Adult Financial Education Survey Reveals Low Practical Application of Financial Knowledge

Overview of the Adult Financial Education Survey

A recent survey conducted by 400F, which operates services like "OkaneKo" and "OKANE-KOllege," sheds light on the current state of financial knowledge among adults in Japan. Collaborating with the Alliance for Creating Financial Education for the Future, the survey sought to assess how effectively adults are engaging with financial education, especially given the increasing importance of such knowledge in contemporary society.

Key Findings

1. Engagement in Financial Learning

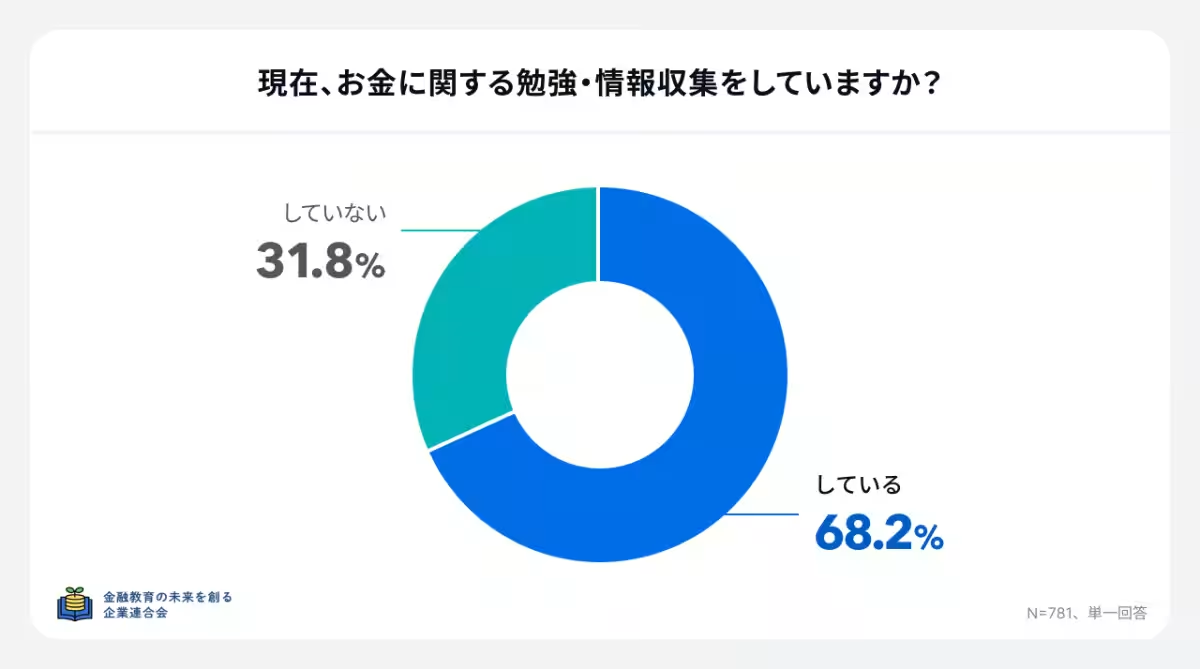

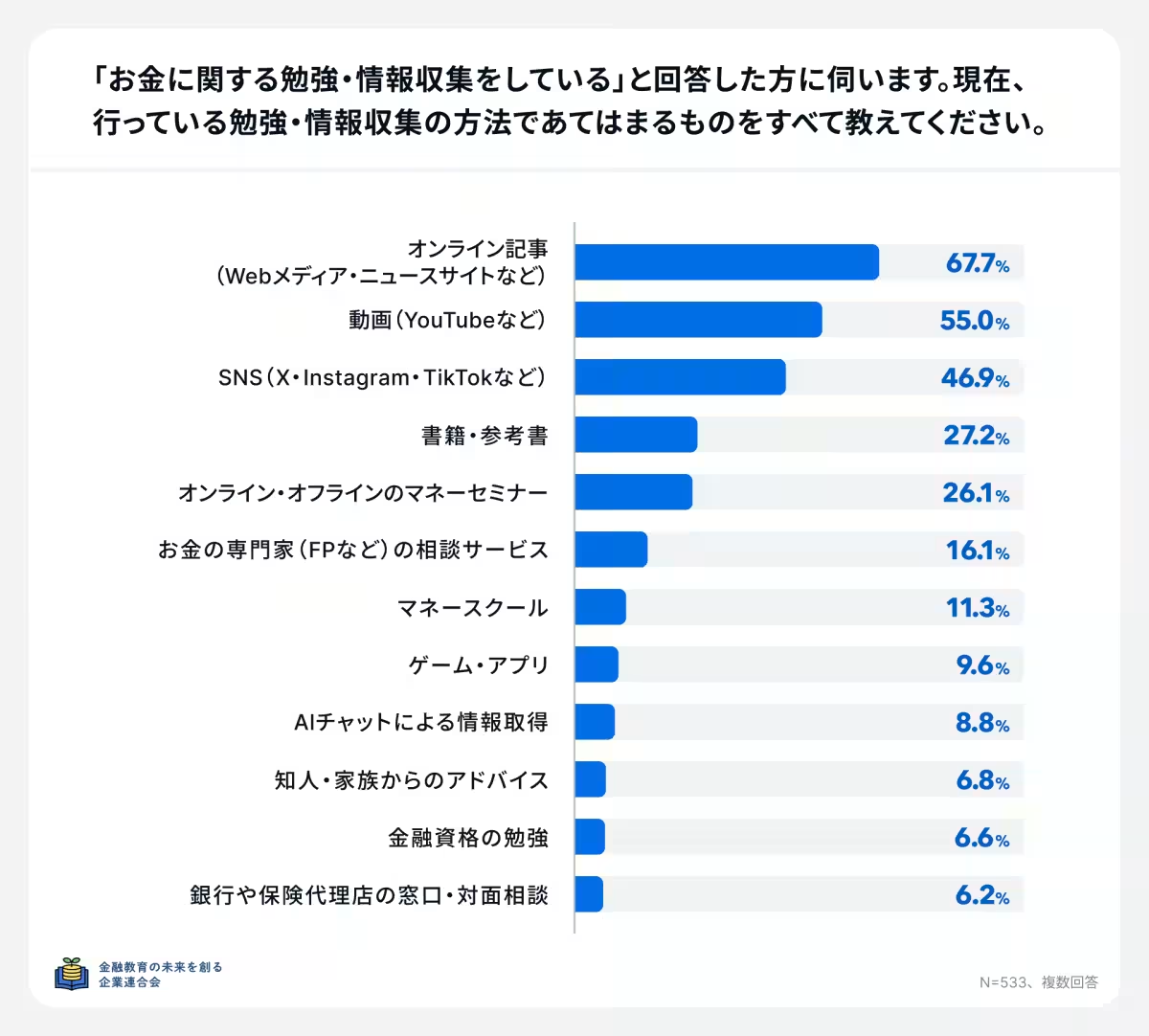

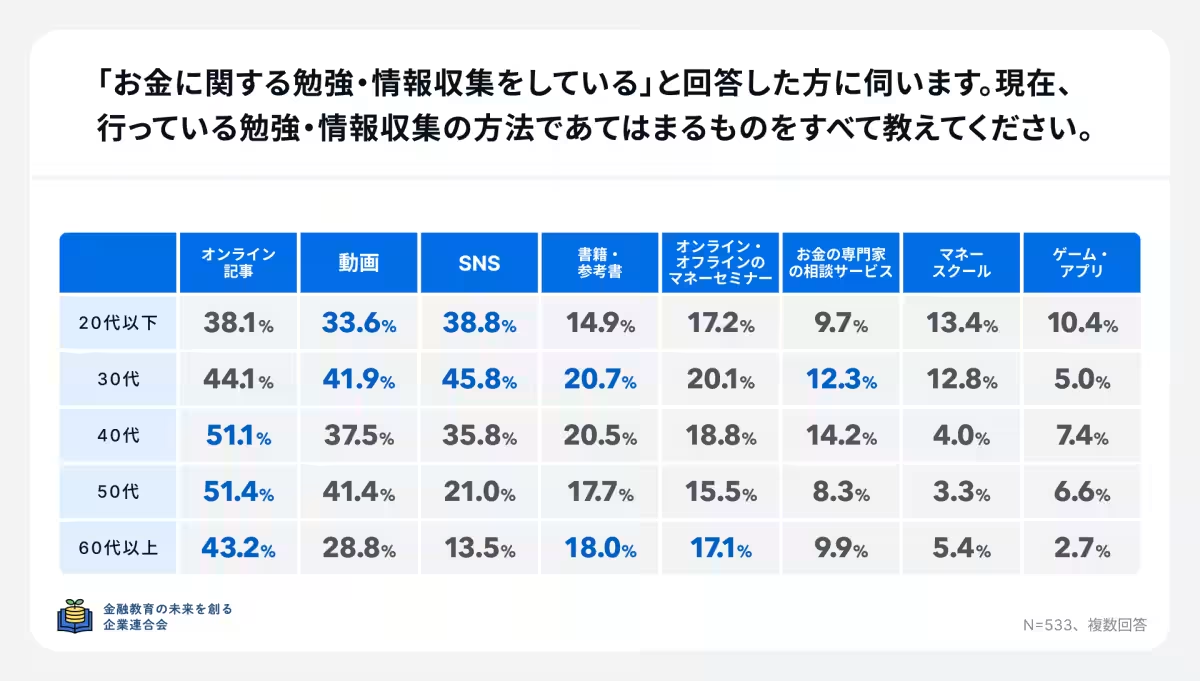

According to the survey, 68.2% of respondents are actively seeking information about finance. The leading resources for this engagement are online articles (67.7%) and videos (55.0%), signaling a shift towards digital mediums in financial education.

2. Main Objectives of Financial Learning

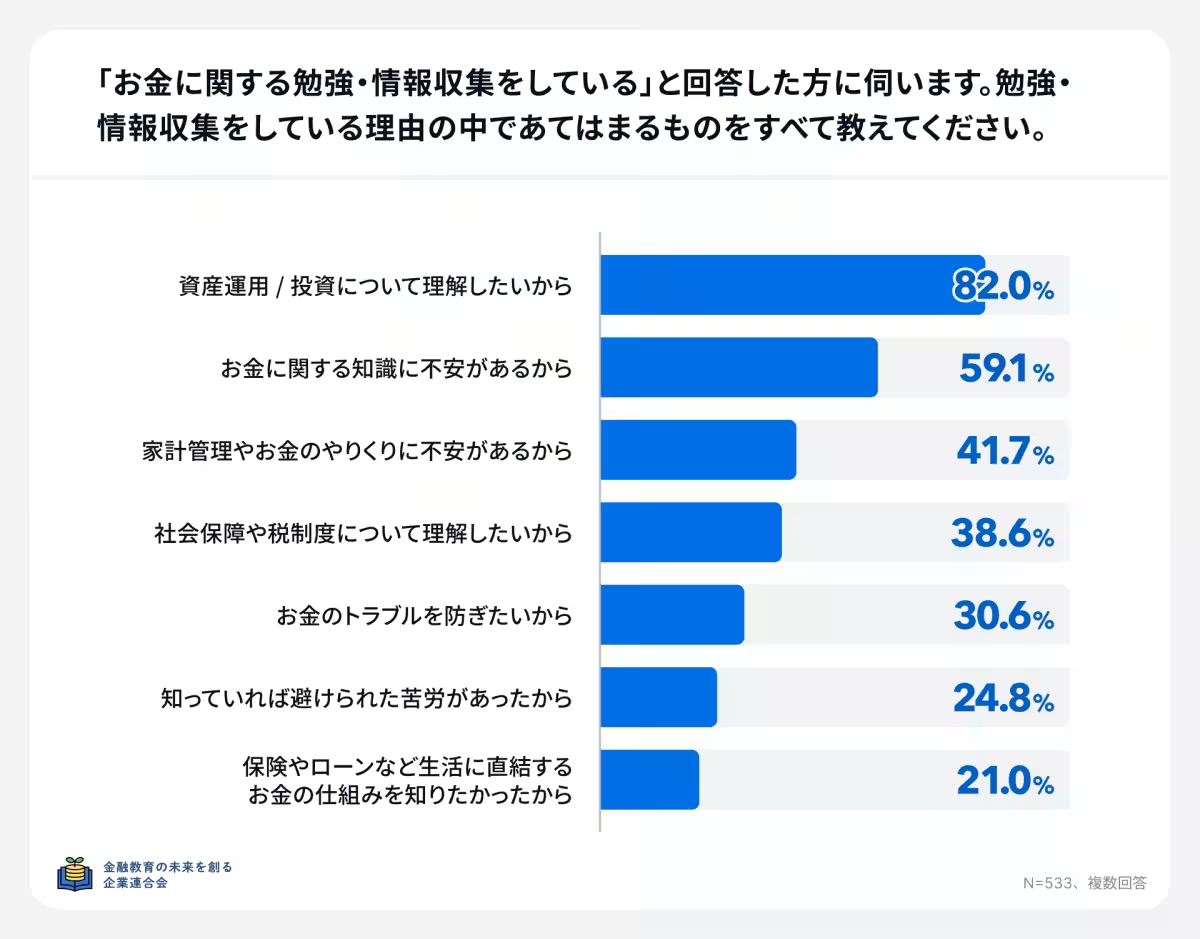

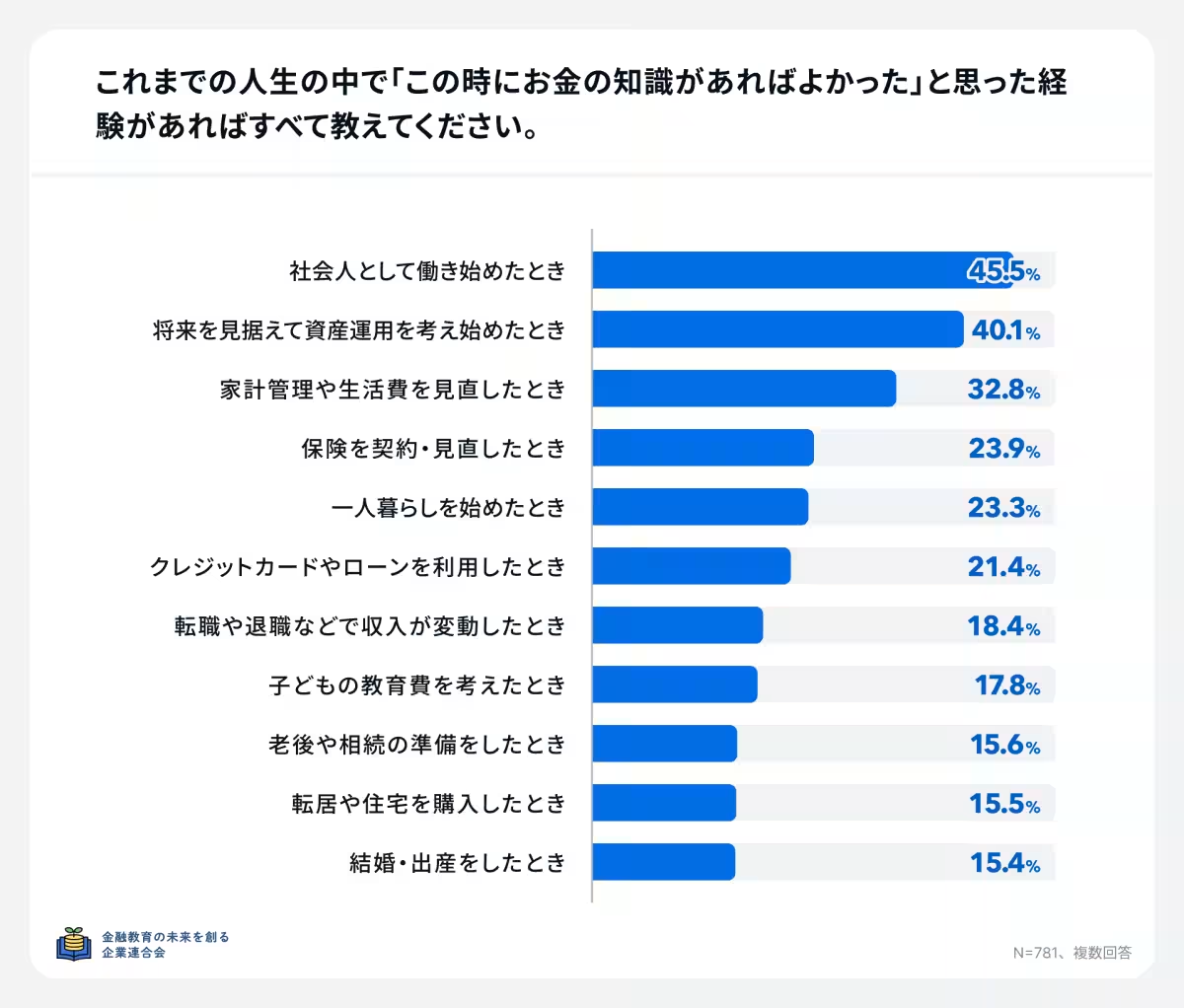

The predominant reason for pursuing financial education is to improve understanding of asset management (82.0%). Participants also expressed concerns regarding their knowledge levels, particularly when they started working as adults (45.5%) or began contemplating investment (40.1%). This emphasizes the significance of being financially literate during critical life transitions.

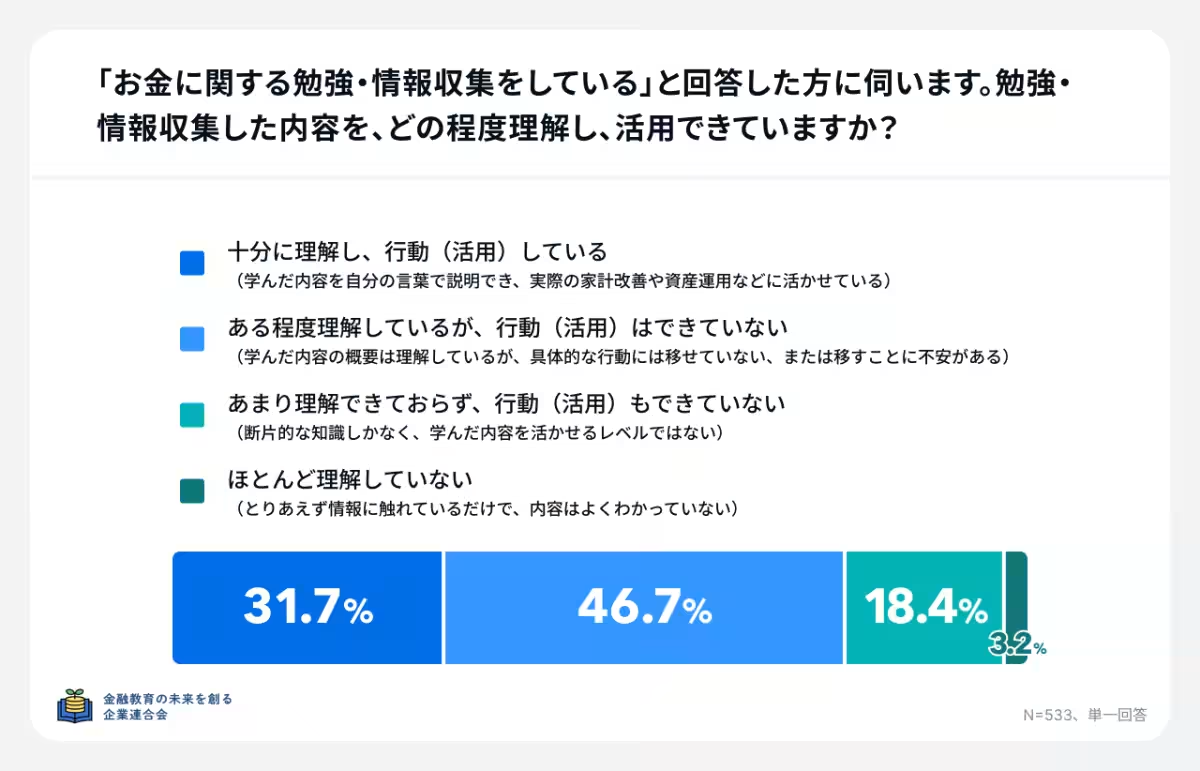

3. The Knowledge-Action Gap

The survey revealed a significant gap between understanding financial concepts and applying them. Only 31.7% reported they are effectively translating learned knowledge into action. Meanwhile, approximately 46.7% acknowledged they understand material but struggle to act on it. This indicates a pressing need for practical support in applying financial education.

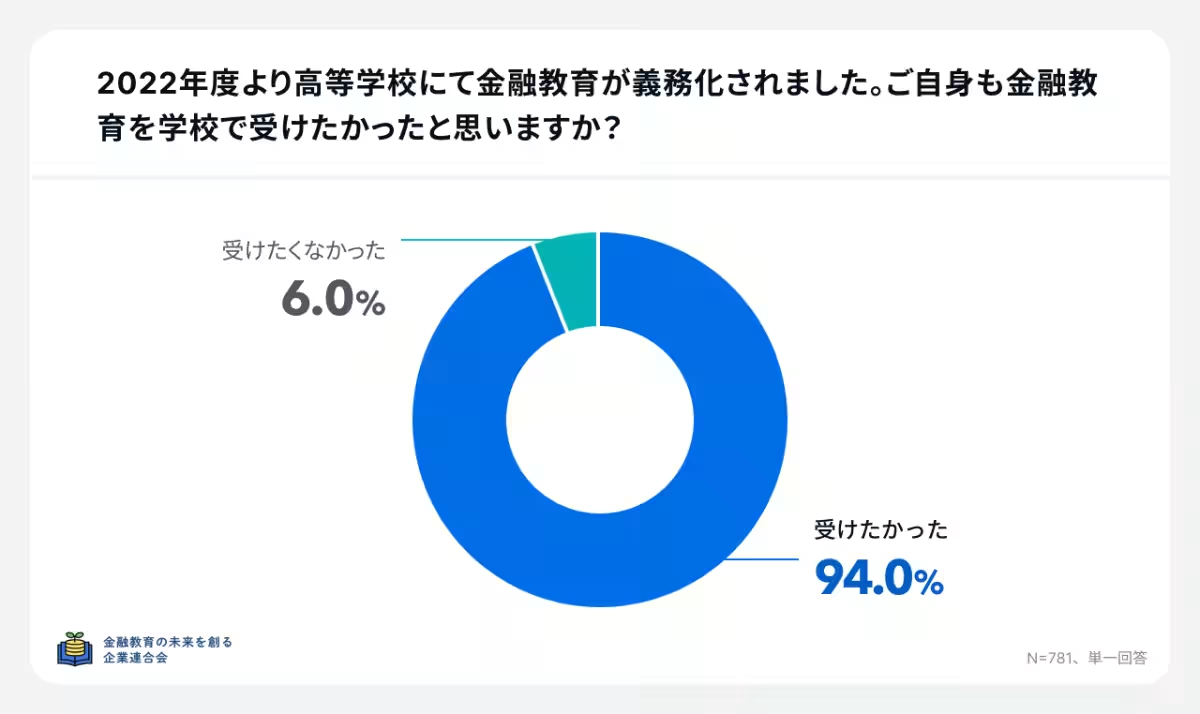

4. Demand for Financial Education in Schools

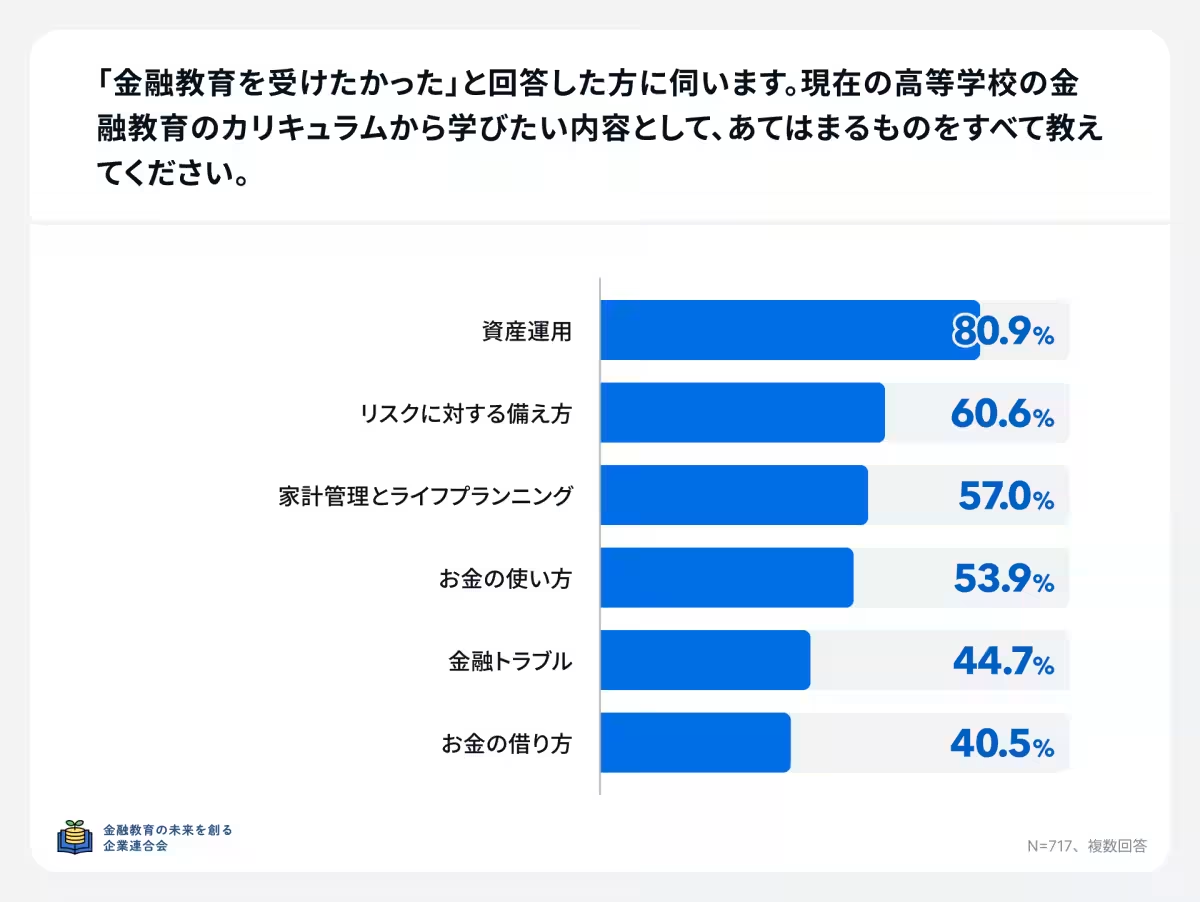

A remarkable 94.0% of participants wished they had received financial education during school. The preferred topics for learning included asset management (80.9%), reflecting a desire for more practical knowledge from a young age.

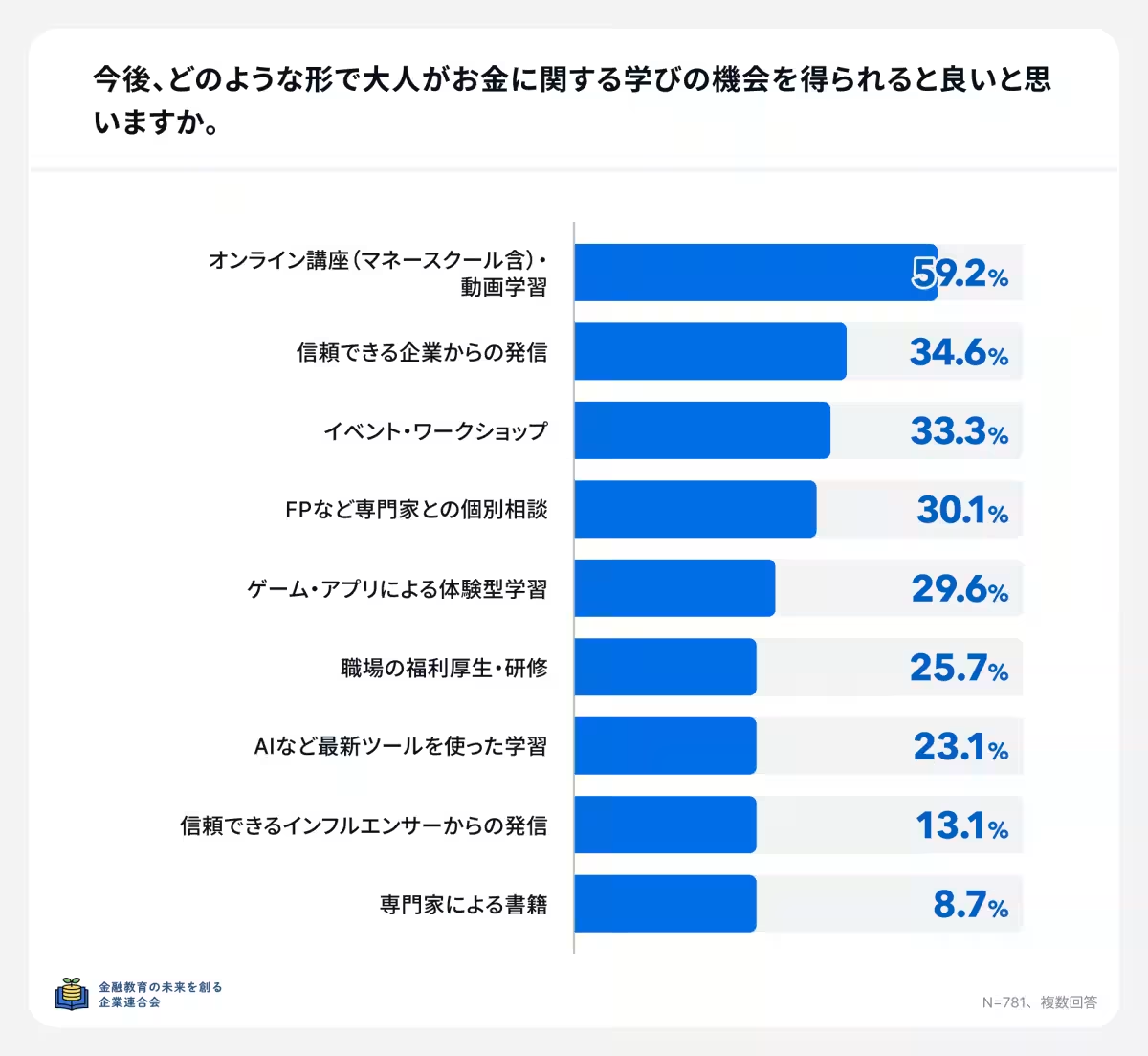

5. Future Learning Preferences

Looking ahead, the most favored method for learning about finance was online courses and video tutorials (59.2%). This preference showcases a trend towards flexible and accessible learning formats that cater to individual schedules.

Implications and Future Endeavors

The results of this survey highlight a growing interest in financial literacy, yet they also expose significant challenges faced by individuals in implementing practical financial solutions. The overwhelming desire for improved school-based financial education indicates a societal shift towards recognizing the importance of financial knowledge from early education.

Future strategies in financial education should focus on bridging the gap between theory and practical application. This may include enhancing online resources, providing hands-on experiences, and fostering partnerships between educational institutions and financial organizations.

Insights from Experts

Yugo Tsuji, the representative director of the Alliance for Creating Financial Education for the Future, emphasized the necessity of extending financial education beyond knowledge dissemination. He stated that it is crucial to support individuals in taking actionable steps with their newfound knowledge, especially in areas directly affecting their everyday lives such as savings and investments.

In closing, as the landscape of financial education evolves, it is essential to cultivate a resilient and knowledgeable society where individuals are empowered to make informed financial decisions at all stages of their lives. The commitment to fostering a culture of financial education is not merely beneficial but imperative for the economic growth of the nation as a whole.

Topics Financial Services & Investing)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.