Manulife Life Insurance Launches Future-Proof Whole Life Insurance v2 at Shizuoka and Hiroshima Banks

New Launch of Future-Proof Whole Life Insurance v2

Manulife Life Insurance Company has officially announced the launch of its new product, `Future-Proof Whole Life Insurance v2`, which will become available on July 1, 2025. This innovative whole life insurance policy will be sold through two major Japanese banks: Shizuoka Bank and Hiroshima Bank. The introduction of this product is part of Manulife's commitment to addressing the evolving needs of customers when it comes to financial security and asset accumulation.

Understanding Future-Proof Whole Life Insurance v2

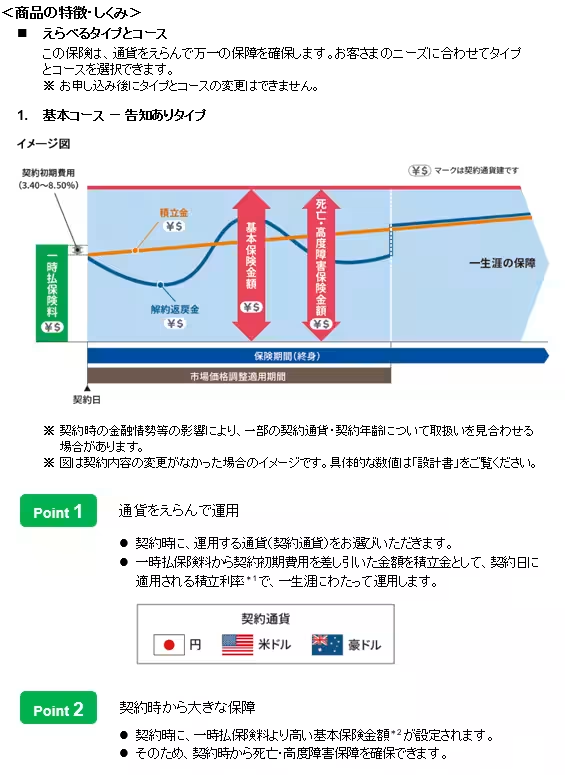

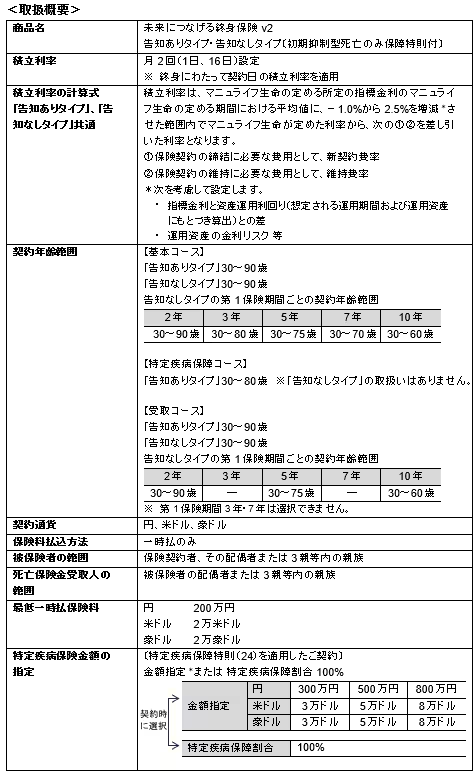

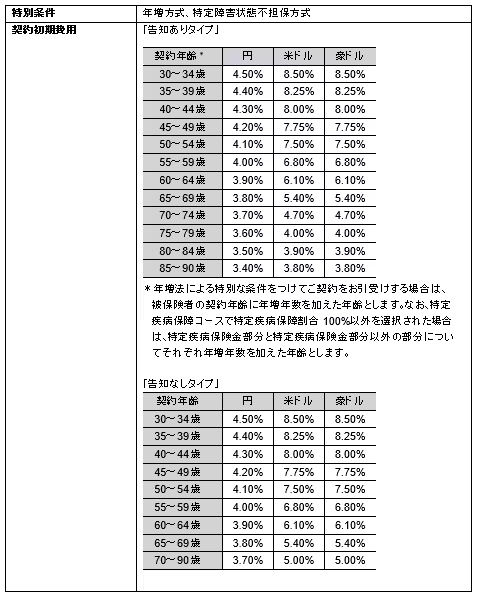

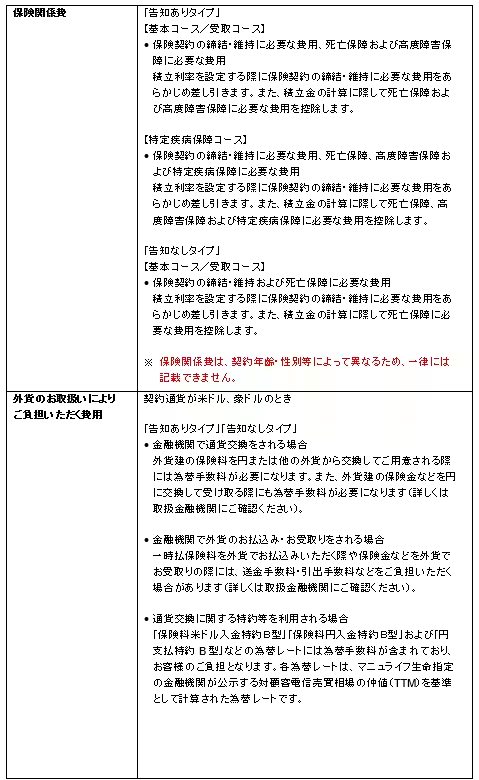

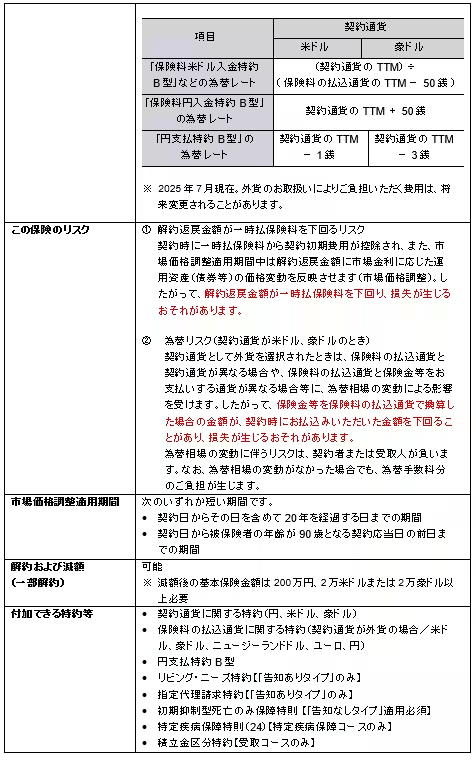

The `Future-Proof Whole Life Insurance v2` is designed to provide lifelong protection against unforeseen events while also fulfilling customers' desires to secure their family’s financial future. This policy features a unique asset formation capability, allowing customers to choose from three different currency options — Japanese Yen, US Dollar, or Australian Dollar — ensuring flexibility according to their financial preferences.

Three Course Options

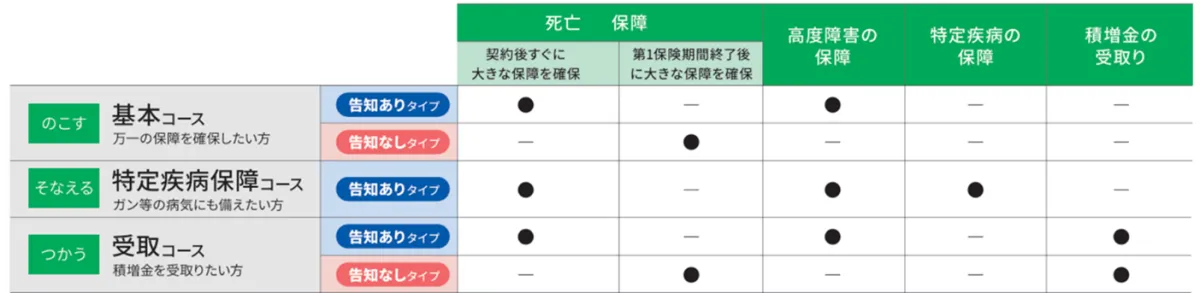

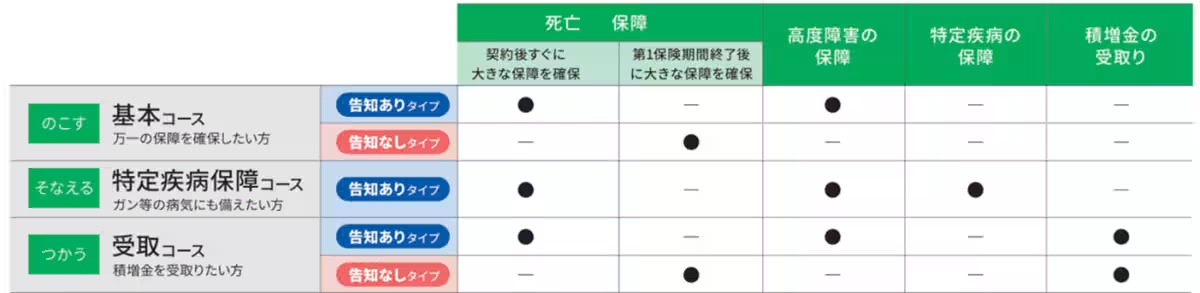

Customers can select from the following courses, each tailored to meet specific needs:

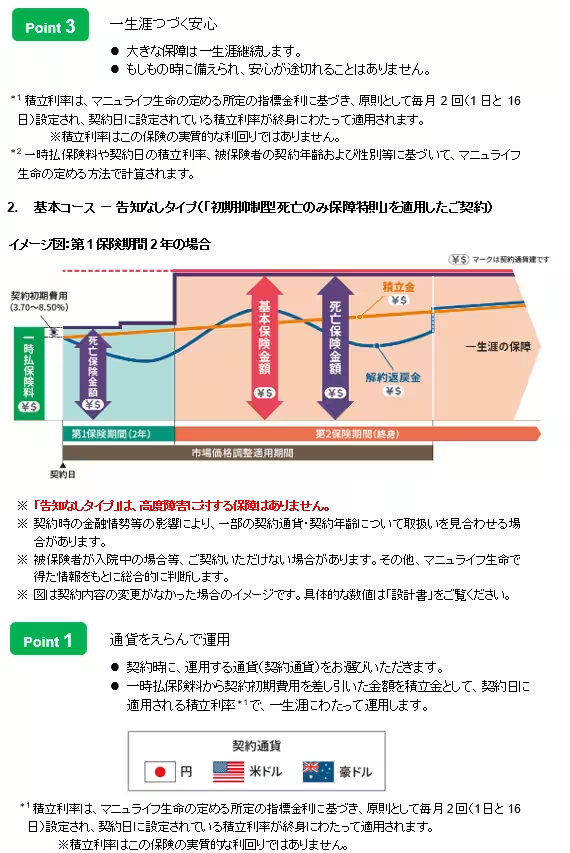

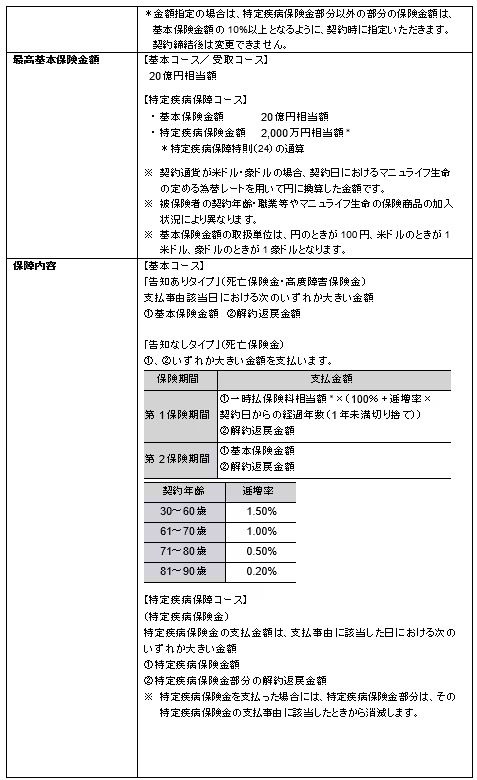

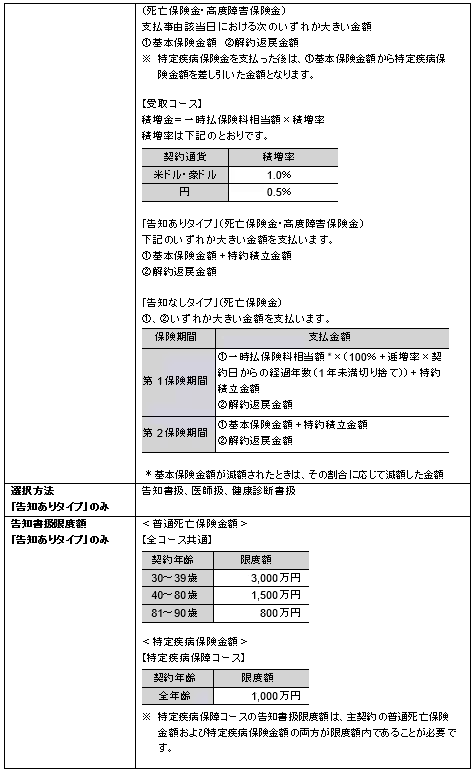

1. Basic Course: This plan offers essential life insurance and disability coverage with significant benefits immediately available after the policy is issued.

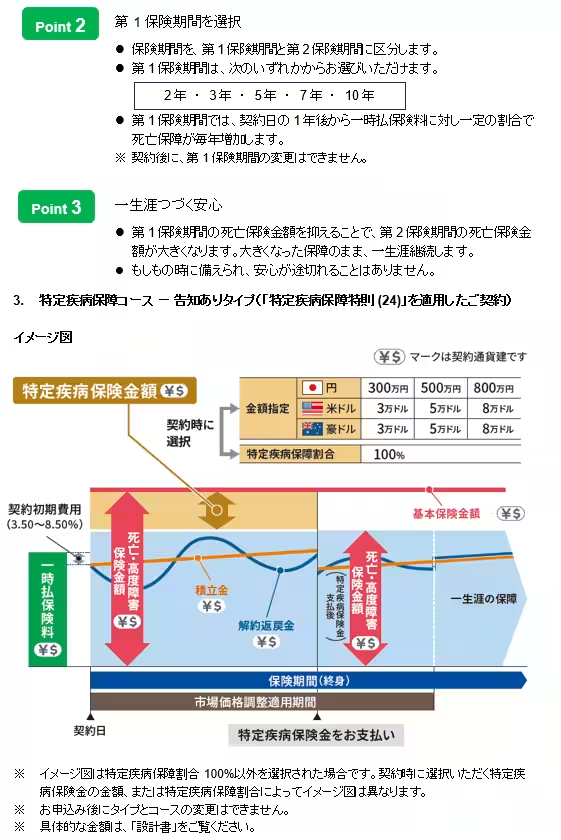

2. Specified Disease Protection Course: This option allows customers to specify the amount of coverage for particular diseases. If they encounter serious health issues outlined in the policy, they will receive predetermined benefits while still retaining a death benefit thereafter.

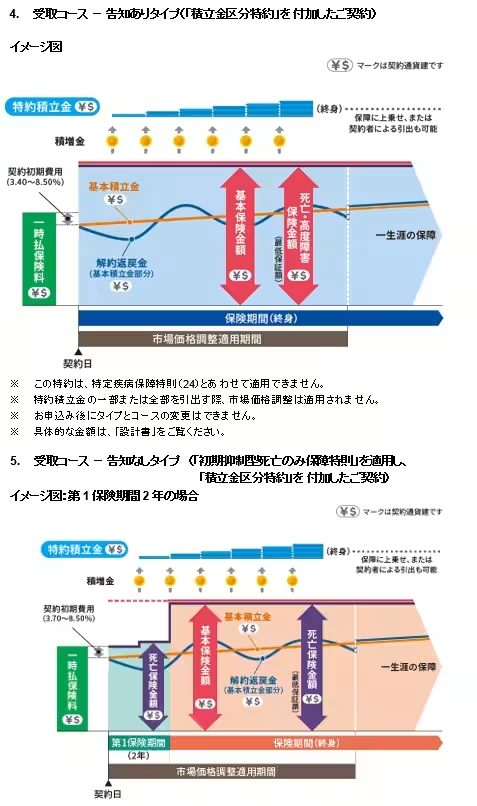

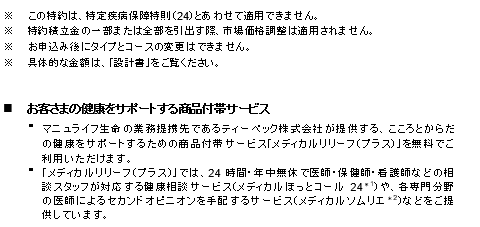

3. Payment Course: This features two components: the basic accumulation fund and an additional attached fund, offering customers the ability to withdraw necessary amounts from their supplementary fund without needing to cancel their policy.

Flexible Coverage Types

The `Future-Proof Whole Life Insurance v2` also presents two types of coverage which provide further customization:

- - Disclosure Type: Customers opting for this type will enjoy larger coverage amounts from the outset.

- - Non-Disclosure Type: This reduces initial coverage for a set period, subsequently increasing the death benefit, thus securing better long-term security.

Targeting Today's Needs

Manulife's latest insurance product aims at catering to the needs of individuals planning for their retirement and managing wealth. The company recognizes that customers are looking for a holistic approach to financial planning, especially in today’s economy.

In the era of longer life spans, often referred to as the '100-Year Life', it is crucial for individuals to lay proper foundations for their financial security. Beyond just providing insurance, Manulife supports long-term asset formation strategies to meet diverse customer demands, from retirement funds to inheritance planning.

About Manulife Life Insurance

As a subsidiary of Manulife Financial Corporation, a major Canadian financial services company, Manulife Life Insurance operates under a guiding philosophy of ensuring customers have reliable options for their financial futures. They emphasize the importance of making informed choices for insurance and wealth creation while serving as specialists in retirement planning. For further information, customers can visit their official website Manulife Japan or connect through their LinkedIn.

Summary

The launch of the `Future-Proof Whole Life Insurance v2` marks an exciting step forward for Manulife, expanding significant support across insurance and asset management that aligns with customer aspirations for financial freedom and security. For additional product details, refer to the official product overview linked above.

Topics Financial Services & Investing)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.