New SBI Wrap All-Equity Course Offers Dynamic Investment Strategies with Smtricdm

Introduction

In an exciting development for investors in Japan, SBI Securities and FOLIO have teamed up to launch a new investment advisory service dubbed the SBI Wrap All-Equity Course. Scheduled to be available from December 20, 2025, this offering is crafted under the guidance of Sumitomo Mitsui DS Asset Management. The course promises to offer cutting-edge insights driven by a commitment to maximizing returns in the equity market, aiming to outperform global benchmarks.

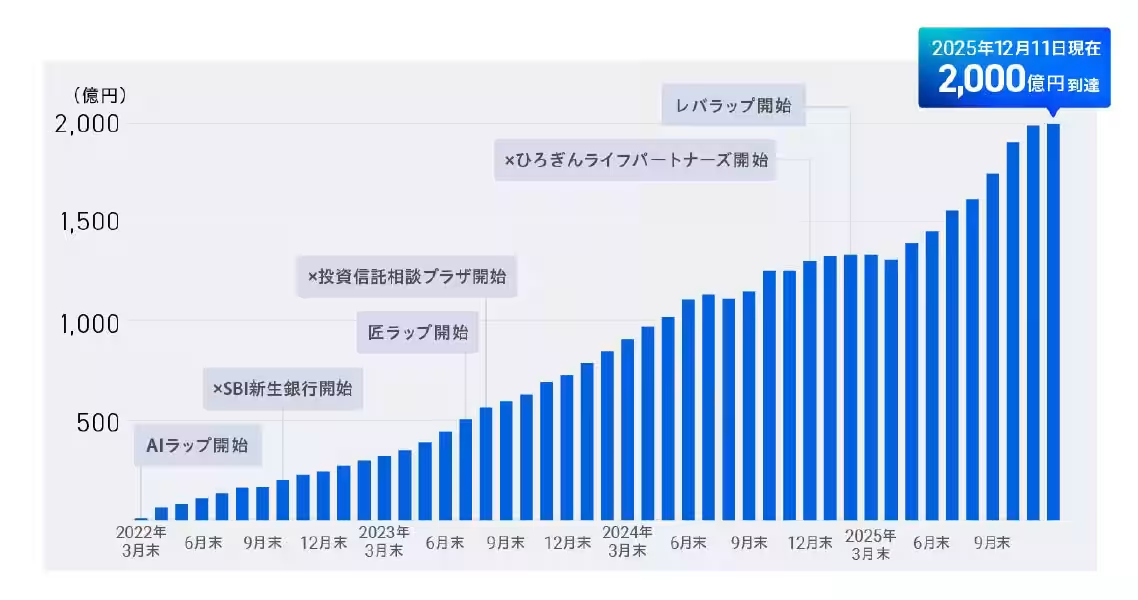

SBI Wrap's Background

Since launching in March 2022, SBI Wrap, via the 4RAP (For-RAP) platform, has gained traction, surpassing 200 billion yen in assets under management as of December 11, 2025. This rise follows a remarkable increase from 150 billion yen recorded just five months earlier in July 2025, showcasing the increasing trust and interest from investors in these tailored investment solutions.

Investment Options Under SBI Wrap

SBI Wrap has diversified its offerings over time, currently providing seven different discretionary asset management services, including:

- - SBI Wrap AI Investment Course

- - SBI Wrap Masterful Management Course

- - SBI Wrap Leverage Management Course: LevNavi

- - SBI Wrap Leverage Management Course: LevChoice

- - SBI Wrap x SBI Shinsei Bank (in-store only)

- - SBI Wrap x Investment Trust Consultation Plaza (in-store only)

- - SBI Wrap x Hirogin Life Partners (in-store only)

Unpacking the All-Equity Course

The newly launched SBI Wrap All-Equity Course will see FOLIO manage investments grounded on advisement from Sumitomo Mitsui DS Asset Management. What sets this course apart is its total allocation towards equities, employing three distinctive investment strategies designed to dynamically adjust asset distribution for achieving enhanced performance beyond current market offerings.

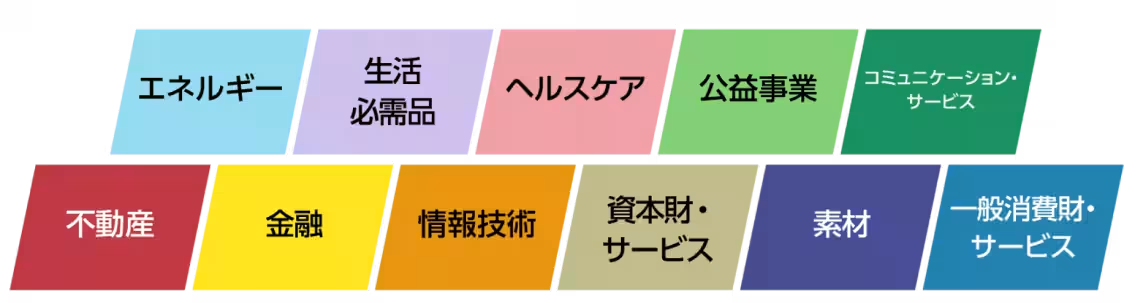

1. US Equity Sector Strategy

This strategy focuses on sectors within the S&P 500, filtering for the highest potential returns based on the Global Industry Classification Standard (GICS). Emphasizing qualitative and quantitative analysis, it leverages data to select attractive sectors that outperform during varying economic cycles. For example, it targets tech during expansions while favoring defensive sectors like utilities and healthcare in downturns.

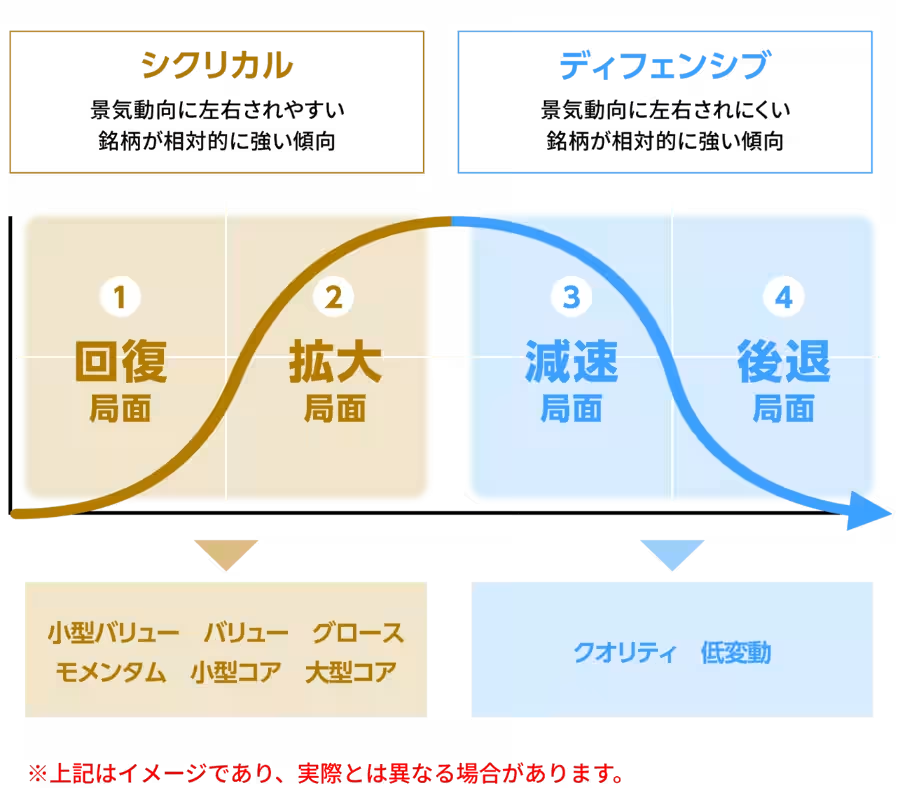

2. US Equity Factor Strategy

This approach assesses market conditions to choose effective factors for investment. Identifying opportunities across various categories such as small value, growth, momentum, and quality, the strategy integrates seasoned team expertise with robust data analytics. The aim is to continuously adapt to economic shifts, ensuring maximum payoff in fluctuating markets.

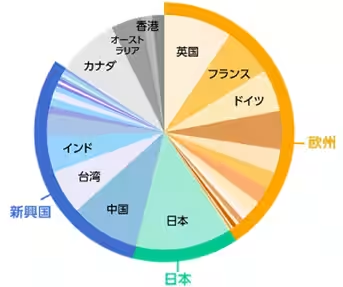

3. Global Equity (Excluding US) Strategy

Focusing on world equity markets outside the United States, this strategy aims to exceed the returns of the MSCI All-Country World Index (excluding the US). By balancing thorough quantitative evaluation with qualitative insights on different regions, it adjusts the asset distribution flexibly, based on economic indicators and market trends. Current allocations suggest a regional emphasis, notably with 40% in Europe, 14% in Japan, and 27% in emerging markets as of September 2025.

The Road Ahead

With the journey towards offering innovative investment solutions continuing, SBI Wrap's All-Equity Course presents an exciting opportunity for discerning investors. Those interested in taking part in this investment journey or exploring more about SBI Wrap can visit:

Conclusion

The launch of the SBI Wrap All-Equity course, blending cutting-edge advisory from Sumitomo Mitsui DS Asset Management and operational excellence from FOLIO, represents a pivotal shift in investment strategy personalized for today’s dynamic market. Investors eager to engage with a forward-thinking investment plan should keep an eye on this new offering from SBI Securities.

Topics Financial Services & Investing)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.