Emerging Trends in Japan's NISA Programs: Insights from OkaneCo Survey

Understanding Public Interest in Japan's NISA Programs

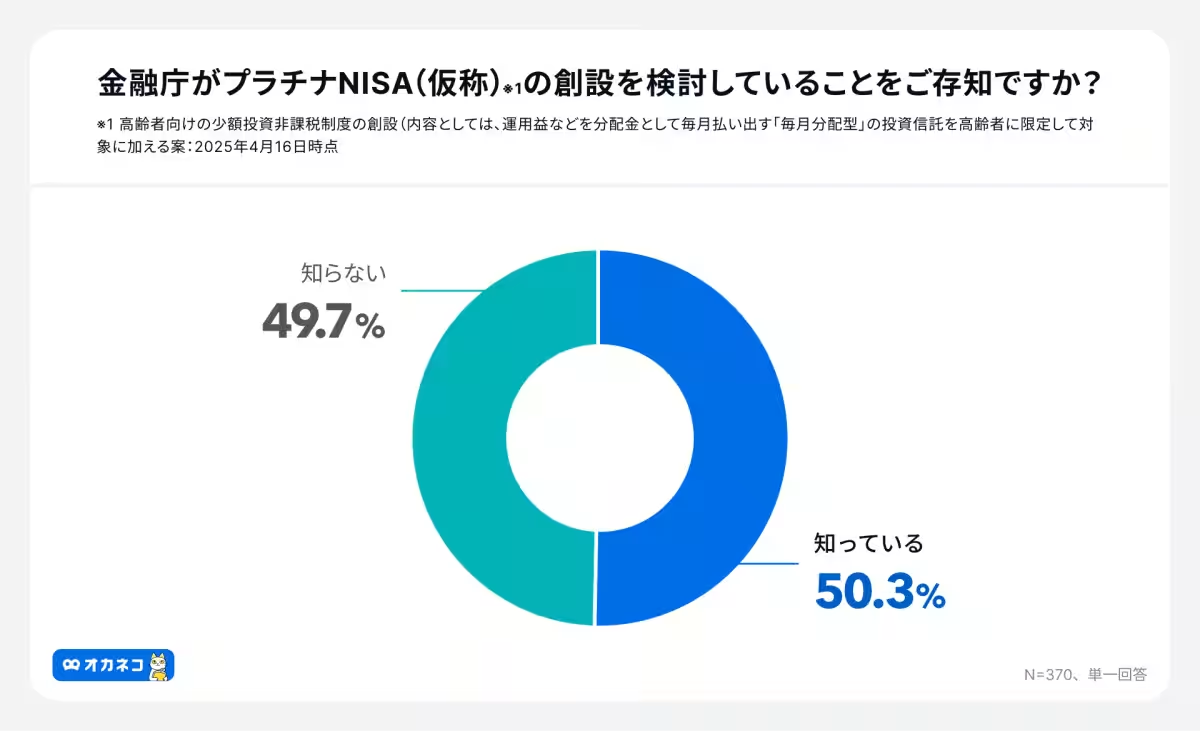

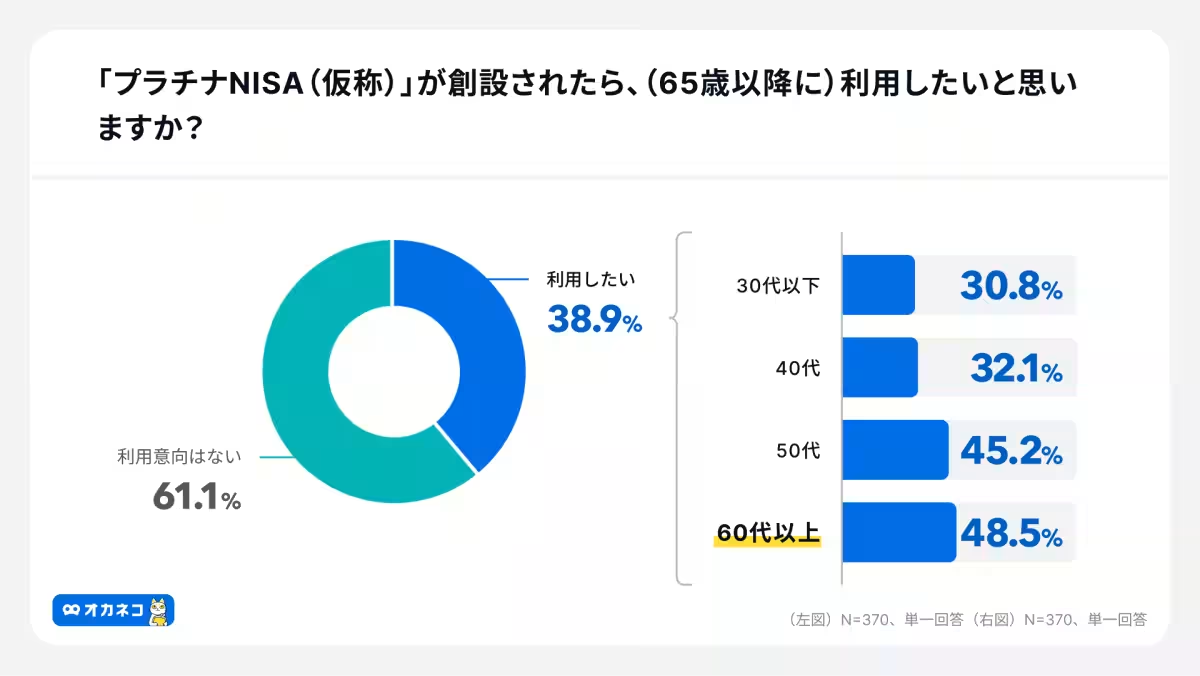

In a recent survey conducted by OkaneCo, a leading financial consultation service in Japan, intriguing insights into the public's perception of the new NISA (Nippon Individual Savings Account) programs have emerged. The survey revealed that awareness of the newly introduced Platinum NISA stands at 50.3%, although only 38.9% expressed intentions to utilize this investment scheme. Notably, among respondents aged 60 and above, nearly half (48.5%) showed a positive inclination towards participating in the initiative. This generational contrast emphasizes a growing acceptance of the Platinum NISA among older adults, highlighting its potential as a valuable financial tool for retirement planning.

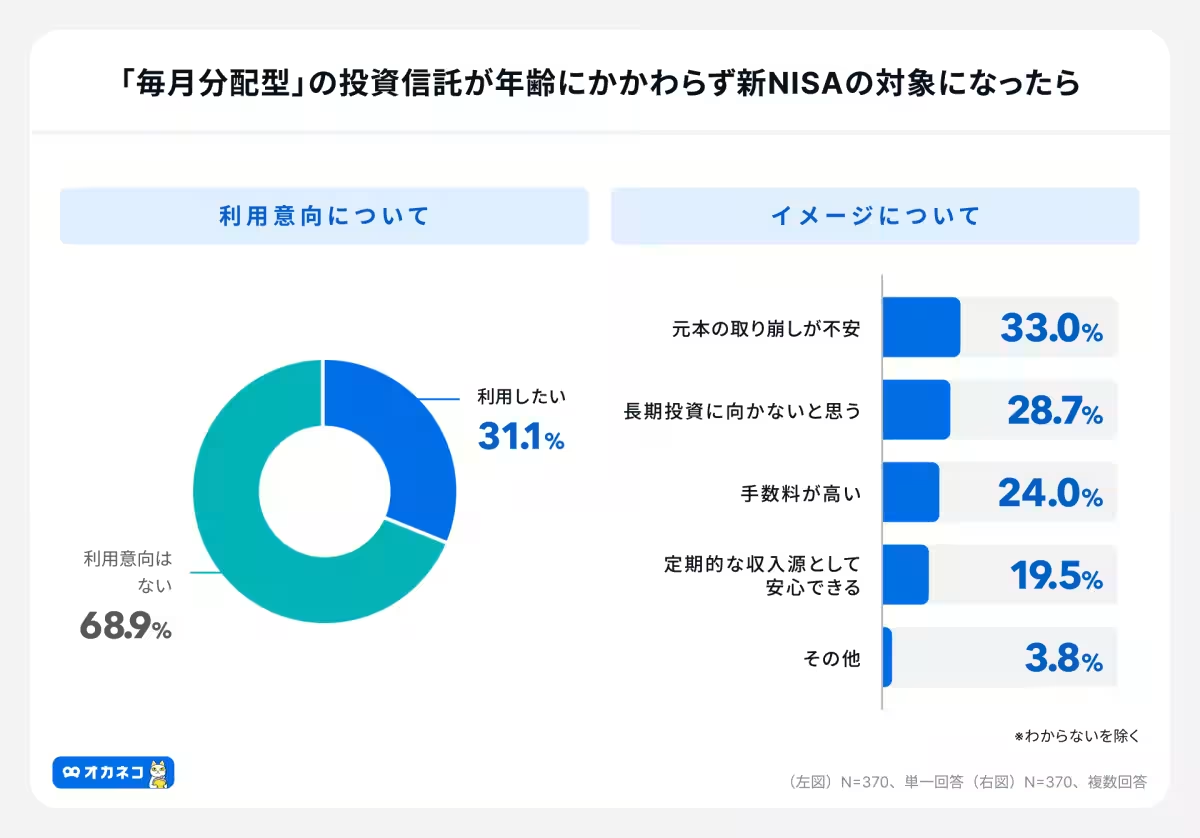

Investment Preferences: Monthly Distribution Investment Trusts

The survey also examined the interest in specific investment products eligible for the Platinum NISA. Among those surveyed, a mere 31.1% indicated a desire to invest in monthly distribution mutual funds under the new NISA framework. Despite its appeal, concerns prevailed, with 33.0% of respondents citing fears about depleting their principal capital and 28.7% questioning the suitability of long-term investments. This cautious attitude underscores a trend in the investment landscape where potential investors seek reassurance and clarity regarding the long-term implications of their financial choices.

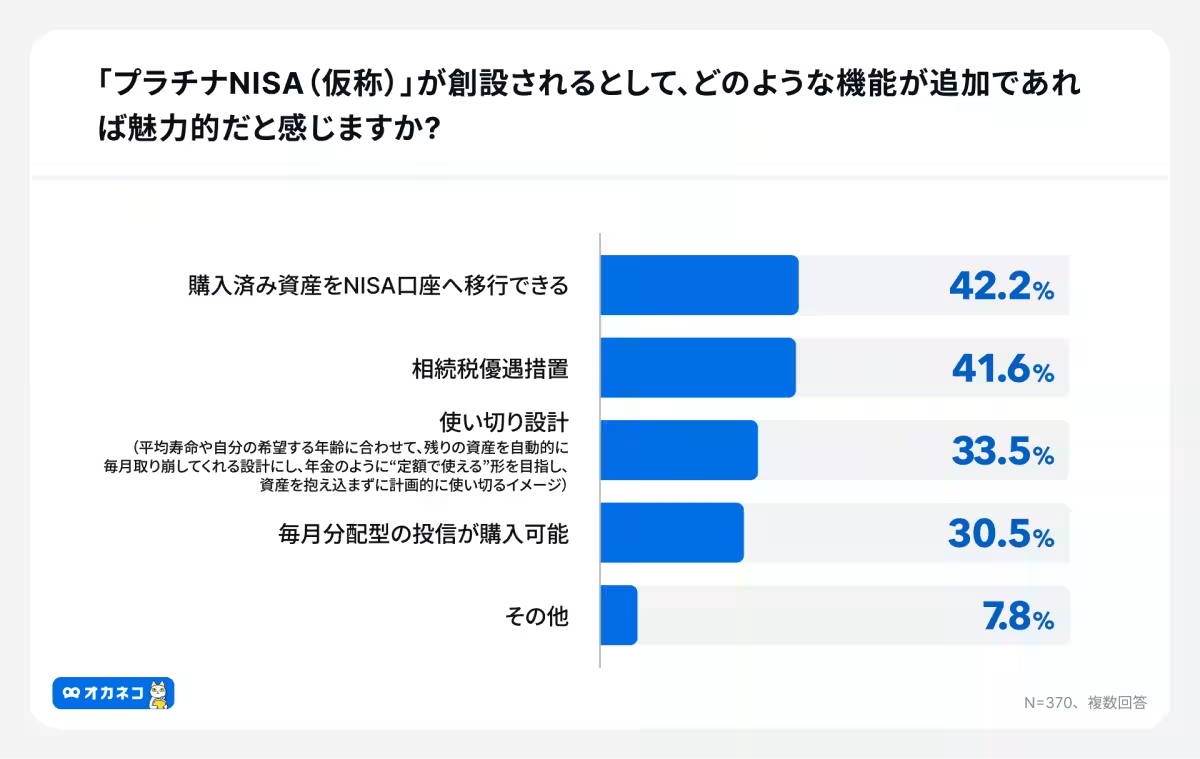

Desired Features for Platinum NISA

When participants were asked about desirable functionalities for the Platinum NISA, two features stood out: asset transfer capabilities and inheritance tax benefits. Around 42.2% expressed interest in features that allow for the transfer of already purchased assets into a NISA account, while 41.6% emphasized the importance of inheritance tax privileges. These findings reflect a clear demand for mechanisms that enable effective asset management and smoother transitions for families navigating wealth transfer—critical considerations for a nation grappling with an aging population.

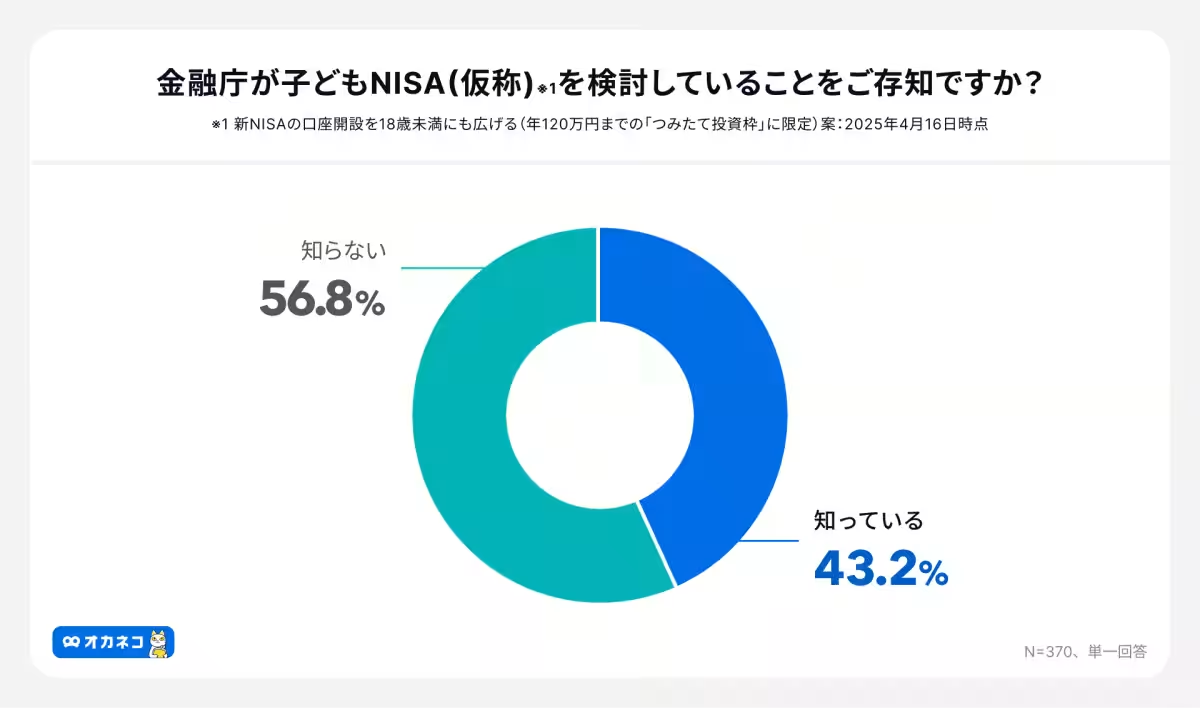

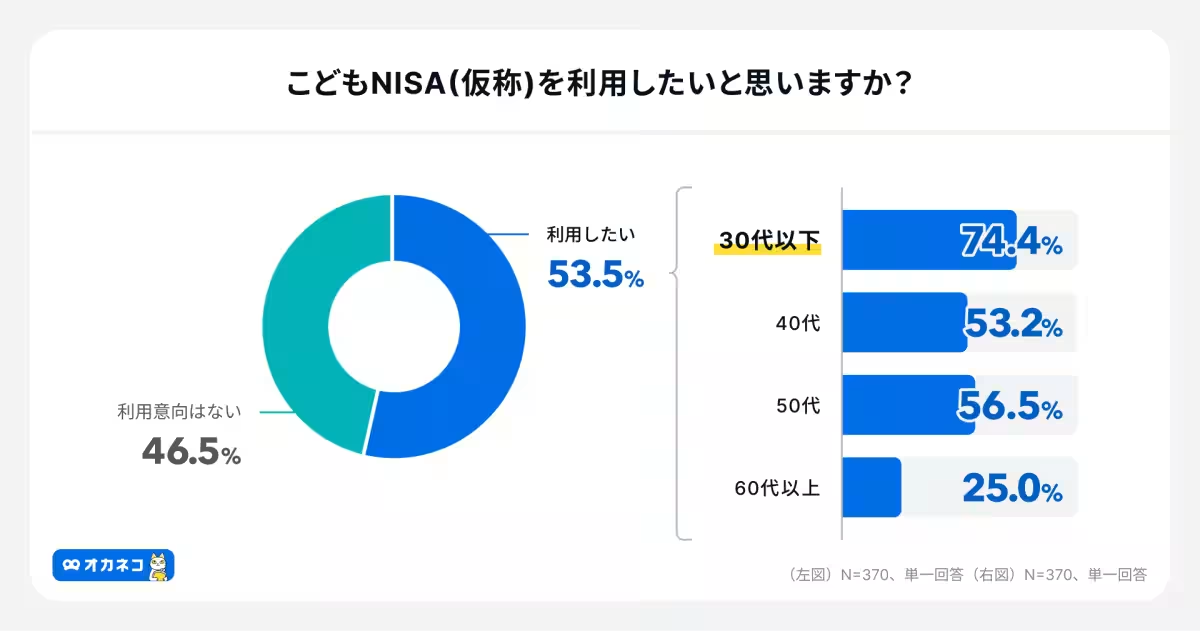

The Popularity of Kodomo NISA

In contrast, awareness of the Children’s NISA program, which aims to enhance investment opportunities for those under 18, reached 43.2%. Notably, 74.4% of respondents aged 30 and below expressed their intent to take advantage of this program, signaling strong interest within the younger parenting demographic. This enthusiasm highlights an emerging trend among younger generations who value financial literacy and proactive saving strategies for their children’s futures.

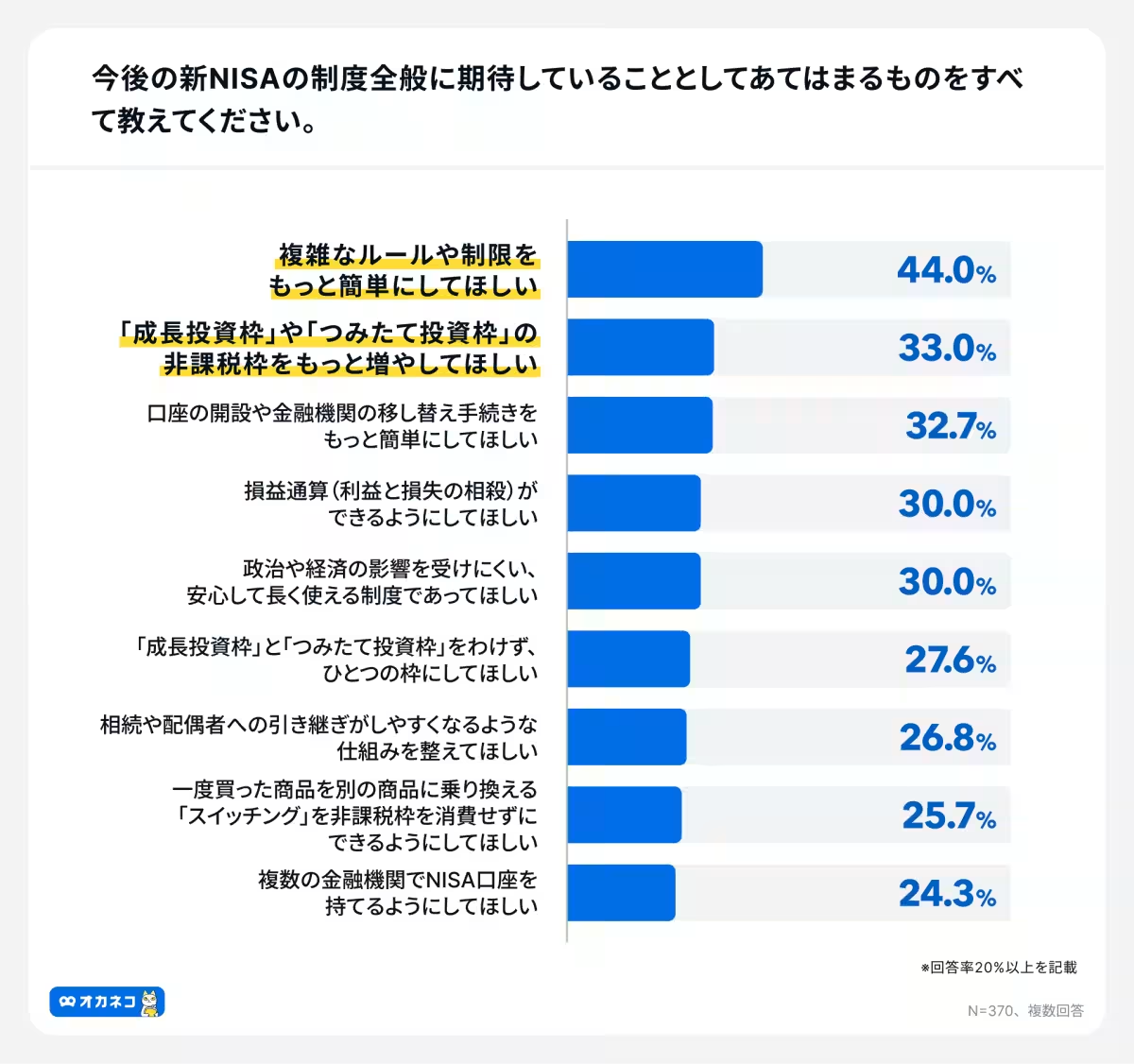

Expectations for the New NISA System

Overall, respondents voiced hopes for a simplified new NISA framework, emphasizing the need for clearer rules and increased tax-exempt investment limits. Specifically, 44.0% requested that complex guidelines be simplified, while 33.0% called for broader tax-exempt allowances within growth investment and installment investment frameworks. These preferences reveal an underlying frustration with the current complexities of the system, suggesting that many users wish to optimize their investment experiences.

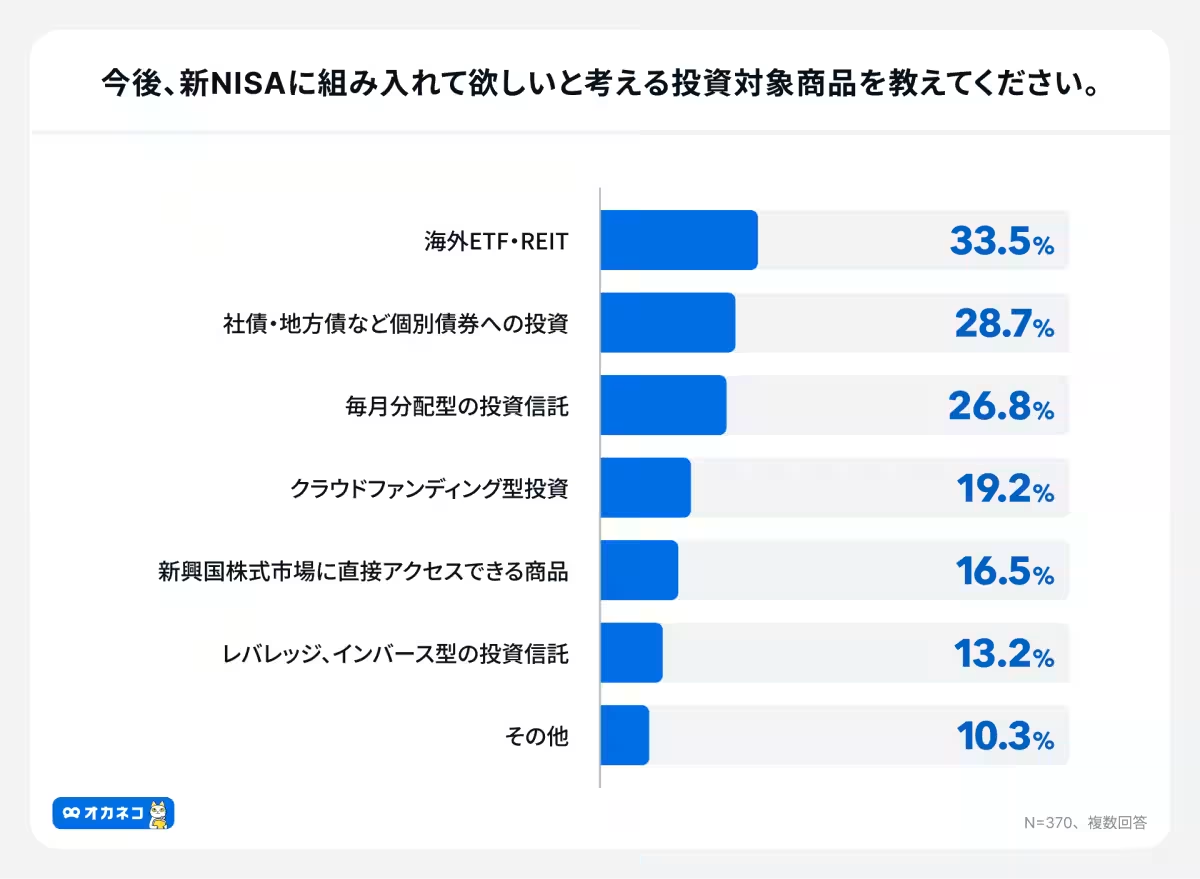

Additionally, when asked about investment products they wish to see included in the new NISA, there was a significant demand for international ETFs (33.5%) and individual bonds (28.7%). This indicates a strong desire for a more diversified portfolio, allowing investors to tailor their investments to their risk tolerance and objectives effectively.

Implications for Future NISA Programs

The insights derived from this survey underscore a critical need for financial institutions and policymakers to respond to the evolving landscape of investment preferences among various age groups. As Japan’s population continues to age, the desire for accessible and effective financial planning tools will only intensify. Residents voiced their challenges with existing systems, pointing out that many still find it difficult to navigate investment options or grasp complex regulations.

To address these issues, OkaneCo remains committed to offering comprehensive consultations that guide users through the intricacies of the NISA programs and overall financial planning. Their aim is to foster a habit among individuals to engage with financial professionals rather than grapple with uncertainties alone. Through specialized advice and strategic financial support, OkaneCo is positioned as a leader in the financial wellness space, contributing meaningfully to improving the financial futures of its users.

This survey serves not only as a reflection of current attitudes toward NISA programs but also highlights the areas where improvements are needed to create a more user-friendly investment framework for all Japanese citizens.

Topics Financial Services & Investing)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.