moomoo Securities and State Street Launch Gold ETF Campaign with 2 Million Yen Prize

Exciting Gold ETF Campaign by moomoo Securities

Starting from November 10, 2025, moomoo Securities Co., Ltd. is thrilled to announce an enticing Gold ETF Campaign in collaboration with State Street Investment Management, aimed at enriching your investment journey!

This campaign presents an incredible opportunity for all investors engaging with the GLD and GLDM Gold ETFs. Participants will not only have the chance to increase their understanding of gold as an investment, but also stand a chance to win cash prizes amounting to 2 million yen through simple participation.

How the Campaign Works

To be a part of this campaign, investors must follow these easy steps:

1. Register on the campaign page.

2. Trade the eligible ETFs: SPDR® Gold Shares (GLD) or SPDR® Gold MiniShares Trust (GLDM).

3. If lucky, win 2,000 yen cash, with results announced in early January.

Prize Increases with Purchase

What sets this campaign apart is its double and triple chance opportunities:

- - When spending 50,000 yen or more, the chances of winning increase by two times.

- - For purchases of 100,000 yen or more, your chances skyrocket to three times.

This campaign runs until December 30, 2025, and aims to encourage interest in gold asset management, which has been experiencing considerable growth.

What's Driving Gold Demand?

Gold is traditionally viewed as a safe asset, and its price has been on a significant uptrend for several years, attributed to three key factors:

1. Rising Demand Due to Inflation

Concerns about global inflation have prompted many investors to seek refuge in gold, which holds value independent of national currencies and their supply controls. As inflation erodes the purchasing power of currency, gold’s intrinsic value has become increasingly appealing.

2. Increased Geopolitical Risks

With geopolitical tensions escalating worldwide, investor uncertainty rises. This environmental uncertainty leads to capital flowing from risk assets such as stocks and bonds to safe-haven assets like gold, solidifying its reputation as “the safe asset during turmoil.”

3. Expectations of U.S. Rate Cuts and Dollar Weakness

Speculations surrounding the Federal Reserve halting interest rate hikes and potentially cutting rates bolster gold's appeal. Lower rates enhance the attractiveness of gold as an investment, especially when coupled with a declining U.S. dollar.

Future of Gold Prices

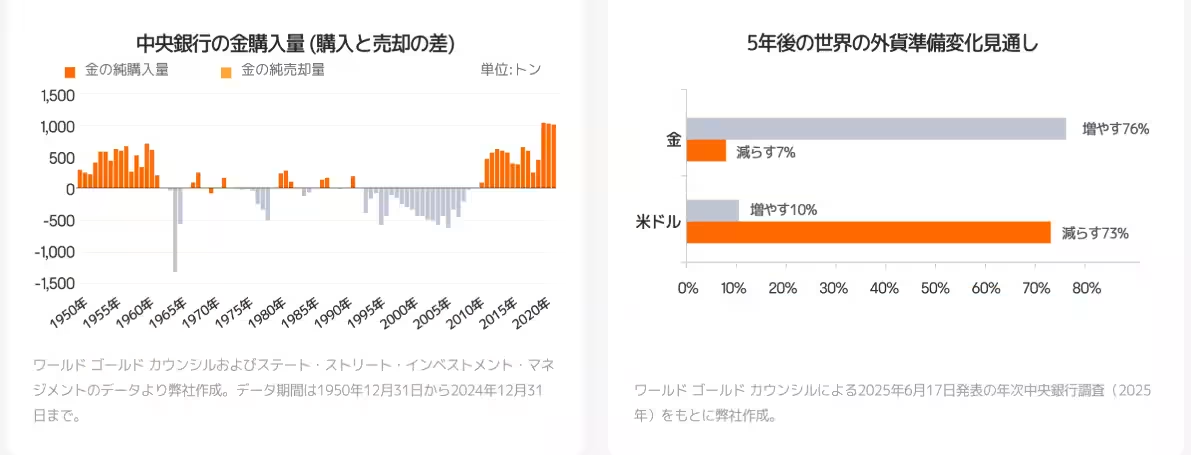

Notably, central banks around the world are purchasing gold at record pace to diversify foreign reserves and stabilize their currencies. This trend is expected to persist over the next five years, contributing to sustained upward momentum in gold prices.

Upcoming Seminar for Investors

To dive deeper into gold investments, moomoo Securities is hosting a seminar on November 16, 2025, featuring prominent media personality Mariko Mabuchi and State Street's gold strategist Aaron Chang. This session seeks to equip both novice and experienced investors with valuable strategies for incorporating gold into their portfolios effectively.

Seminar Details:

- - Date: November 16, 2025

- - Time: 16:00 - 18:00

- - Location: moomoo Securities Store, Omotesando, Tokyo

- - Registration: Starting at 15:30 (limited to the first 50 participants)

As interest in gold continues to grow, we invite all investors to explore this campaign and educational event, enhancing your investment strategy and knowledge about this precious asset. For more information, visit: moomoo Securities.

Embrace this golden opportunity and start your journey in gold investment with moomoo Securities today!

Topics Financial Services & Investing)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.