Global X Japan Secures Approval for Two Gold ETFs on Tokyo Stock Exchange

Global X Japan Secures Approval for Gold ETFs

Global X Japan, a subsidiary of the Daikyo Securities Group located in Chiyoda, Tokyo, has announced a significant milestone in its journey to enhance investment opportunities in Japan. As of today, the Tokyo Stock Exchange has granted approval for two new Exchange-Traded Funds (ETFs): the Global X Gold ETF (425A) and the Global X Gold ETF (JPY Hedged) (424A). Both ETFs are scheduled to be listed on the stock exchange on September 26, 2025.

Overview of the ETFs

Global X Gold ETF (425A)

The Global X Gold ETF aims to track the Mirae Asset Gold Bullion ETF Index on a yen-adjusted basis. This ETF will invest in the Global X Gold Bullion ETF, which is a registered investment trust based in Australia that is backed by physical gold bullion. The primary objective is to provide investors with exposure to the performance of gold as a fundamental asset, while also offering the liquidity and ease of trading electronic securities.

Global X Gold ETF (JPY Hedged) (424A)

The Global X Gold ETF (JPY Hedged) similarly seeks to track the Mirae Asset Gold Bullion ETF Hedged Index. This variant offers an additional layer of protection against currency fluctuations, making it an attractive option for investors who wish to mitigate the effects of currency risk while investing in gold. Like its counterpart, it also invests in the Global X Gold Bullion ETF.

Key Features of the Funds

Both ETFs are structured to distribute profits twice a year, allowing investors to benefit from periodic earnings. The funds are part of a broader strategy by Global X Japan, which prides itself on offering an innovative product lineup that includes thematic, income-oriented, core, and commodity-based ETFs. Since its establishment in September 2019, Global X Japan has launched 55 ETFs tailored to respond to diverse investment needs of Japanese investors.

Investment Risks and Considerations

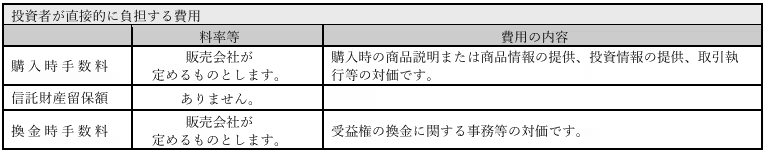

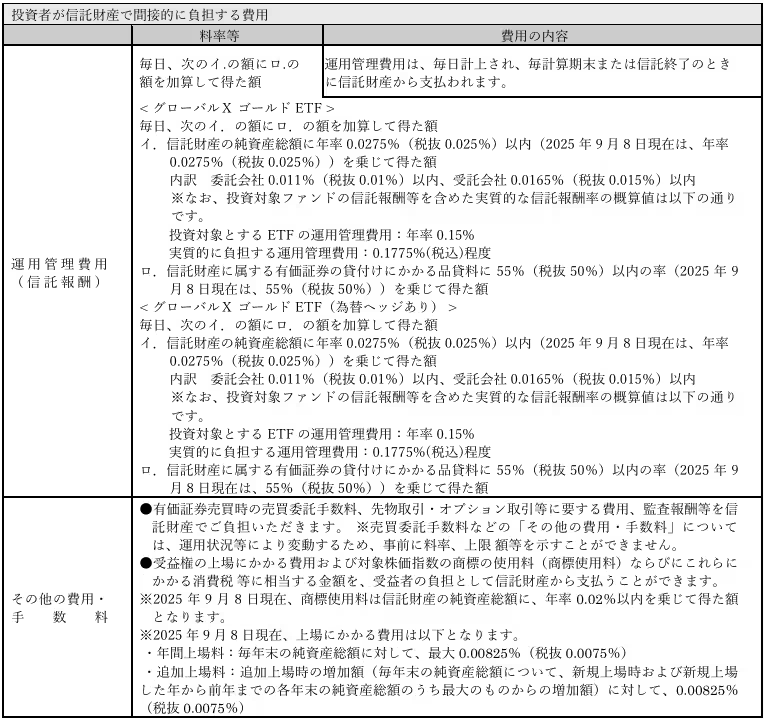

Investors should be aware that, like any investment vehicle, these ETFs carry risks. The value of the fund's shares can fluctuate due to various factors including market conditions, currency exchange rates, credit risk, and country-specific risks. Investors should be prepared for the possibility of receiving less than their initial investment, as there is no guarantee of principal. It is important for potential investors to understand these risks fully before participating.

Disclaimer on Index Copyrights

The index data provided for both ETFs is managed by Mirae Asset Global Index Private Limited. The company emphasizes that information related to the indices should not be considered as an endorsement or guarantee of any securities. Furthermore, they disclaim responsibility for the accuracy and completeness of the index values and associated data used in the ETFs.

About Global X Japan

Global X Japan is Japan's sole ETF-specialized asset management company with a dedicated focus on innovative ETF offerings. With a commitment to cater to a wide array of investor needs, the firm has established itself as a significant player in the Japanese investment landscape. For more information about the funds and company, visit their official website or YouTube channel.

Contact Information

Inquiries about these new funds can be directed to Global X Japan:

- - For media-related questions: [email protected]

- - For investor-related questions: [email protected]

In conclusion, the approval of the Global X Gold ETFs marks a progressive step toward enhancing investment opportunities in Japan’s financial markets, providing investors with diversified options in gold investments in the coming years.

Topics Financial Services & Investing)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.