SBI Okasan Asset Management's ROBOPRO Fund Surpasses 100 Billion Yen in Assets

ROBOPRO Fund Breaks Through 100 Billion Yen

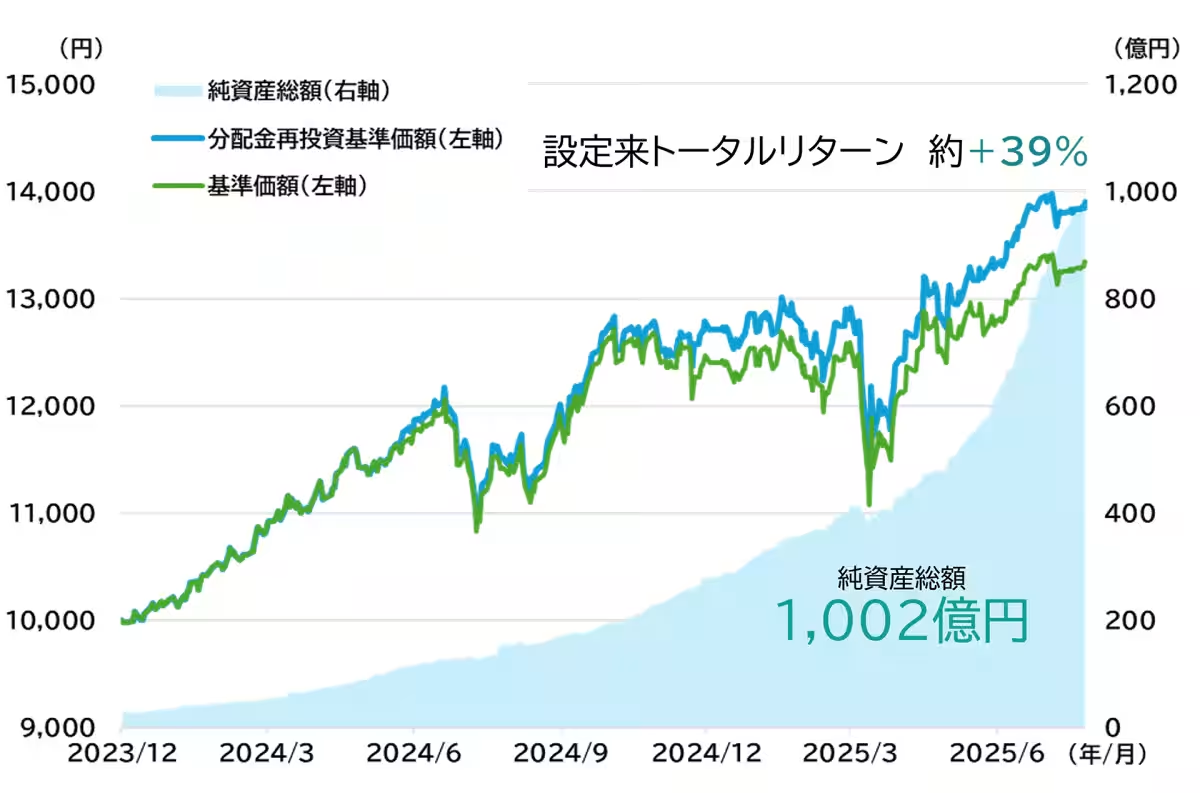

On August 22, 2025, the ROBOPRO Fund established by SBI Okasan Asset Management, headquartered in Chuo-ku, Tokyo, surpassed 100 billion yen in net assets, achieving this milestone in just over 1 year and 8 months since its establishment on December 28, 2023. This achievement underscores investors' trust in this innovative approach to asset management utilizing AI technology.

Strong Performance Supports Asset Growth

The ROBOPRO Fund has shown resilient performance, boasting an increase of approximately 39% in total return since its inception (based on reinvested dividend pricing). As of August 22, 2025, the fund's robust growth is a testament to the effective strategies employed in managing assets through advanced AI methodologies.

Leading in Fund Inflows for Two Consecutive Months

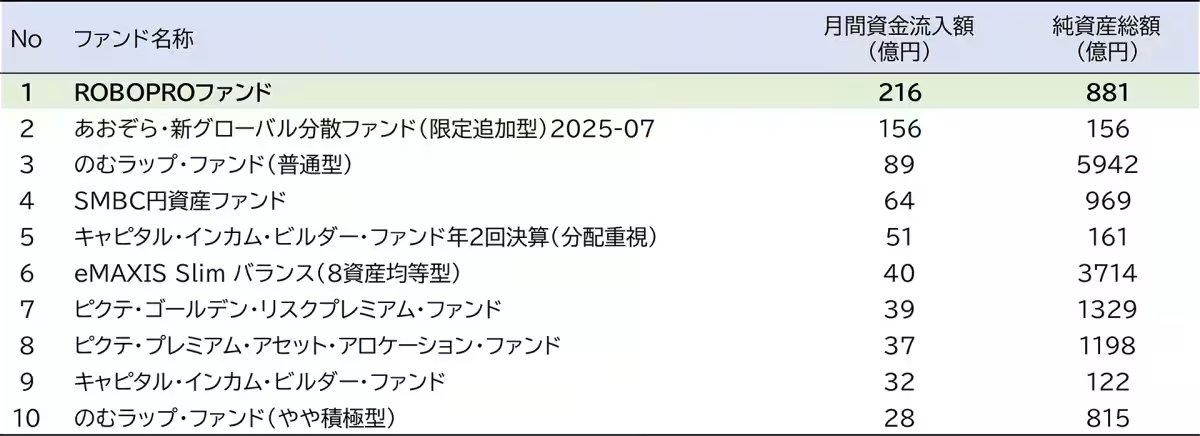

The influx of funds into the ROBOPRO Fund has continued to flourish, highlighted by a record of approximately 21.6 billion yen in inflow during July 2025. For two successive months, it ranked first among balanced funds in terms of net inflow. This consistent and performance-backed inflow indicates increasing recognition of the fund as a reliable AI-managed investment option.

Features of the ROBOPRO Fund

- - AI-Driven Market Analysis: The fund leverages AI to analyze vast amounts of market data, predicting returns on various investment assets, including stocks, bonds, REITs, and commodities.

- - Emotionless Decision-Making: The use of AI ensures that investment decisions are logical and not subjected to market emotions.

- - Diversified Portfolio: The ROBOPRO Fund invests in a wide array of global assets, ensuring diversification across different markets.

- - Agile Portfolio Rebalancing: The fund's portfolio is rebalanced monthly to adapt to market changes effectively.

A Milestone, Not the Finish Line

The achievement of surpassing 100 billion yen is viewed as a significant milestone by the ROBOPRO Fund management, rather than an endpoint. SBI Okasan Asset Management and FOLIO plan to continue enhancing fund management quality through further AI utilization, contributing to investors' asset growth.

Manager's Perspective

Masayuki Tsuji, Head of Solutions Operation, stated, “Reaching the milestone of 100 billion yen in net assets reflects the trust placed in us by our investors. We regularly rebalance our portfolios based on AI-driven return predictions to navigate market fluctuations. The consistency of this approach has led to strong performance and increased fund inflows. We view this achievement as a checkpoint and will continue striving for performance improvements to benefit our investors in asset management.”

Company Philosophy

With over 60 years of history, SBI Okasan Asset Management's corporate philosophy is “Challenge & Uniqueness – Contributing to the Future of Asset Management and Exceeding Customer Expectations.” The company aims to create unique value through continual challenges and innovations.

For further details about the ROBOPRO Fund, please visit:

The ROBOPRO Fund primarily targets domestic and international equities, domestic and international bonds, real estate investment trusts, and commodities. Please note, the fund's net asset value fluctuates based on the performance of included securities and currency exchange rates, and principal investments are not guaranteed. Ensure to thoroughly read the Investment Trust Prospectus and related documents before making any investment decisions.

Topics Financial Services & Investing)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.