Manulife Life Insurance Launches Innovative V2 Variable Insurance Plan on November 1st

Manulife Life Insurance's New Offering: Kokuwari Variable Insurance V2

Manulife Life Insurance Co., led by CEO Ryan Sherland and based in Shinjuku, Tokyo, has announced the launch of its new variable insurance product, "Kokuwari Variable Insurance V2", starting November 1, 2025. This innovative product is designed to provide not only essential life coverage but also support for asset formation suitable for the modern age, addressing the needs of clients looking towards long-term financial security in retirement and estate planning.

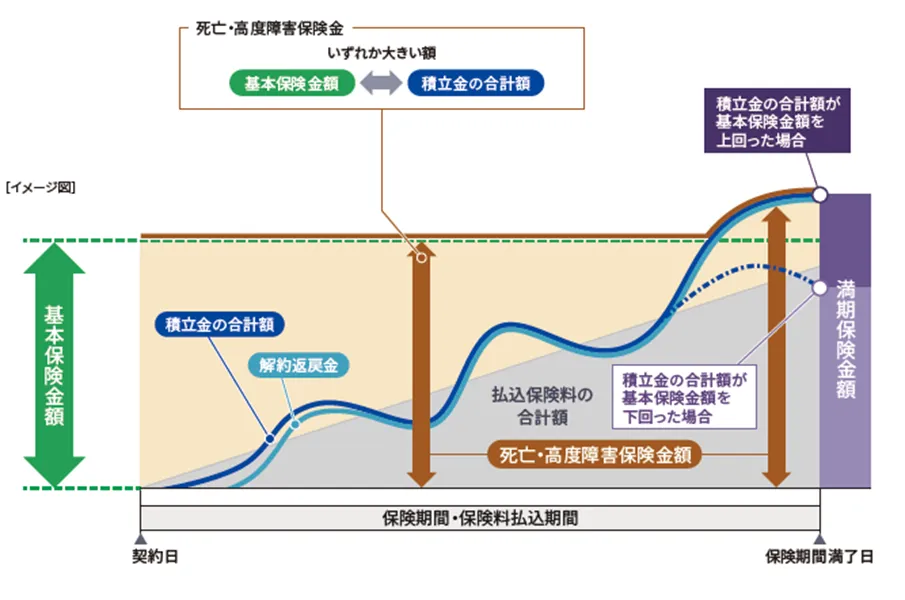

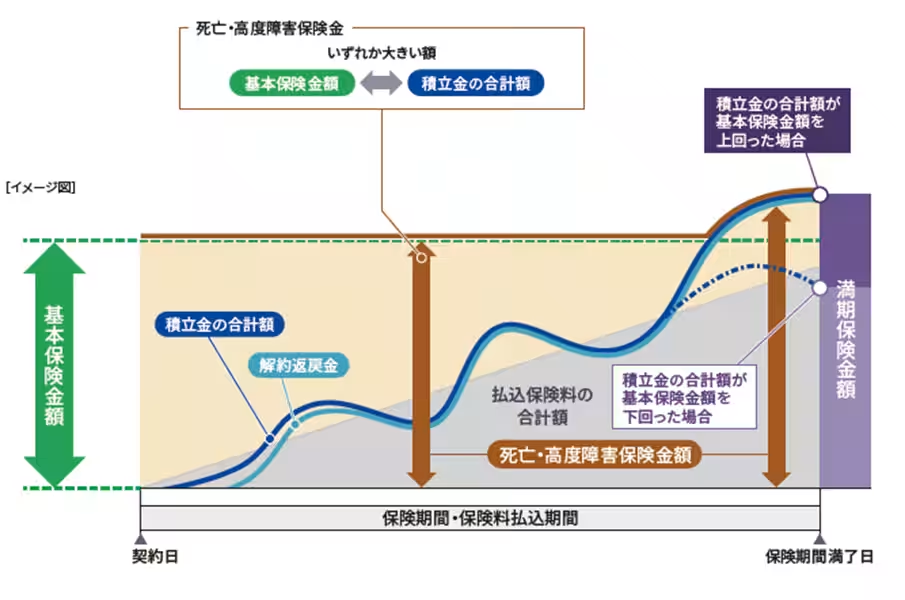

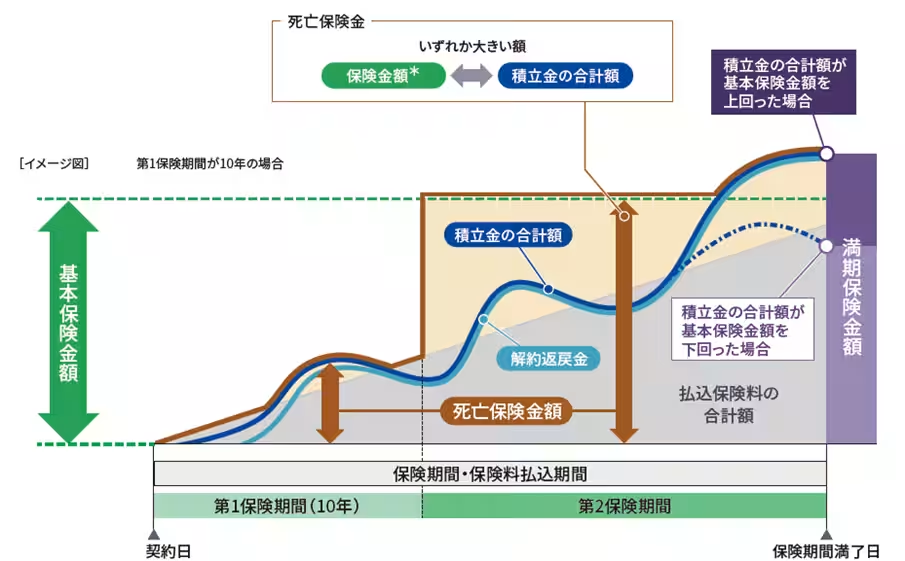

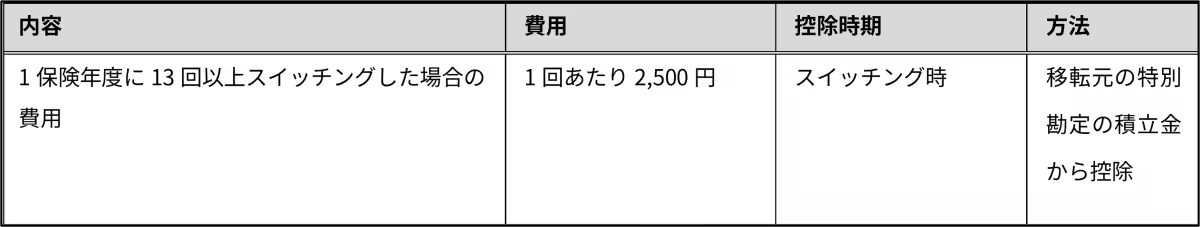

The Kokuwari Variable Insurance V2 combines both protection and asset development functions into a yen-denominated variable insurance plan. To enhance customization, it introduces new features not found in its predecessor. Key among these is the inclusion of a 'No Declaration Type', providing clients with greater flexibility in securing the necessary coverage for various life stages. This option allows customers to select coverage based on their needs without the requirement to declare their health status, making it more accessible.

Recent trends reveal a growing interest among younger demographics in investment strategies to combat inflation while building personal wealth. Following the launch of the first Kokuwari Variable Insurance in 2019, this revamped version aims to meet clients' diverse needs through significant enhancements, including the addition of a no declaration option, enabling a more tailored experience for each individual.

With the Kokuwari Variable Insurance V2, clients can choose from ten special account options that align with their individual investment styles and risk tolerances. This adaptability is complemented by a selection of carefully curated funds aimed at long-term growth and preparedness against unforeseen circumstances.

Product Enhancements

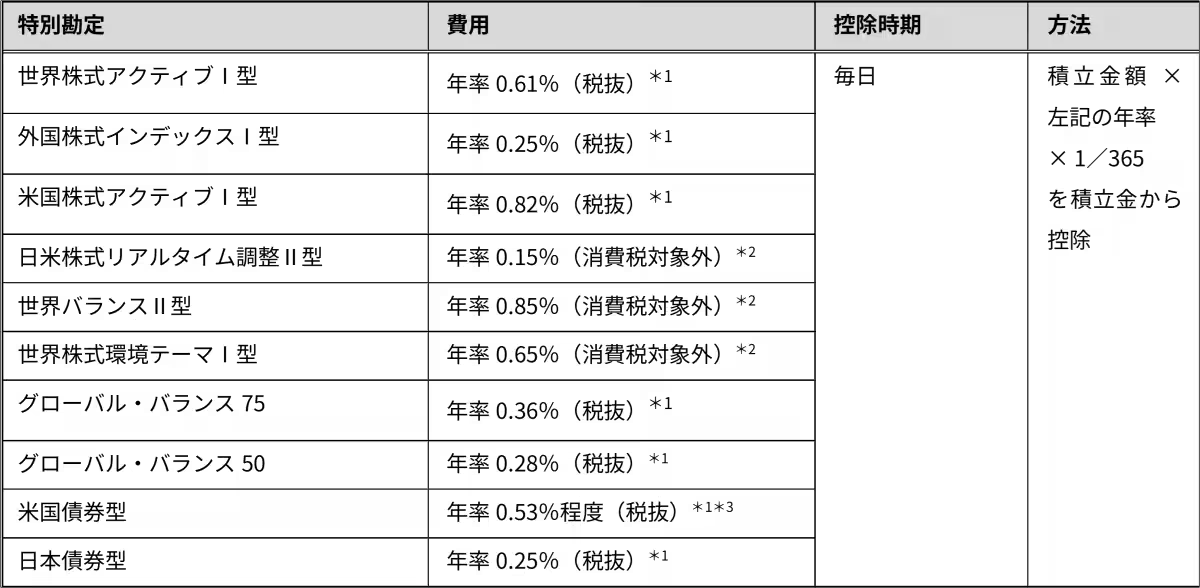

Key updates in the new product include:

1. Introduction of a No Declaration Type: Clients can now opt for coverage without the need for health disclosures.

2. Revised Premium Rates: Existing insurance rates have been updated alongside the introduction of the new features, including a specific exemption for insurance premiums due to critical illnesses under the declaration type.

3. Expanded Age Range for Contracts: The eligibility age range for new contracts has been widened.

4. New Special Account Addition: A new special account has been introduced, allowing clients greater investment options.

5. Change Feature for Disaster Coverage: Clients can switch to a lump-sum life insurance policy with disaster coverage.

According to Manulife’s product development executive, Kurt Zahn, "Kokuwari Variable Insurance V2" is crafted to respond to economic changes and meet the diverse needs of our customers. We aim to provide them with the flexibility and choices necessary for their insurance and asset formation goals, while also aligning with their personal life plans. This supports our brand message of empowering clients with 'Certain Choices in Life'.

Manulife Life Insurance serves clients through an extensive network comprising over 65 locations and approximately 1,780 insurance agents across Japan, delivering high-quality products and personalized advice tailored to different life stages. The company's offerings are designed to assist clients through all aspects of life—from unexpected events to retiring and managing asset inheritance.

About Manulife Life Insurance

Manulife Life Insurance is part of Manulife Financial Corporation, a leading financial services group based in Canada. Guided by the brand message of 'Certain Choices in Life', the company provides life insurance, retirement planning, and asset formation solutions customized for each client, enabling secure choices for a better future. By combining global expertise with local market insights, Manulife aims to support clients in achieving long-term financial well-being and inheritance solutions. For more information, visit Manulife's official website or follow us on LinkedIn.

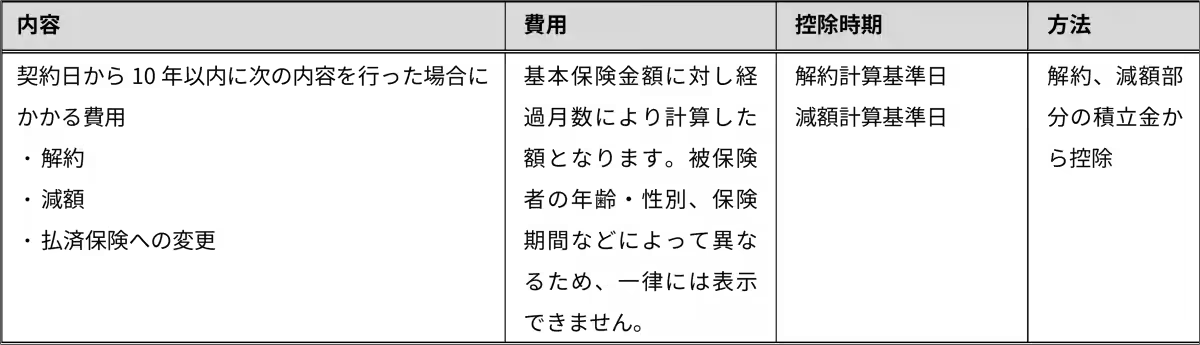

Key Points of the New Product

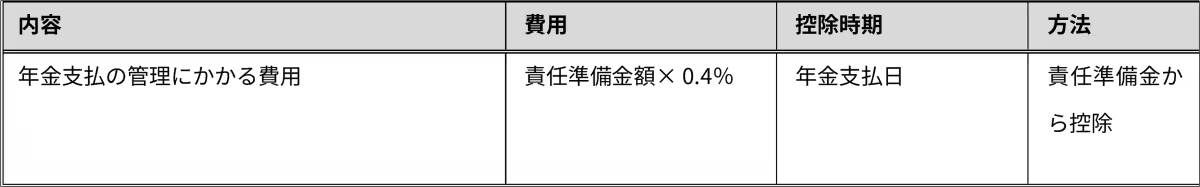

- - Selection between 'Declaration Type' and 'No Declaration Type'.

- - Enhanced benefits under the Declaration Type for critical illnesses.

- - Clients can opt for a maximum policy amount over ¥10 million for discounts.

- - Special provisions for unique cases, including corporate and sole proprietor contracts.

Clients interested in this innovative insurance offering are encouraged to consult with their insurance agents to explore their options and expand their financial security.

Topics Financial Services & Investing)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.