accuracy of their tax submissions. The top reasons cited for feeling stressed included worries about whether their reporting was correct, a lack of confidence in their accounting knowledge, and the overwhelming volume of work that comes with organizing receipts and invoices. It appears that the psychological hurdles posed by uncertainty regarding submission accuracy are substantial, overshadowing the sheer volume of tasks required.

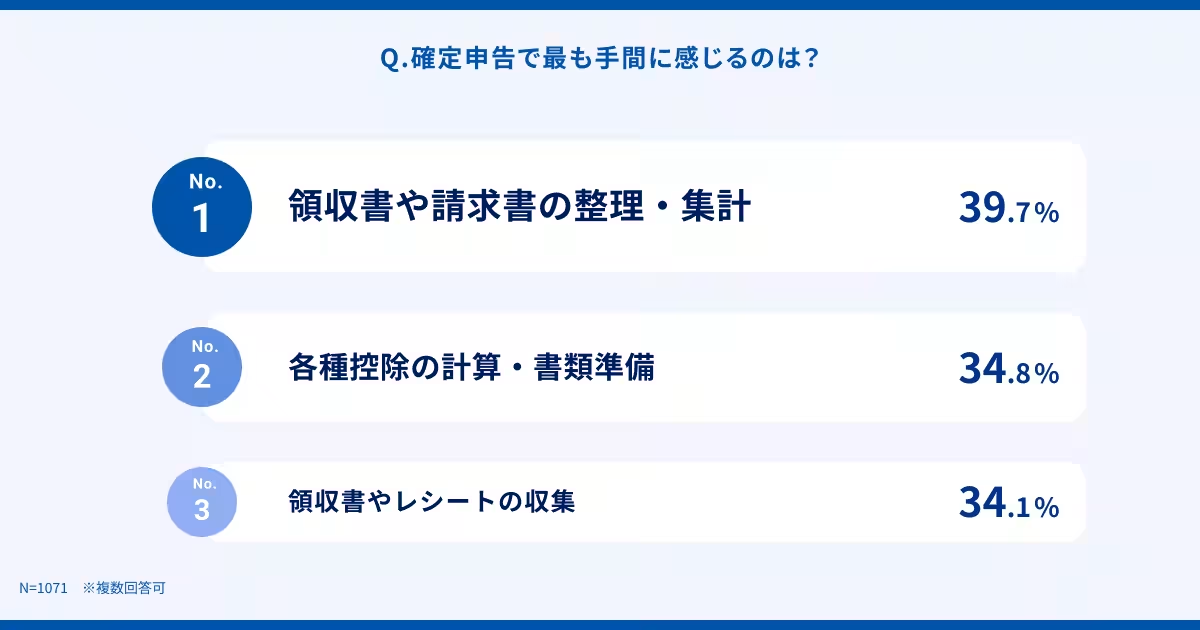

Time-Consuming Tasks

Among the various tasks associated with tax filing, respondents reported that organizing and tallying receipts and invoices was the most cumbersome. This was followed by calculations for various deductions and gathering receipts, indicating that the preparation work before even completing the tax forms is often the most demanding. The survey painted a clear picture: the preliminary steps of compiling and organizing necessary documents impose significant burdens on taxpayers.

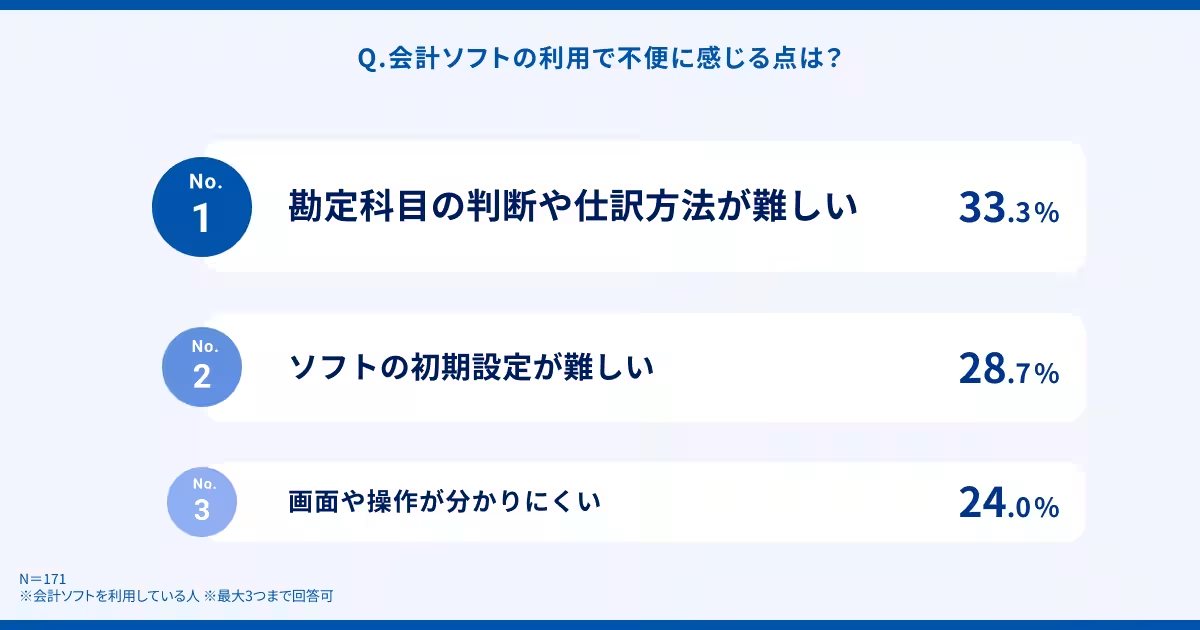

Challenges with Tax Software

Participants also expressed frustrations regarding software used for tax filing. Many found determining the appropriate account categories and methods for bookkeeping to be particularly challenging. After investing in software meant to streamline the tax process, individuals still identified a need for specialized accounting knowledge to navigate crucial decision points, highlighting a paradox where technology intended to simplify the process still left users grappling with complexities.

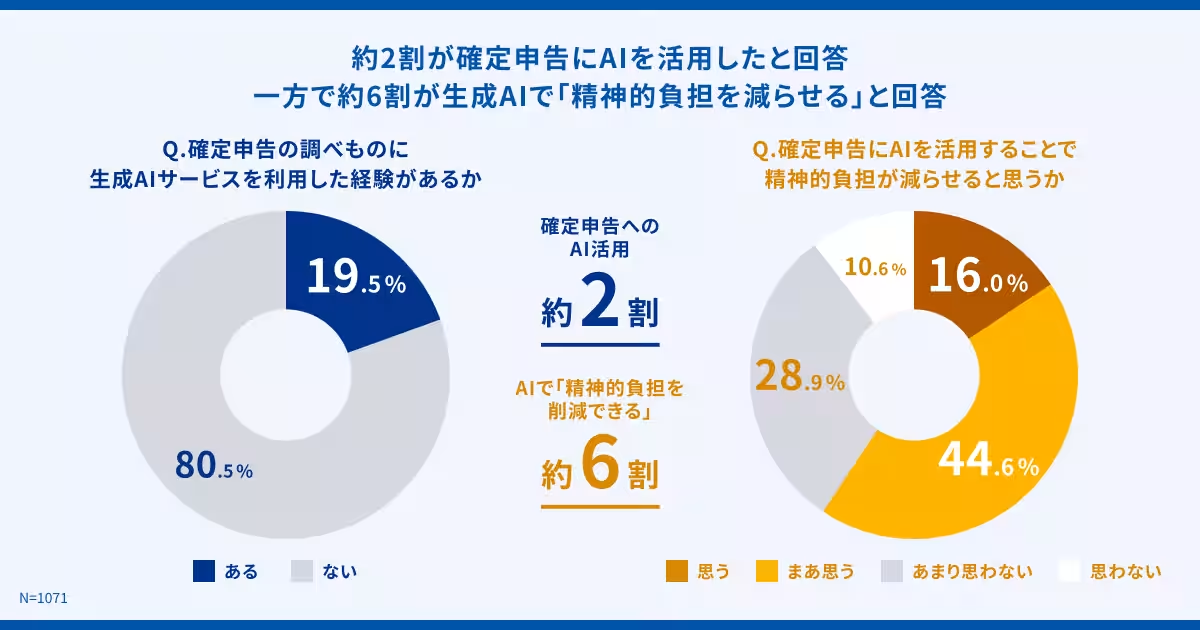

AI's Role in Alleviating Stress

Interestingly, the survey indicated that while only about 20% of respondents had applied AI tools in their tax filing, a noteworthy 60% believed that integrating AI could reduce their mental workload. The dichotomy suggests that while familiarity with AI remains low, there is strong public interest in harnessing such technology to ease stress during tax season.

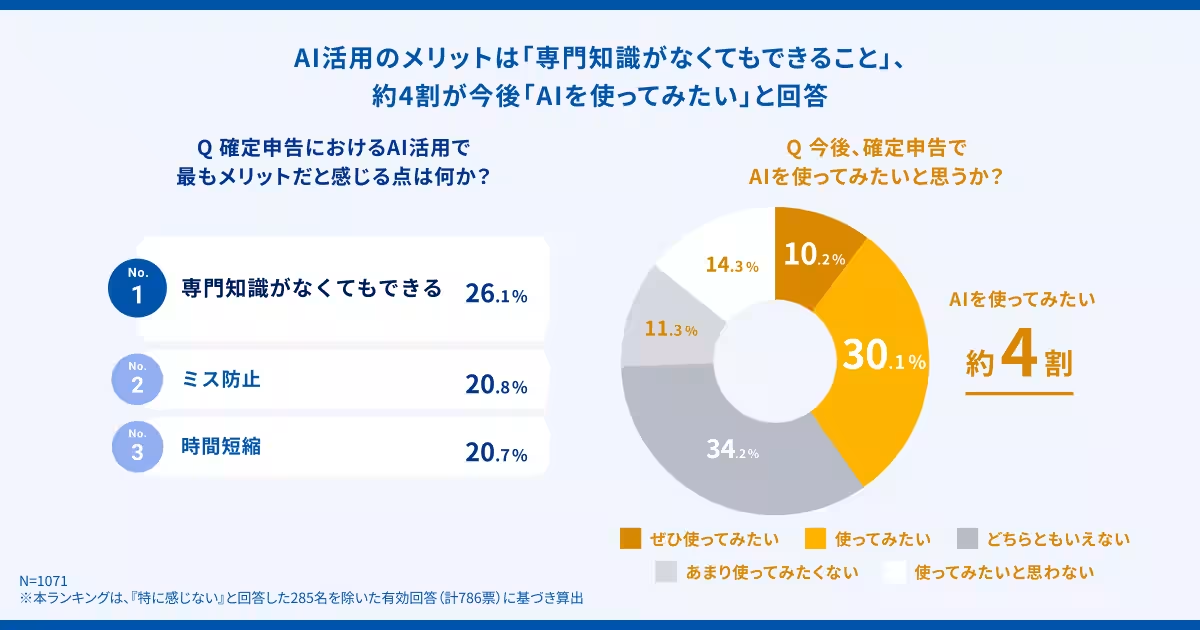

Potential Benefits of AI in Tax Filing

Many survey participants expressed that one of the advantages of using AI in tax filing would be the ability to complete the process without requiring specialized knowledge. Furthermore, 40.3% indicated a willingness to explore AI tools for future tax filing, demonstrating a growing openness to technology-assisted solutions among taxpayers.

Future Perspectives from Money Forward

As highlighted by Kaichi Yamada, Group CSO at Money Forward, the findings underscore the pressing need to address the mental challenges faced during tax filing. The anticipation of relief through AI signifies not only the recognition of the technology's potential but also an eagerness among individuals to adopt it. With advancements in AI and continuous improvements in user experience, the landscape of tax filing is poised for significant transformation.

About Money Forward AI Tax Return Services

Money Forward offers an AI-native tax filing service designed to simplify the experience for users, particularly beginners lacking confidence in accounting. This service allows users to upload their receipts, which the AI analyzes and uses to draft tax submissions. New integration features allow for direct submission of tax documents via the Money Forward Cloud service as of February 4. Planned enhancements include features for automatically analyzing tax-related documents via smartphone uploads and integrations with financial services.

In summary, as Money Forward continues to innovate within the realm of tax reporting, it aims to create a system where even those with minimal knowledge can perform their tax filings smoothly, demystifying the process for all involved.

Topics Financial Services & Investing)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.