CDL Launches Monitoring Feature to Enhance Compliance Management for Corporations

Enhancing Compliance Management with CDL's New Monitoring Feature

As global financial systems face increased scrutiny ahead of the FATF's 2028 review process, the need for effective measures against money laundering and related crimes is critical. On June 5, 2025, Compliance Data Lab Inc. (CDL), based in Chiyoda, Tokyo, will unveil a significant enhancement to its compliance support service, the Compliance Station® UBO. This upgrade introduces the Compliance Station® UBO Monitoring, a feature designed to keep users abreast of essential changes in the corporate landscape such as alterations in company names, executives, and beneficial ownership.

Traditional practices often fall short in identifying critical alterations in corporate status, primarily because many financial institutions collect information on their business partners infrequently, typically every one to three years. This sporadic reporting can lead to potential oversights on vital changes. With the implementation of the new monitoring feature, users will be able to receive timely notifications regarding substantial shifts linked to risk assessments on corporations they engage with. This ensures that the users always have access to the most up-to-date corporate information.

Key Features of the Service

The service utilizes a robust database from the reputable corporate research firm, Tokyo Shoko Research. This provides users with comprehensive data regarding industry sectors, business activities, and thresholds of beneficial ownership which are often challenging to capture through public sources. As a result, users will be informed of changes even in areas that lack transparency in public information.

Benefits of Implementation

The introduction of this service in the realm of compliance management is expected to yield several significant advantages, particularly concerning anti-money laundering measures:

1. Early Detection of Financial Crimes: The monitoring feature significantly enhances the potential to identify illicit activities that may have otherwise gone unnoticed during regular intervals of data collection. This proactive approach places organizations in a better position to address and mitigate risks swiftly.

2. Optimized Resource Allocation: By alleviating the need for constant oversight of all business partners, institutions can focus their efforts on those corporations that show signs of changes. This prioritization leads to more efficient management of compliance resources.

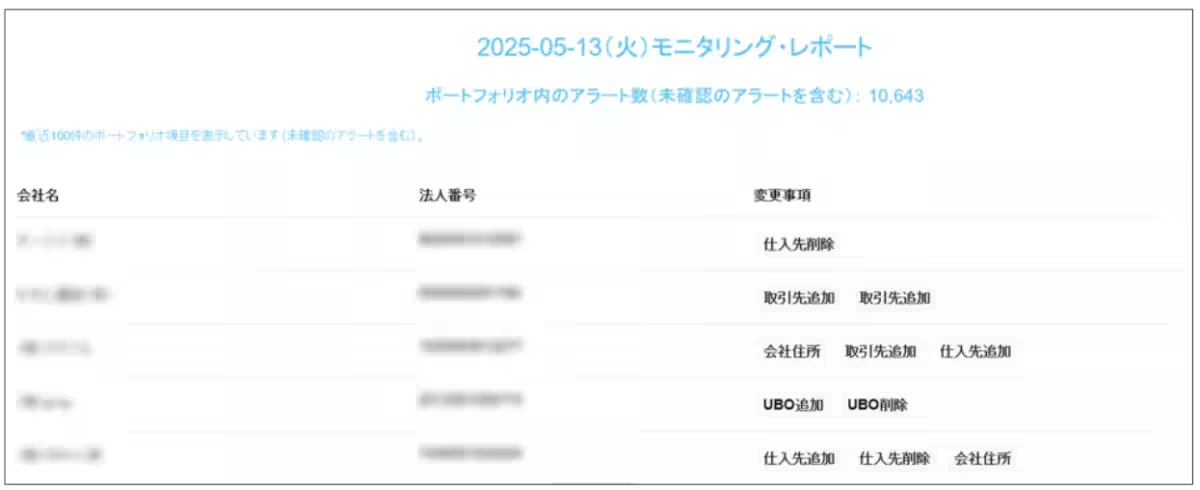

Visual Representation of the New Feature

The monitoring feature is integrated within the portfolio display, allowing users to quickly see a list of companies where changes have occurred. From this interface, they can access the latest information directly. Moreover, users have the option to download lists of entities with changes in Excel or CSV format, enabling bulk updates on the essential corporation’s information.

Pricing Model

The utilization fees are calculated based on the expected number of corporate portfolios annually, making it accessible and tailored for each organization. For detailed pricing, potential users are encouraged to contact CDL directly.

Service Launch Date

The Compliance Station® UBO Monitoring will officially launch on June 5, 2025.

Clarifying Key Terms

* UBO Information: Refers to individuals or entities who hold more than 25% of voting rights directly or indirectly.

About CDL

Compliance Data Lab Inc. (CDL) is led by CEO Hiroshi Yamazaki, a certified Anti-Money Laundering Specialist and Global Sanctions Specialist, with a Master's in Engineering from Johns Hopkins University. The company, established on April 1, 2021, focuses on providing data services, consulting, solutions development, and operational outsourcing related to compliance management. Their vision is to simplify sophisticated compliance management through data utilization and to become the premier solution provider in this space.

Mission and Vision

CDL recognizes the increasing complexity of financial crimes and the mounting compliance burdens for corporations. Their mission to make advanced compliance management accessible empowers organizations to efficiently combat financial crimes utilizing cutting-edge data and technology.

Through this innovative monitoring feature, CDL is committing itself to uphold and enhance the effectiveness of compliance protocols that will not only respond to regulatory demands but will also lead the industry towards better compliance practices.

Topics Business Technology)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.