Understanding the Gap Between Real Estate Investors and Home Seekers in Japan

Exploring the Disparities Between Real Estate Investors and Home Seekers in Japan

In a groundbreaking collaboration, LIFULL HOME'S, Japan's leading real estate and housing information service, and Kenbiya, a respected platform for real estate investment insights, have conducted a thorough study to understand the differences between real estate investors and individuals searching for housing. This analysis sheds light on the contrasting needs and preferences that these two groups embody, revealing significant insights into the housing market.

Study Overview

LIFULL, headquartered in the Chiyoda area of Tokyo, operates LIFULL HOME'S, which serves as a resource for both home seekers and real estate investors. The recent survey was sparked by the observation that these two groups often have differing priorities. While real estate investors tend to focus on profitability and potential property appreciation, home seekers are primarily concerned with current living conditions and convenience.

Key Findings

1. Gap in Geographic Preferences: The study unveiled varied preferences between investors and home hunters across different districts. Interestingly, many suburbs were identified as favorable by investors, contrasting with the central Tokyo areas that house significant rental demand. Only Hino City and Akishima City from Tokyo made the list of popular districts for investors, while suburban cities like Mobara in Chiba and Miura in Kanagawa ranked high among investors.

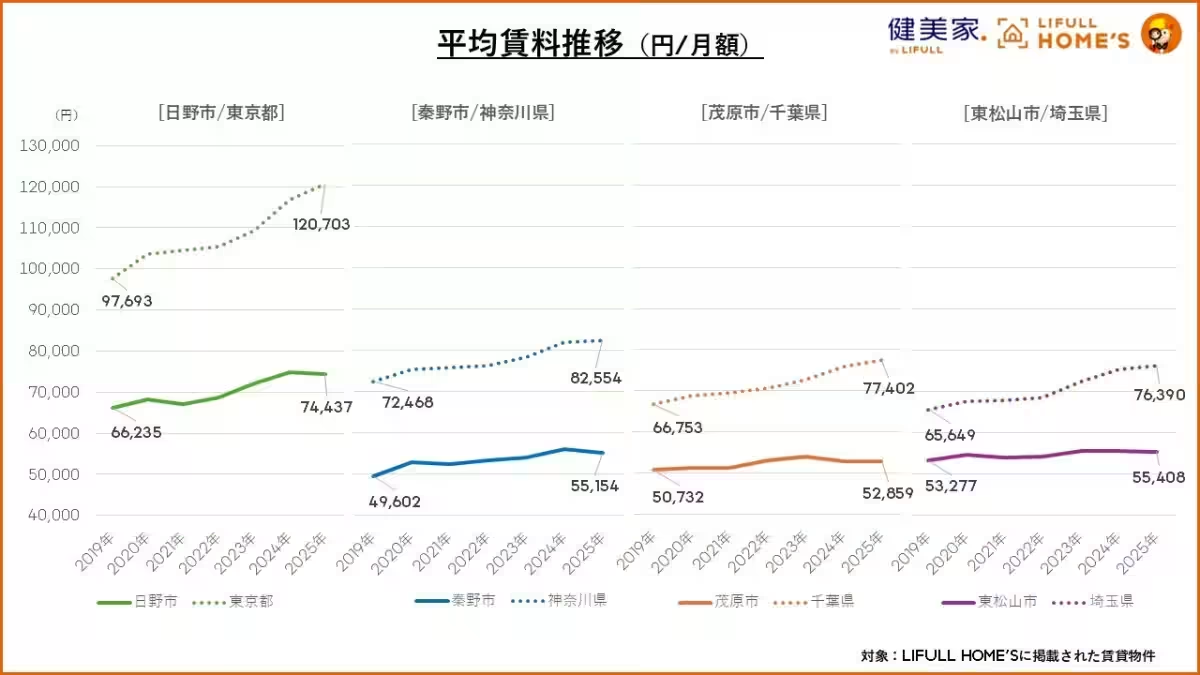

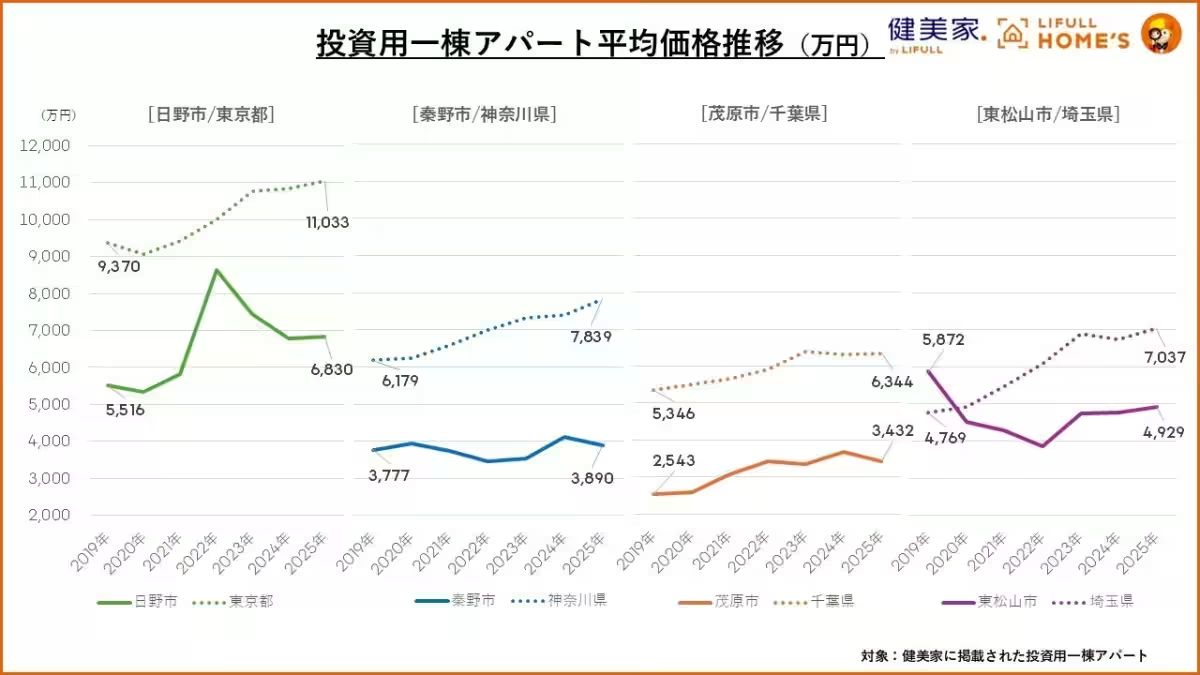

2. Rent and Price Trends: An analysis of average rent prices showed that the areas favored by investors typically have lower rent costs and mild rent increases over recent years. This stability in rental prices may appeal to investors looking for dependable income streams. Similarly, the average prices for entire apartments have remained comparatively affordable in these districts, enhancing their attractiveness for investment.

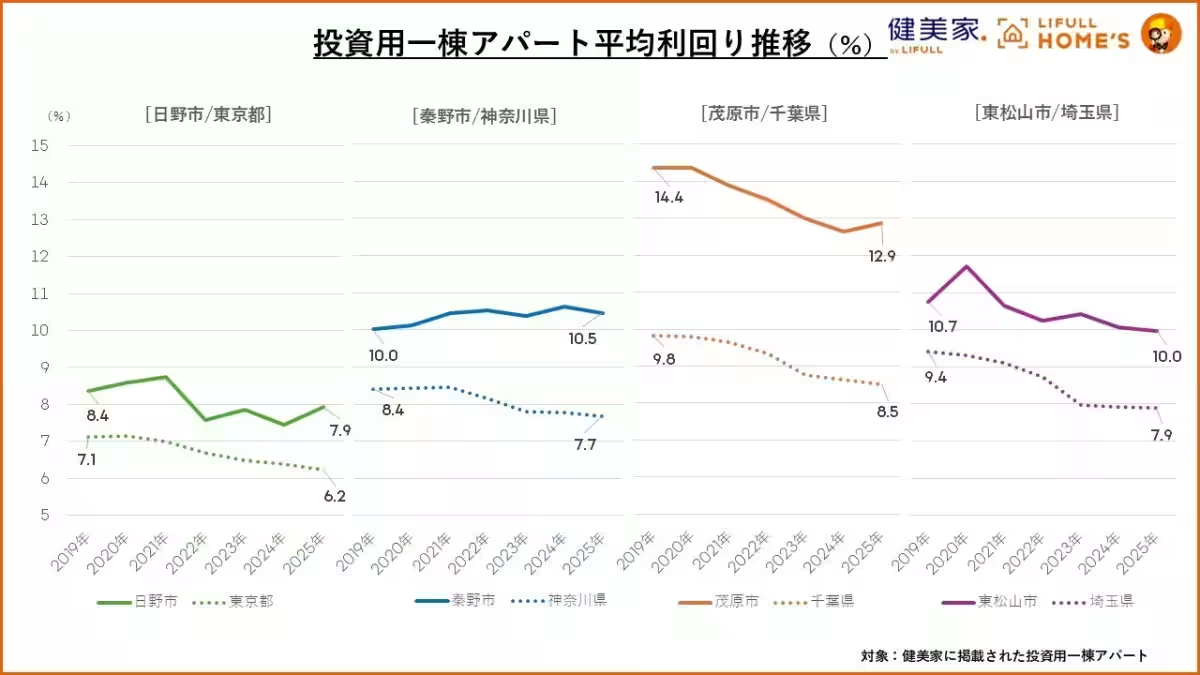

3. Yield Considerations: The study also distinguished average yield rates across the areas studied, revealing that many of the preferred districts maintained yields above the prefectural averages. This indicates that while the property prices are lower, there exists a solid demand for rental properties, validating these regions as viable options for investors seeking stable returns.

The Investor's Viewpoint

Toshiaki Nakayama, the Chief Analyst at LIFULL HOME'S, explained that investors often prefer areas that may not attract high attention but offer stable rents and yields. These investors tend to avoid the riskier, high-cost areas of central Tokyo due to concerns over vacancy rates and potential income fluctuations. The focus remains on finding properties that ensure a reliable cash flow without exorbitant entry costs.

Home Seekers vs. Investors

In discussing preferences, Nakayama highlighted that regular leasing users typically gravitate towards districts that provide easy access to workplaces or schools, combining both lifestyle convenience and affordability. Conversely, individual investors prioritize the profitability of their investments. This often means favoring areas that may seem less attractive but promise stability, translating into thoughtful investment decisions.

Analyzing Trends in Upcoming Years

Looking ahead, the study indicated a shift in preferences with suburban areas emerging as viable investment options. Previous results showed a decreasing number of attractive districts in Chiba and increasing recognition of areas in Saitama. This trend could signal a broader shift in the real estate market, potentially influenced by population distributions and urban developments.

Conclusion

Overall, the comprehensive analysis by LIFULL HOME'S and Kenbiya has illuminated the distinct differences between real estate investors and home seekers in Japan. Understanding these disparities is vital for stakeholders in the housing market, as it creates opportunities for tailored services that address the unique needs of each group. As urbanization continues to evolve, these insights may shape the future trajectories of property management and investment strategies in Japan.

For more information about LIFULL HOME'S, visit their official website at LIFULL HOME'S. For insights into real estate investment, check out Kenbiya.

Topics Consumer Products & Retail)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.