The 2025 Financial Awareness Survey: How Money Mindsets Are Shaping Investments and Spending

The 2025 Financial Awareness Survey: Insights on Spending and Investments

In 2025, Money Forward Home conducted an extensive financial awareness survey targeting users of their money visualization service, "Money Forward ME." The survey aimed to gather insights into spending behaviors, the impact of price increases, and how the emergence of generative AI is influencing financial decision-making.

Key Findings of the Survey

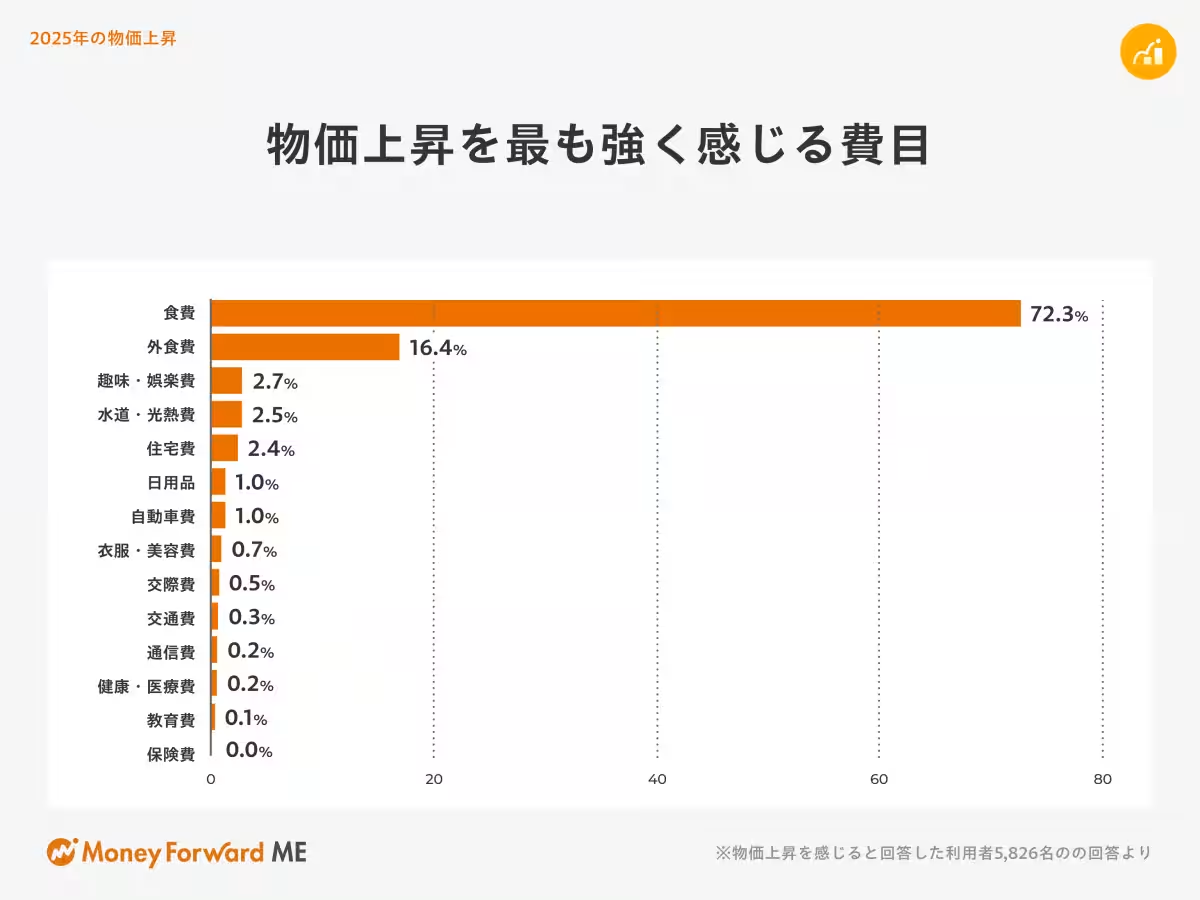

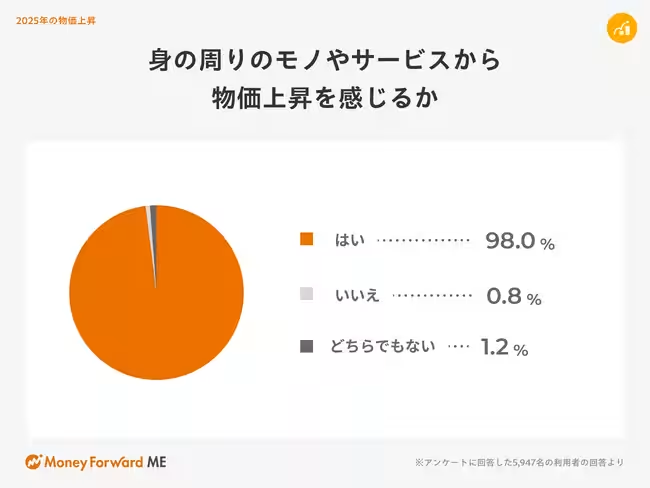

Escalating Living Costs: A Focus on Food Expenses

A staggering 98.0% of respondents reported feeling the sting of rising prices, with food costs identified as the most significantly affected category. It marked the fourth consecutive year that food expenses were reported as the primary area of concern for many households, highlighting an ongoing struggle with daily essentials amidst inflation.

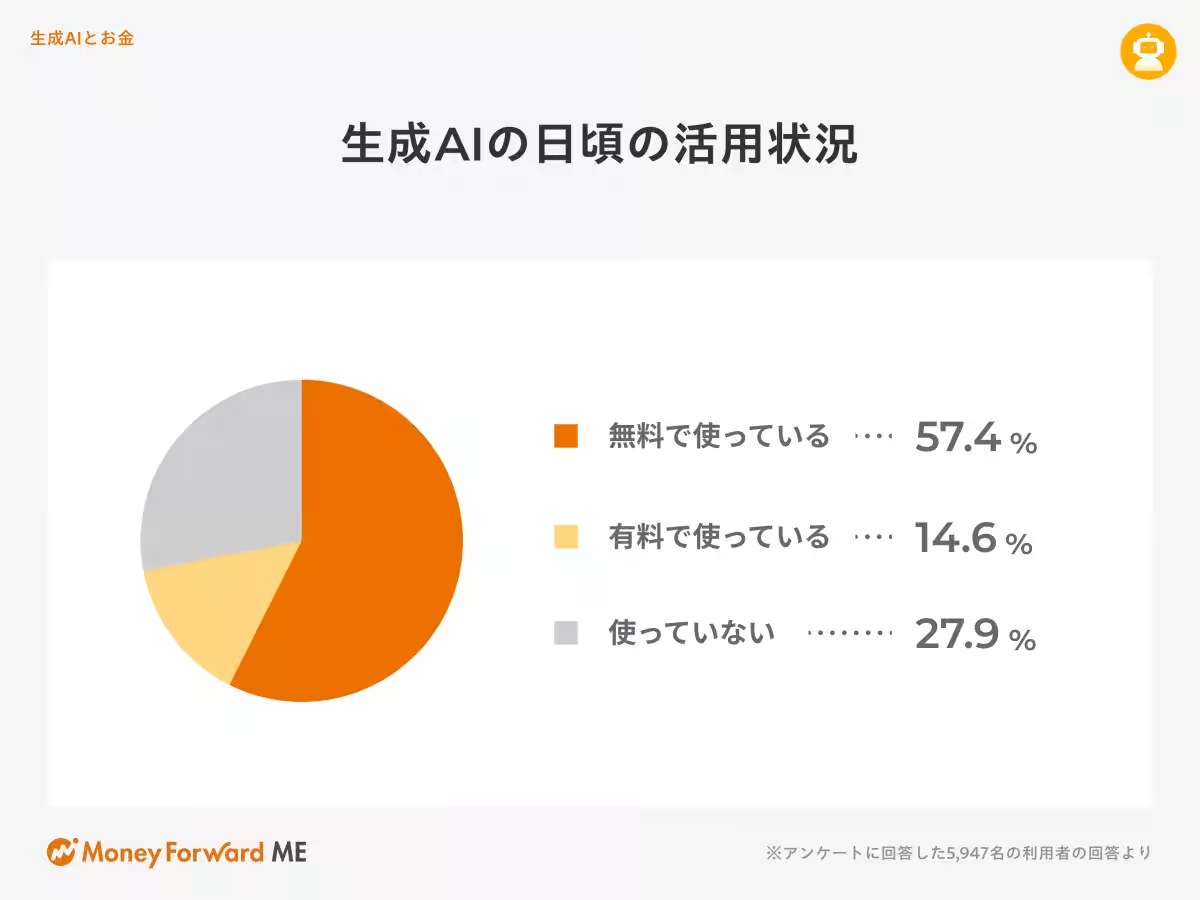

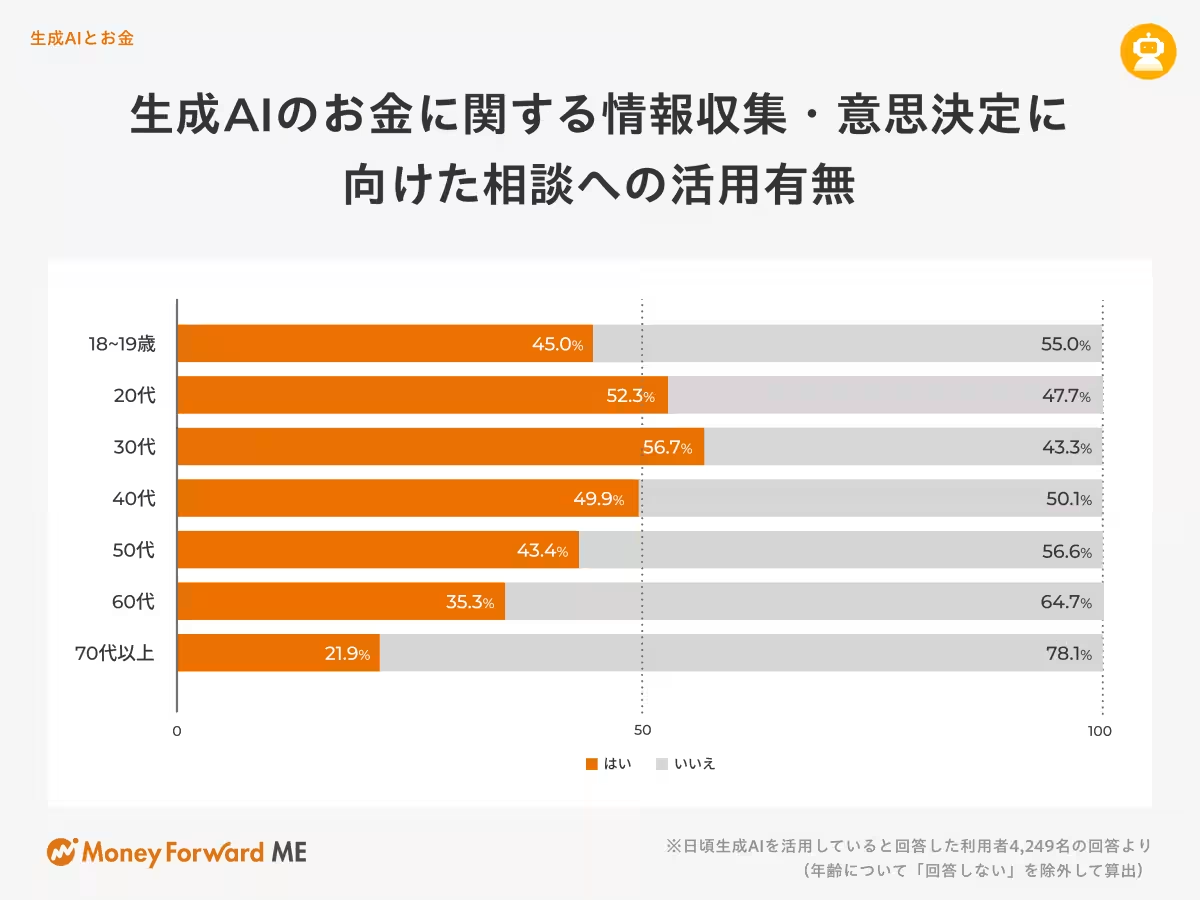

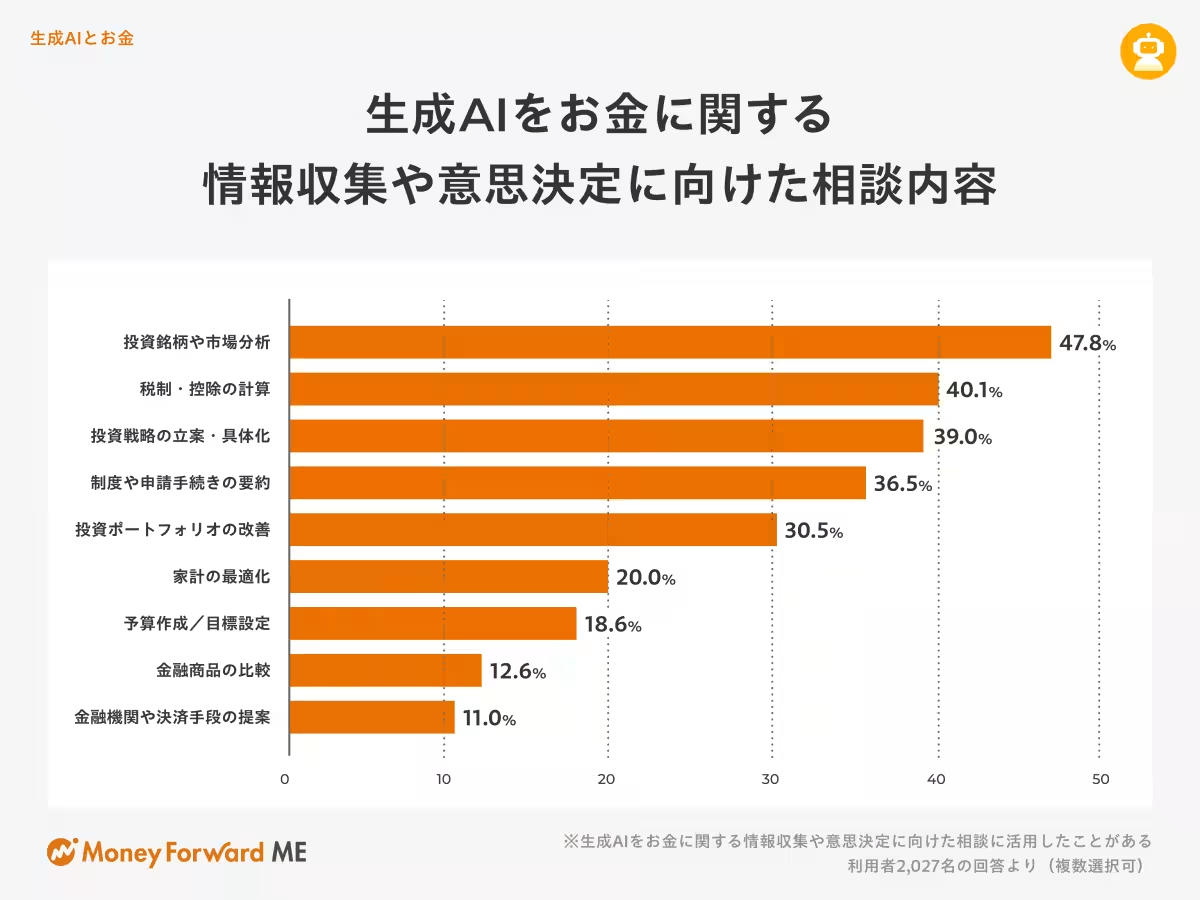

Generative AI in Money Management

The survey unveiled that 72.0% of respondents leverage generative AI regularly, with over half of users in their 20s and 30s utilizing it for gathering financial information and decision-making support. This trend indicates a growing trust in AI's assistance in navigating investment strategies, market analyses, and understanding tax implications, revealing a progressive shift in how young adults approach their finance.

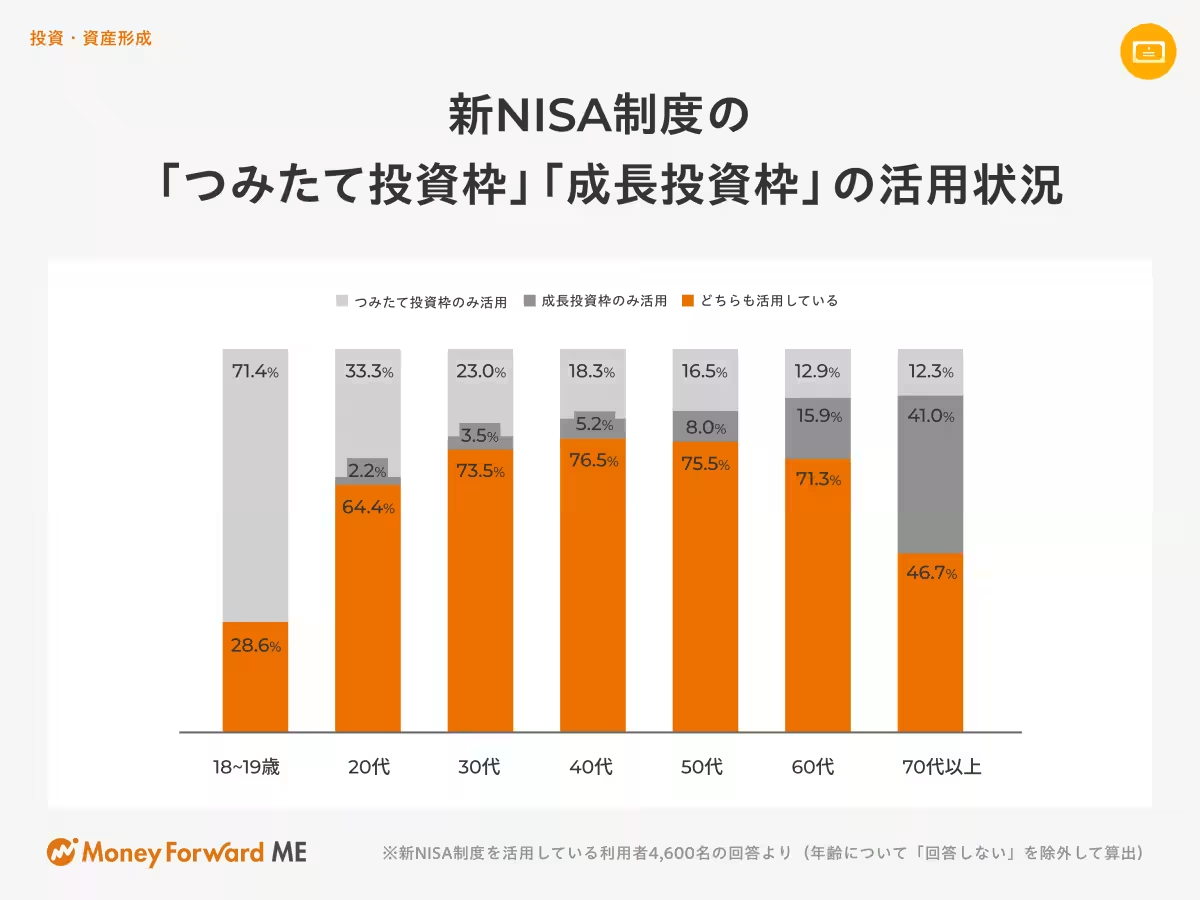

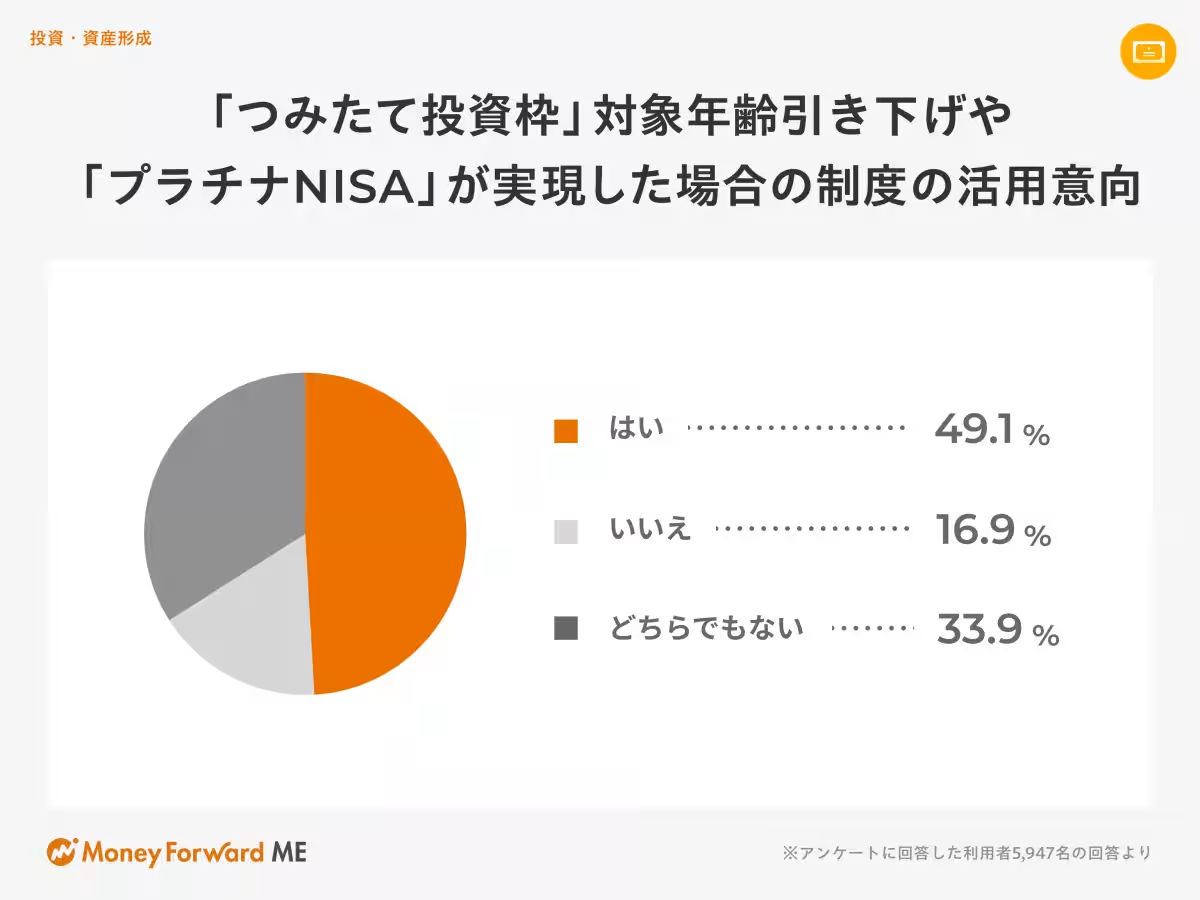

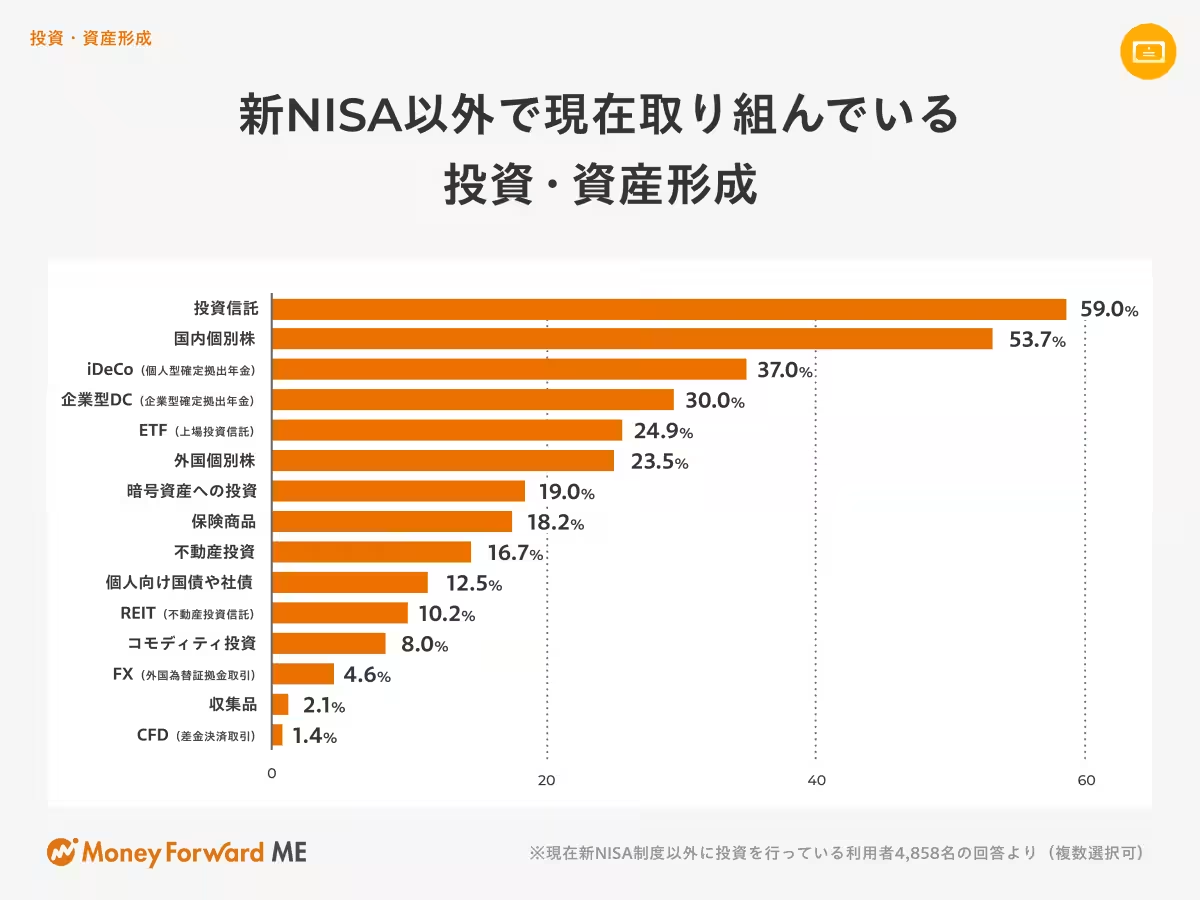

New NISA Adoption and Investment Prioritization

Approximately 77.8% of participants reported using the new NISA (Nippon Individual Savings Account), with 72.9% utilizing both the "contribution limit" and the "growth investment limit." Notably, for three consecutive years, the top choice for bonus allocation among respondents was to re-invest into these savings and investment avenues, showcasing a robust intention toward wealth accumulation.

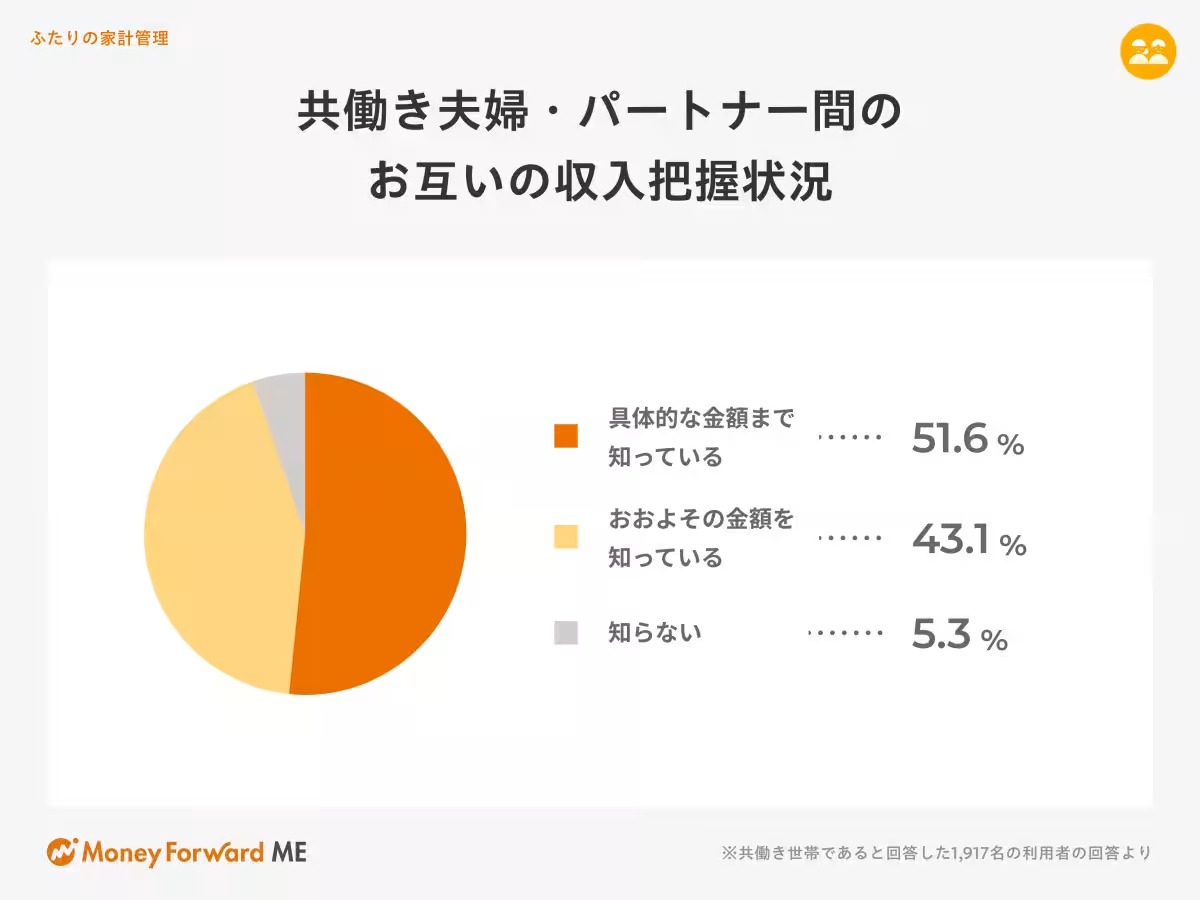

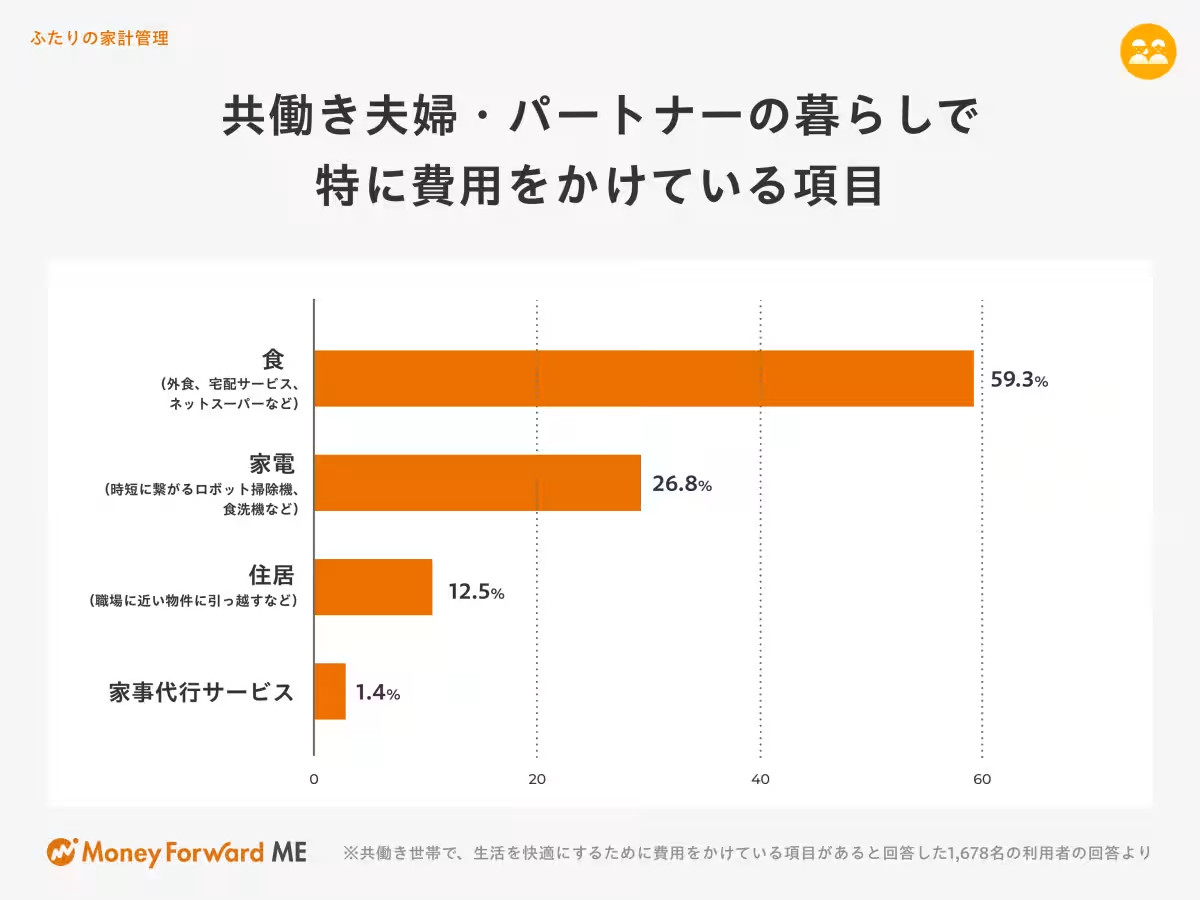

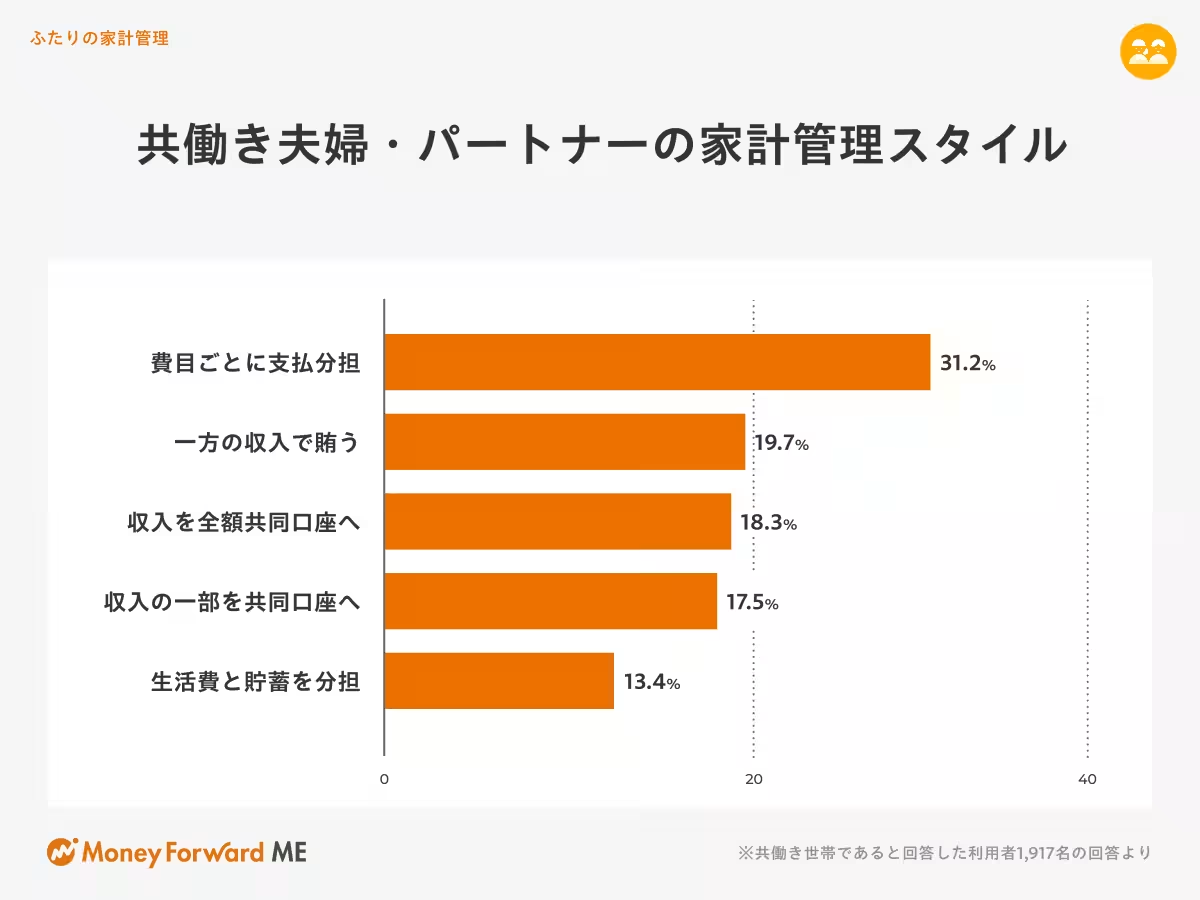

Insights from Dual-Income Households

The survey also examined the financial dynamics within dual-income households. An impressive 51.6% of these respondents know one another's exact income figures, and 31.2% indicated that expenses are divided by category. Such insights reflect a collaborative effort in financial management and point to a societal shift where transparency in finances is becoming more commonplace.

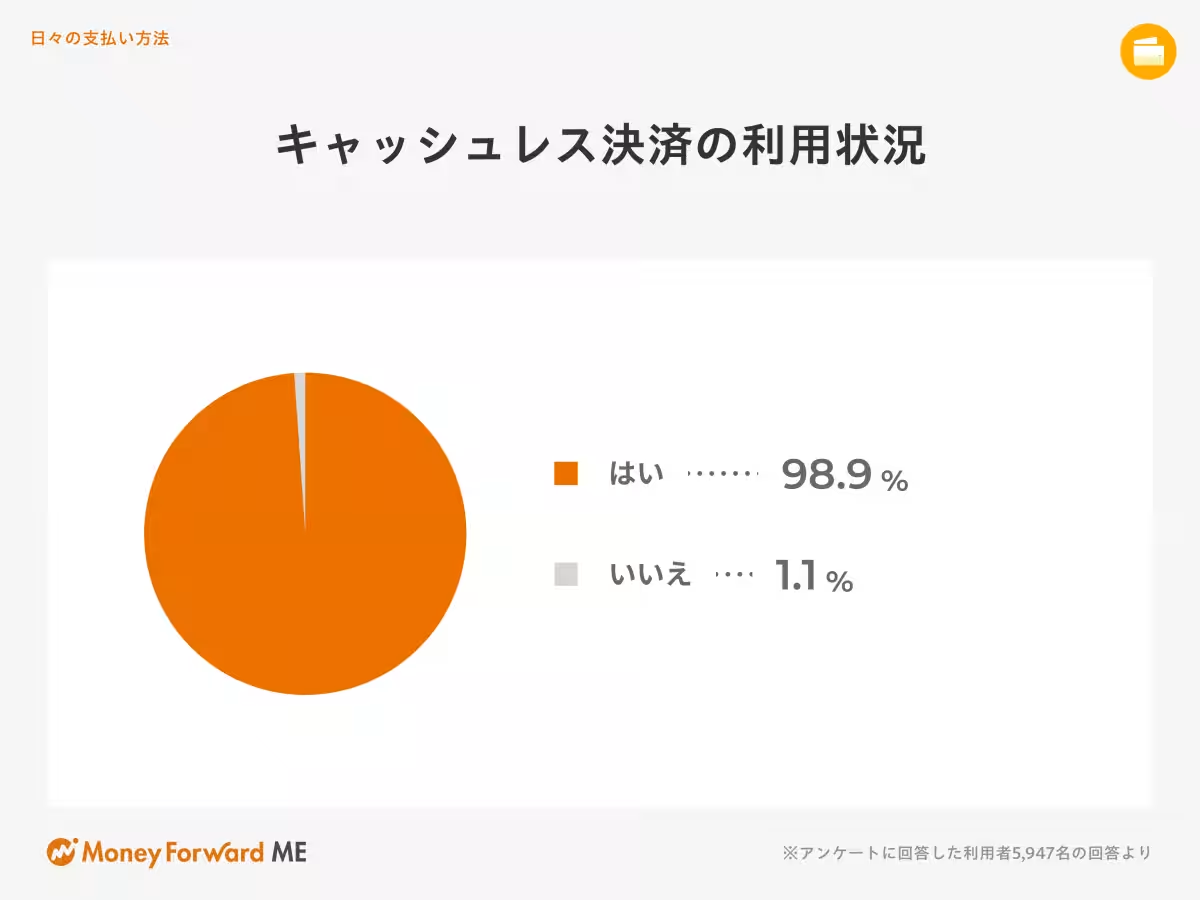

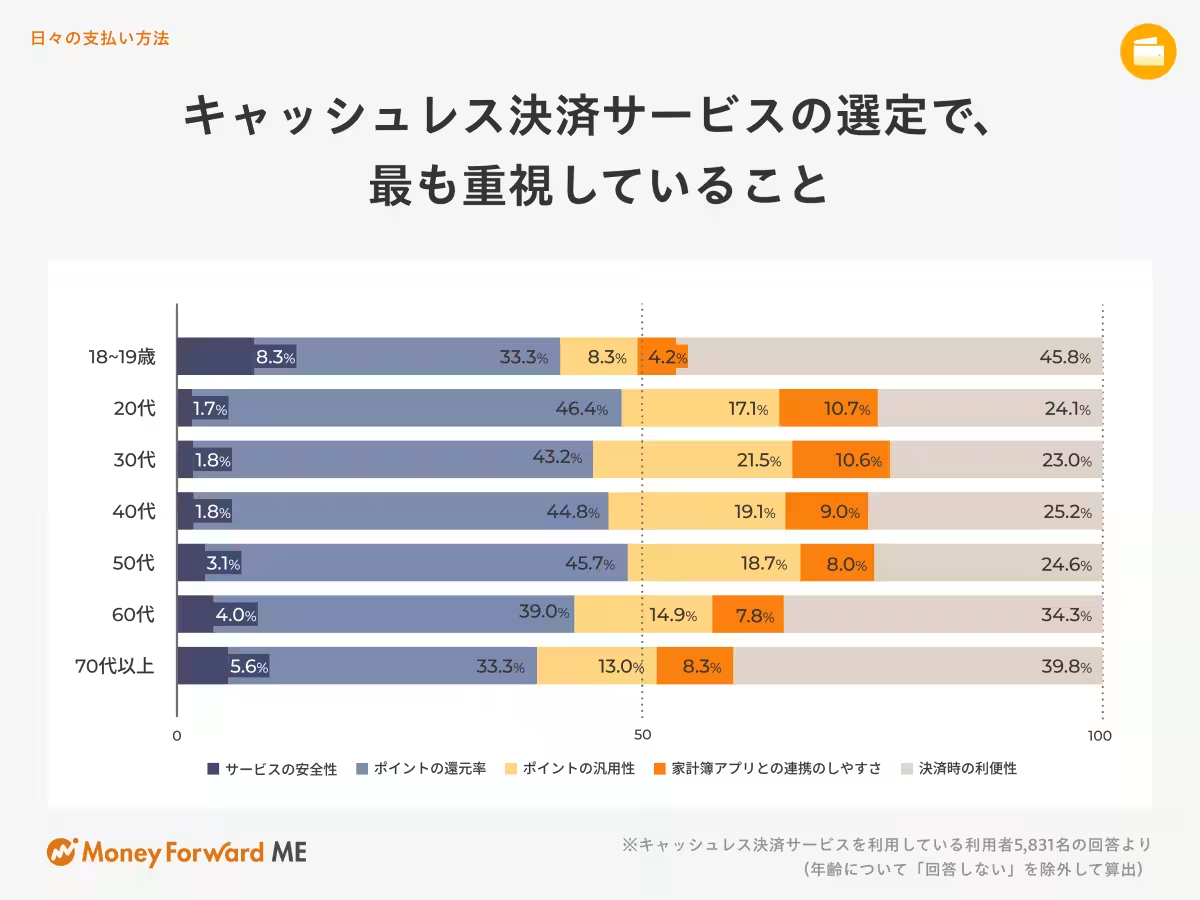

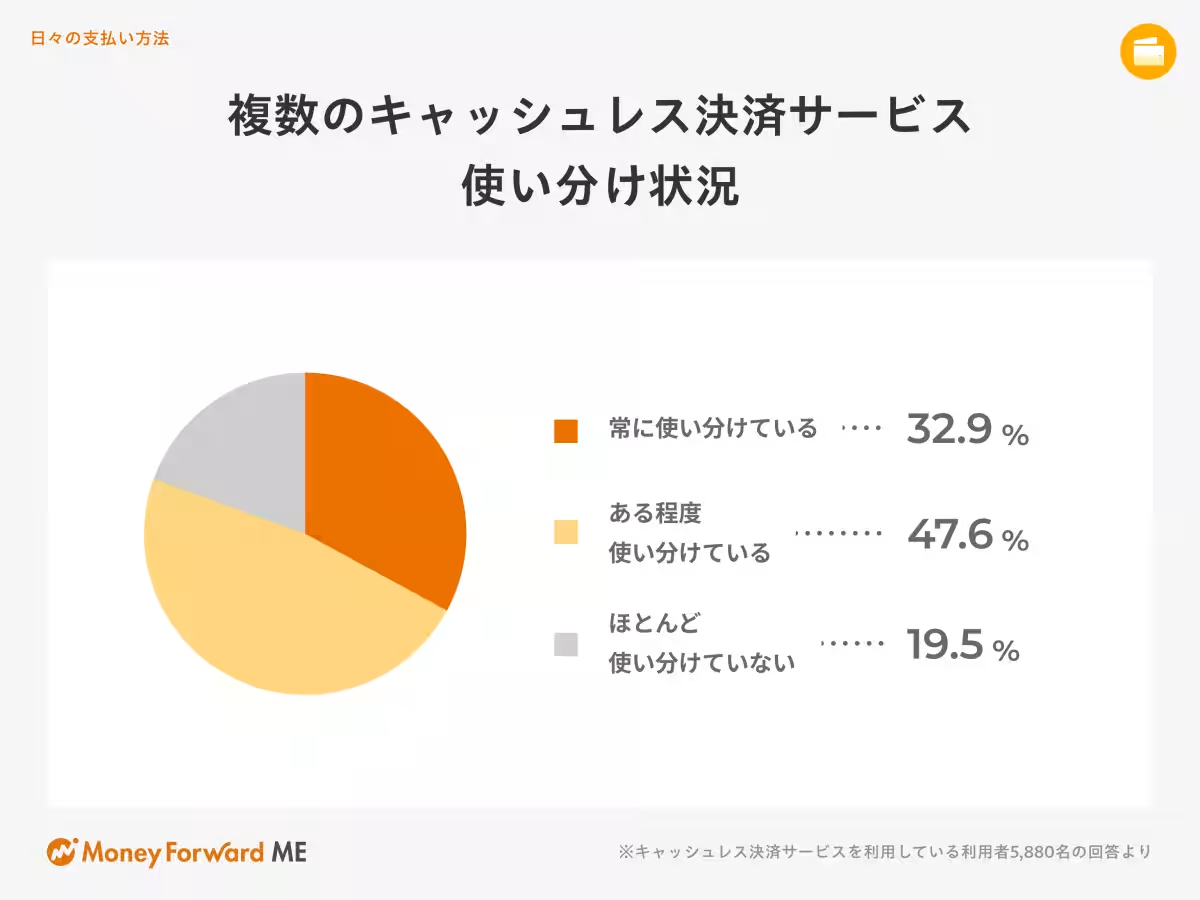

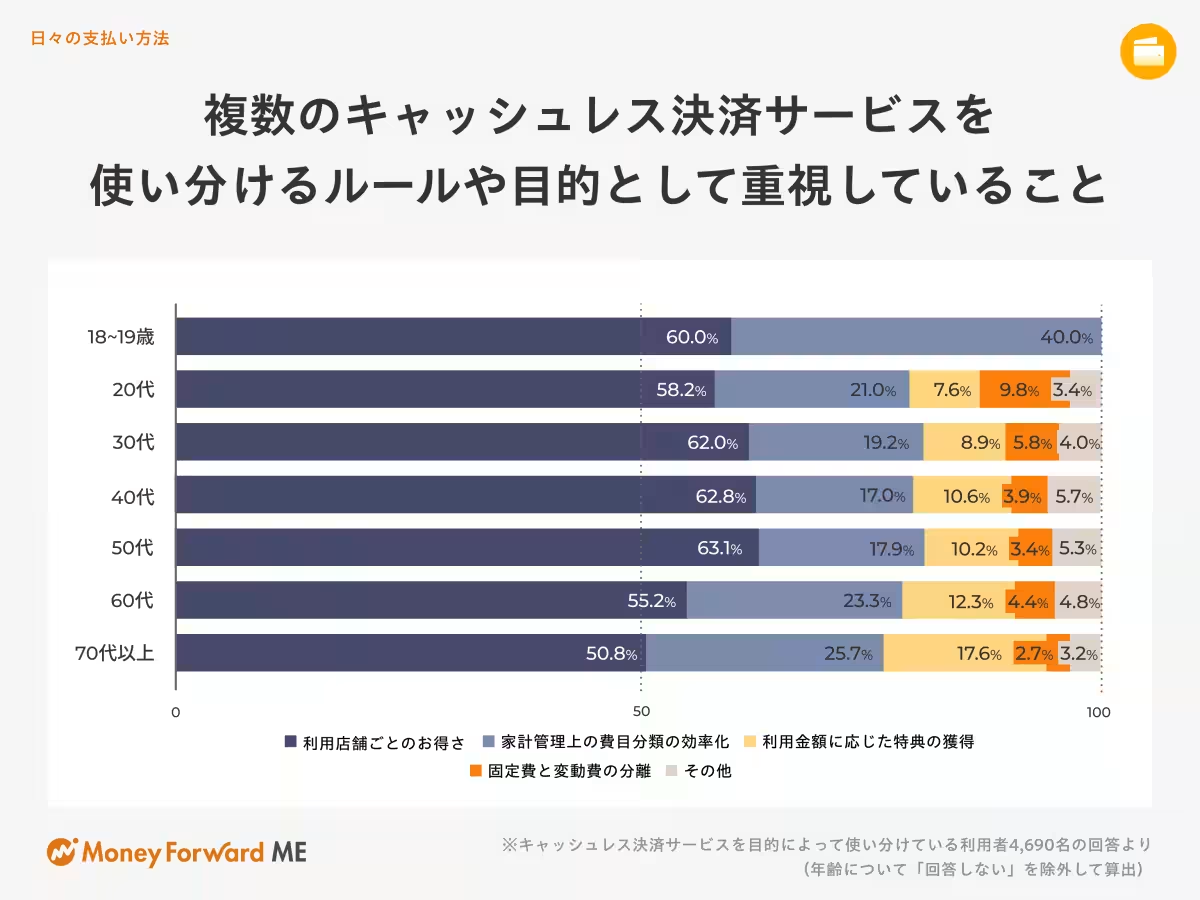

Cashless Transactions Become the Norm

A massive 98.9% of respondents reported using cashless payment options regularly. The preference for using certain services was strongly influenced by the benefits associated with loyalty points and discounts, indicating a strategic approach to spending to maximize value.

Investment Strategies and Aspirations

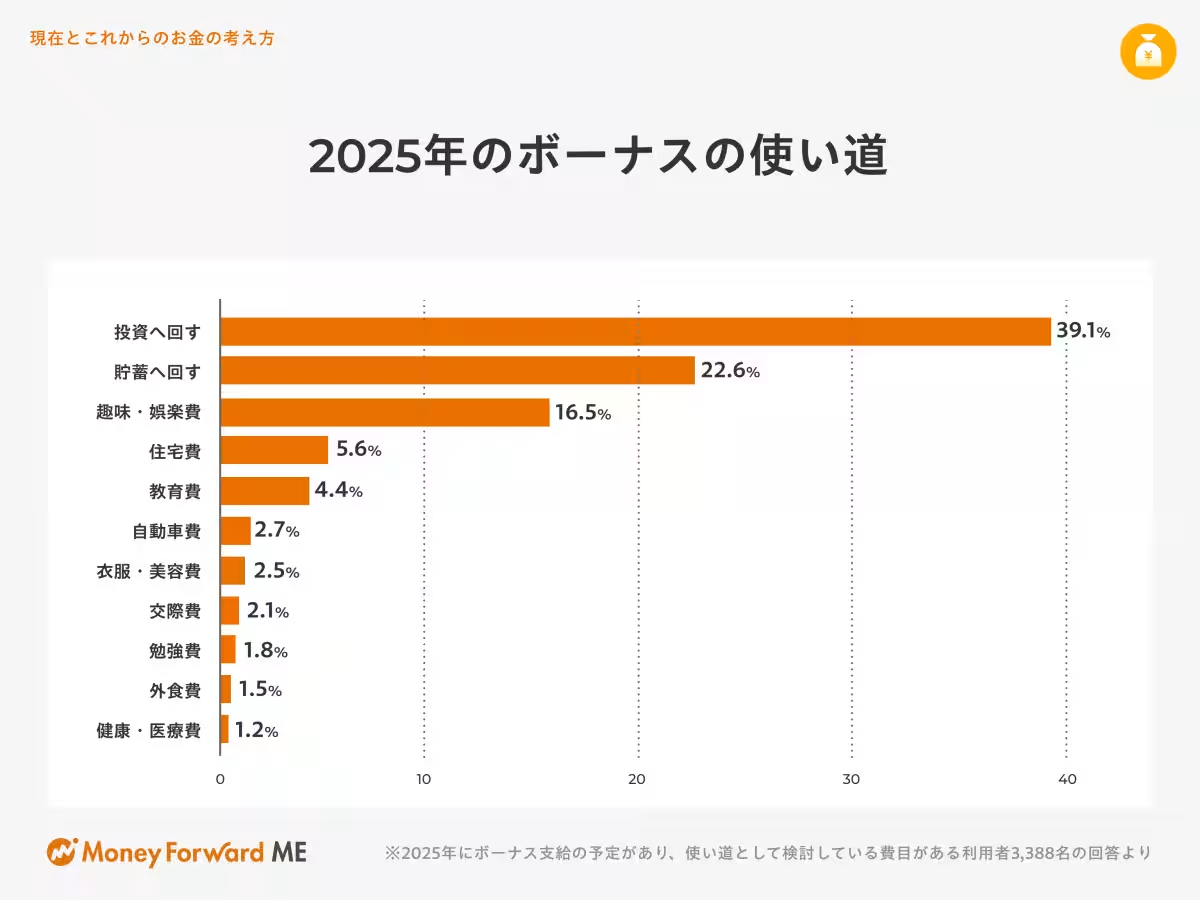

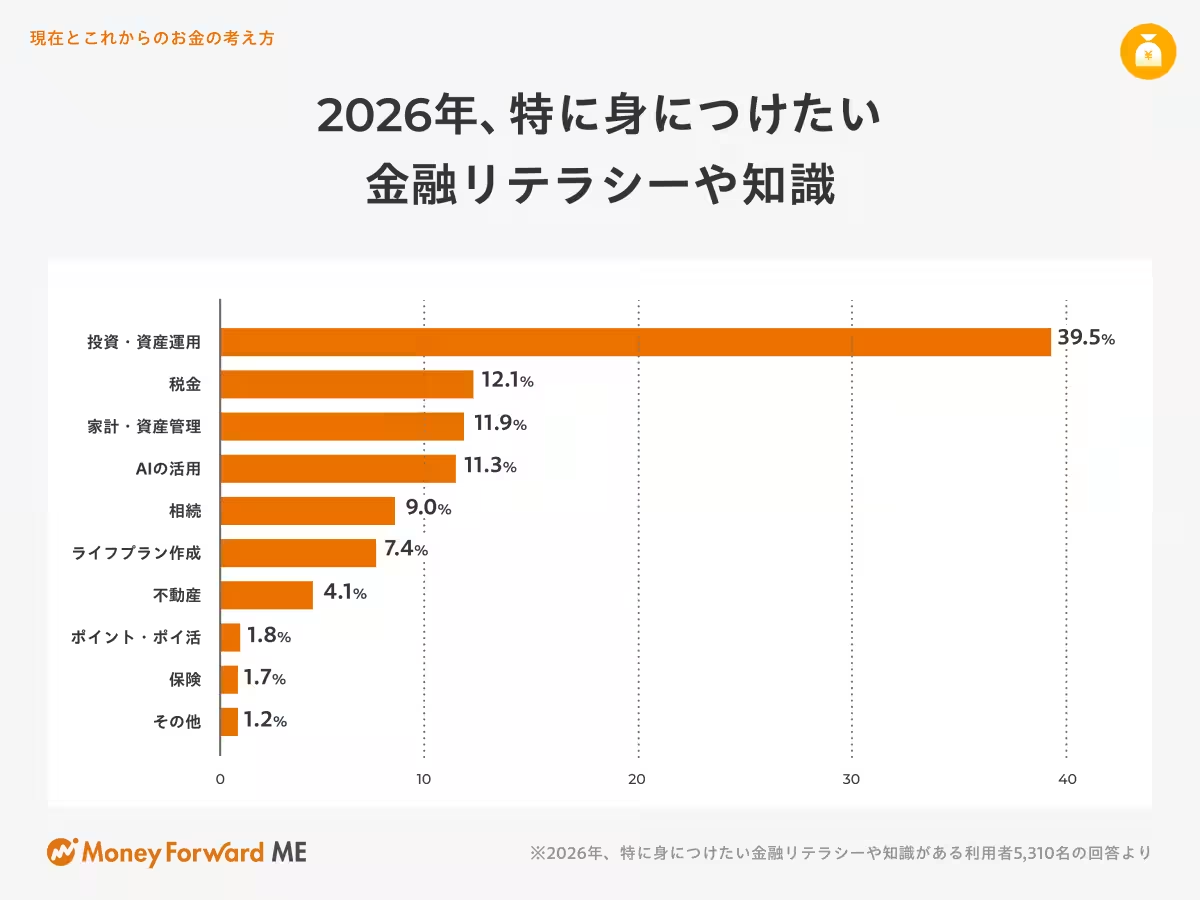

The survey illustrated that 39.1% of respondents intended to direct their bonuses towards investments in 2025. This focus illustrates a clear shift from saving to investment as the latter's popularity surged, reinforced by new regulations under the NISA framework. When asked about financial literacy aspirations for 2026, participants predominantly highlighted the desire to deepen their understanding of investment strategies and asset management.

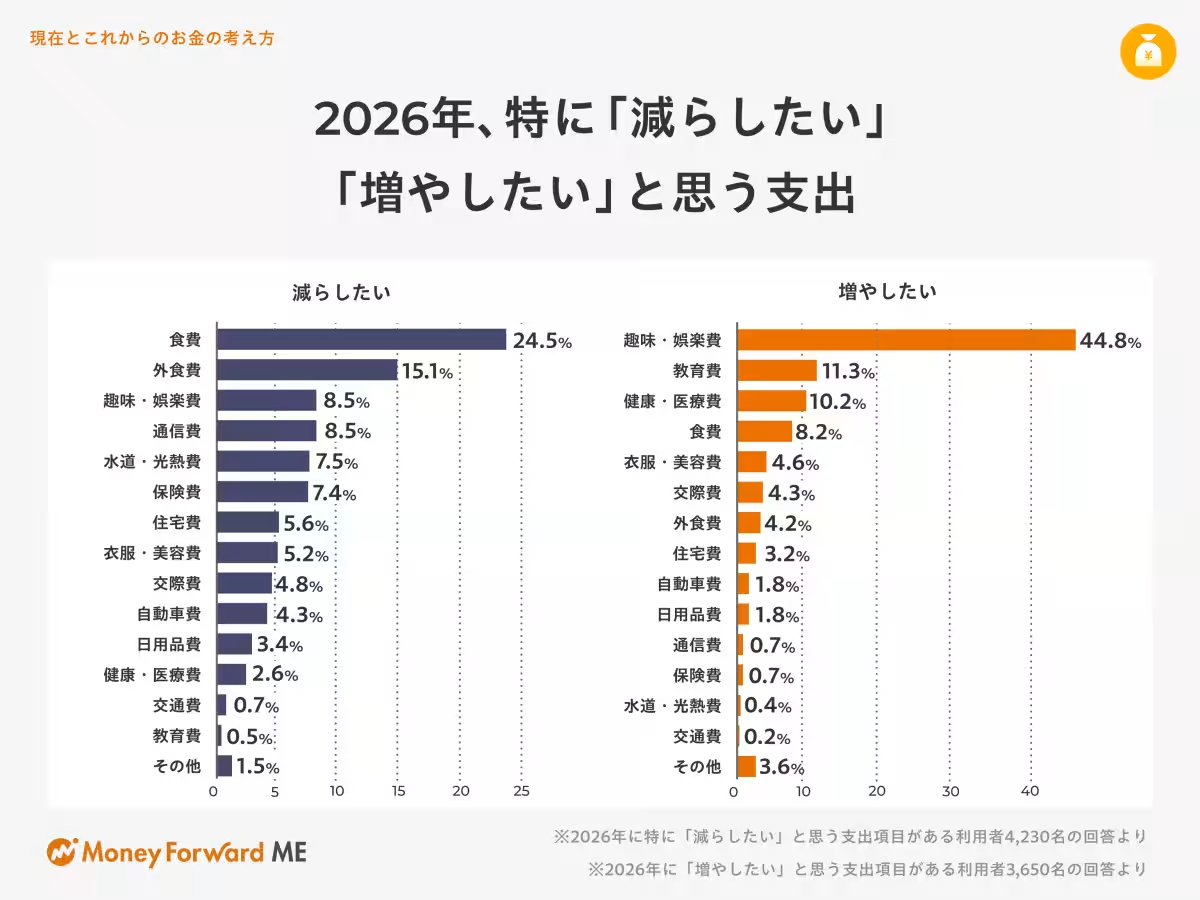

Spending Trends: What to Reduce and What to Increase

Participants indicated that they are looking to decrease spending on food expenses, while simultaneously aiming to enhance expenditures related to hobbies and recreation. This split suggests careful consideration of where to allocate financial resources while also emphasizing quality leisure time.

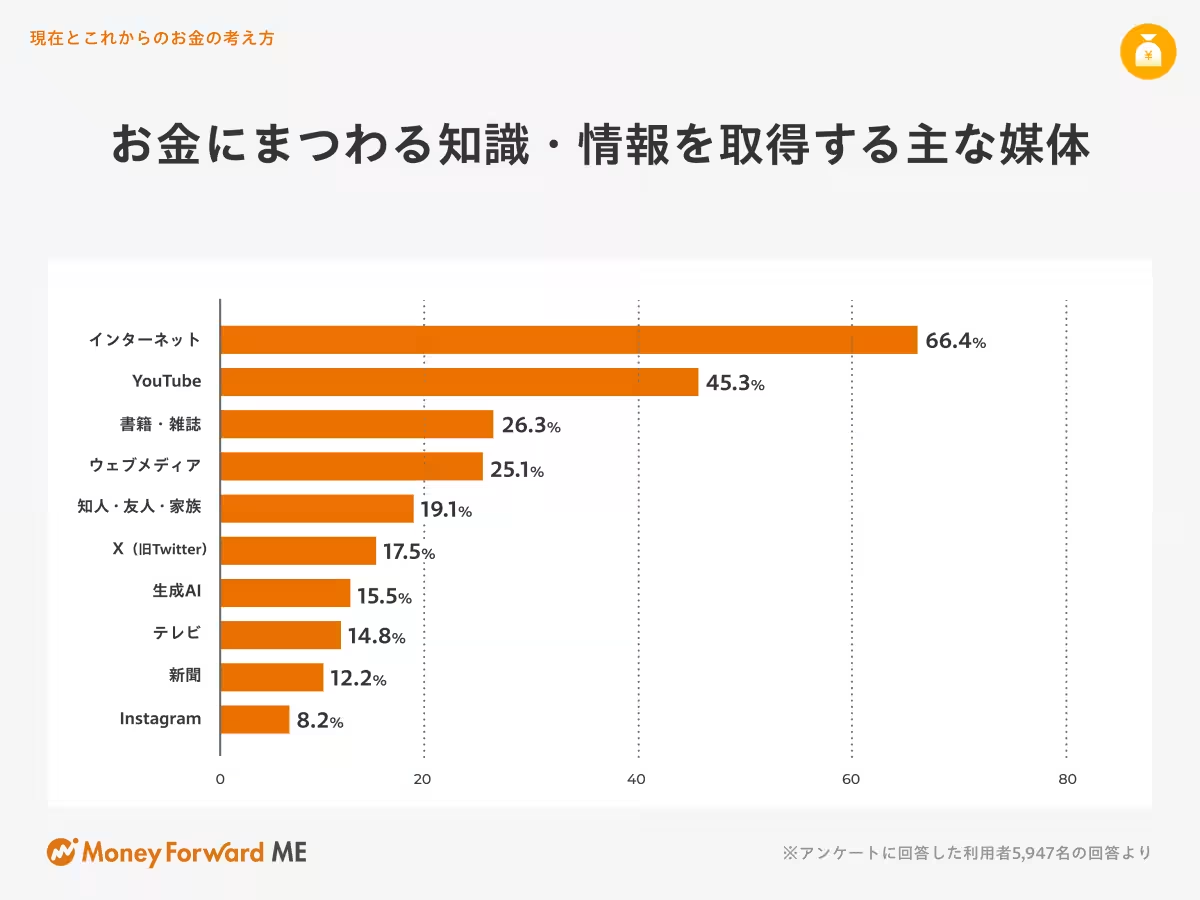

Preferred Information Sources for Financial Literacy

The survey revealed a substantial shift in how individuals seek financial knowledge, with 66.4% using internet searches and an impressive 45.3% turning to YouTube for information—a notable increase over the preceding years. This trend underscores a movement toward digital platforms as primary sources for financial literacy, reflecting a more engaged and tech-savvy generation.

Conclusion

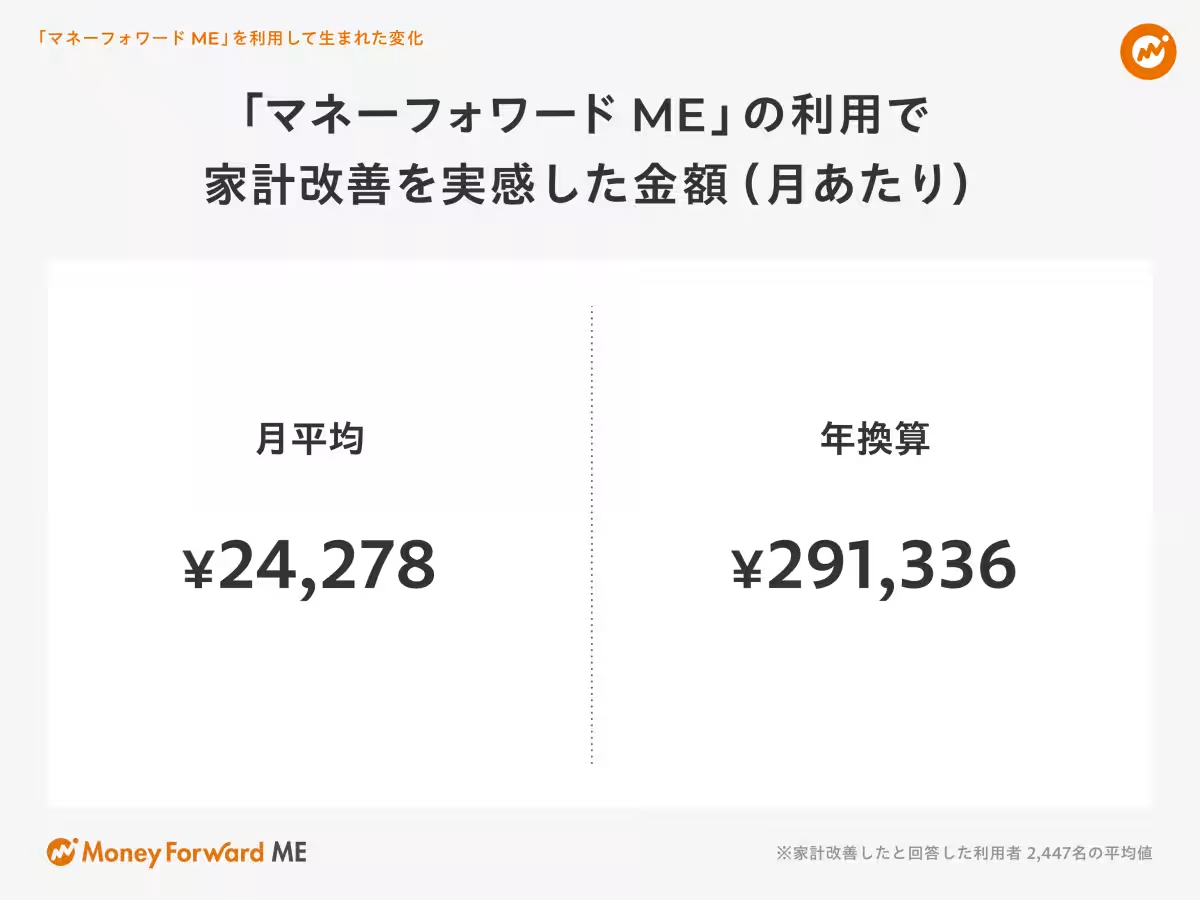

In summary, the 2025 Financial Awareness Survey highlights a significant transformation in how individuals manage their finances, especially through the incorporation of technology and collaborative approaches to budgeting and investment. Users of "Money Forward ME" find themselves adapting to economic challenges while seeking greater financial understanding and empowerment. As they navigate increasing costs and investment opportunities, the data collected serves not just as a snapshot of current habits, but also as a guide for future financial strategies. Money Forward Home aims to further support this journey, enhancing user experiences in financial management and education through innovative features and services.

Topics Financial Services & Investing)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.