Is Real Estate a Viable Tax Savings Strategy for High Earners?

Exploring Tax Savings Through Real Estate

As high-income earners navigate the complex landscape of tax savings, many wonder whether investing in real estate can be a viable strategy. Recent research conducted by Prosper Design Corporation sheds light on the preferences and experiences of individuals earning over 20 million yen annually regarding various tax-saving measures.

The Landscape of Tax Savings

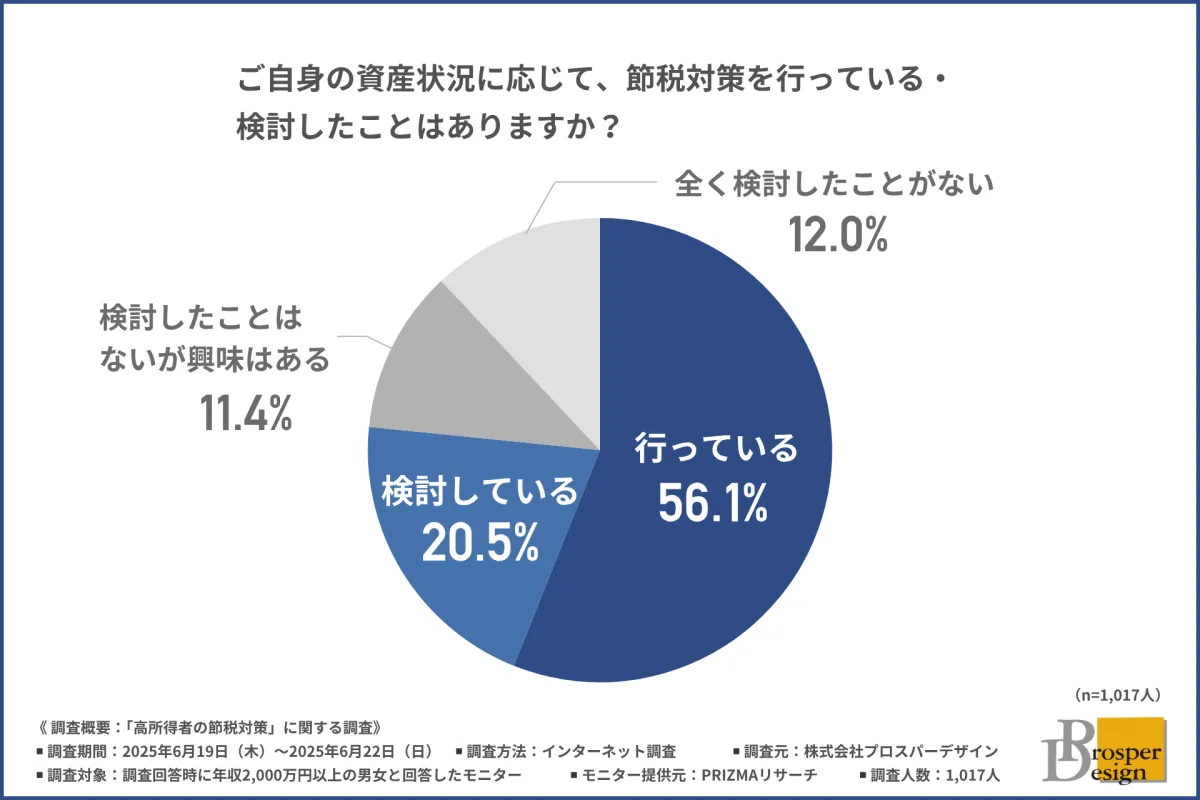

A survey of 1,017 participants revealed that over 80% of high earners are either actively engaged in tax-saving measures or considering them. However, a significant portion of respondents, about 40%, expressed dissatisfaction with their current tax-saving strategies, indicating challenges in achieving real results. This raises critical questions about the effectiveness of commonly used methods like hometown tax donations, insurance products, and the Nippon Individual Savings Account (NISA).

Insights from the Survey

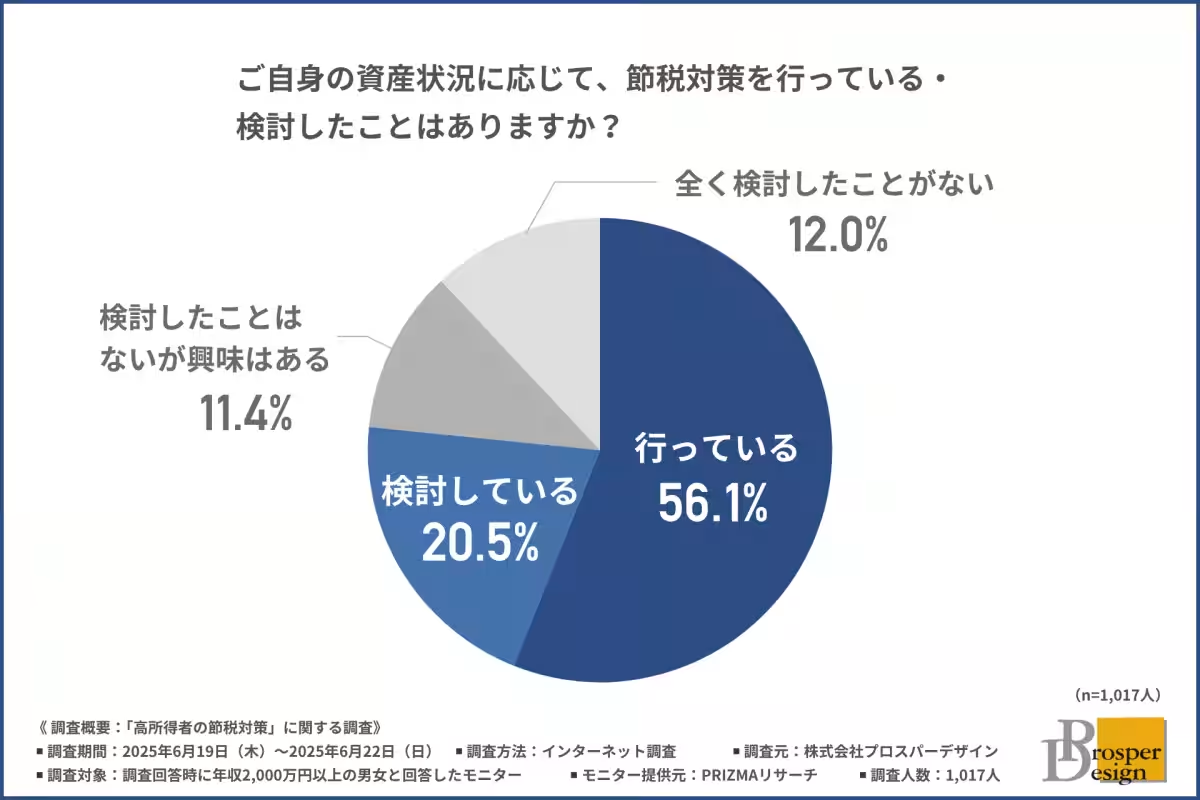

When asked about their current tax-saving strategies, 61.6% of respondents cited hometown tax donations as their primary method, followed by 54.4% for insurance products and NISA. Interestingly, 41.2% indicated interest in generating income through rental properties. This highlights a growing curiosity about real estate as a means of tax savings among high-income earners.

The Appeal of Real Estate

Real estate investment appears appealing for several reasons, including potential tax deductions and the capacity to generate rental income. Participants in the survey recognized that while the idea of leveraging real estate for tax benefits is intriguing, the practical challenges often deter them from taking action. Just under half of the respondents identified challenges such as feeling that the tax benefits aren’t substantial enough or being overwhelmed by the complexities of current tax laws.

The Allure of Second Homes

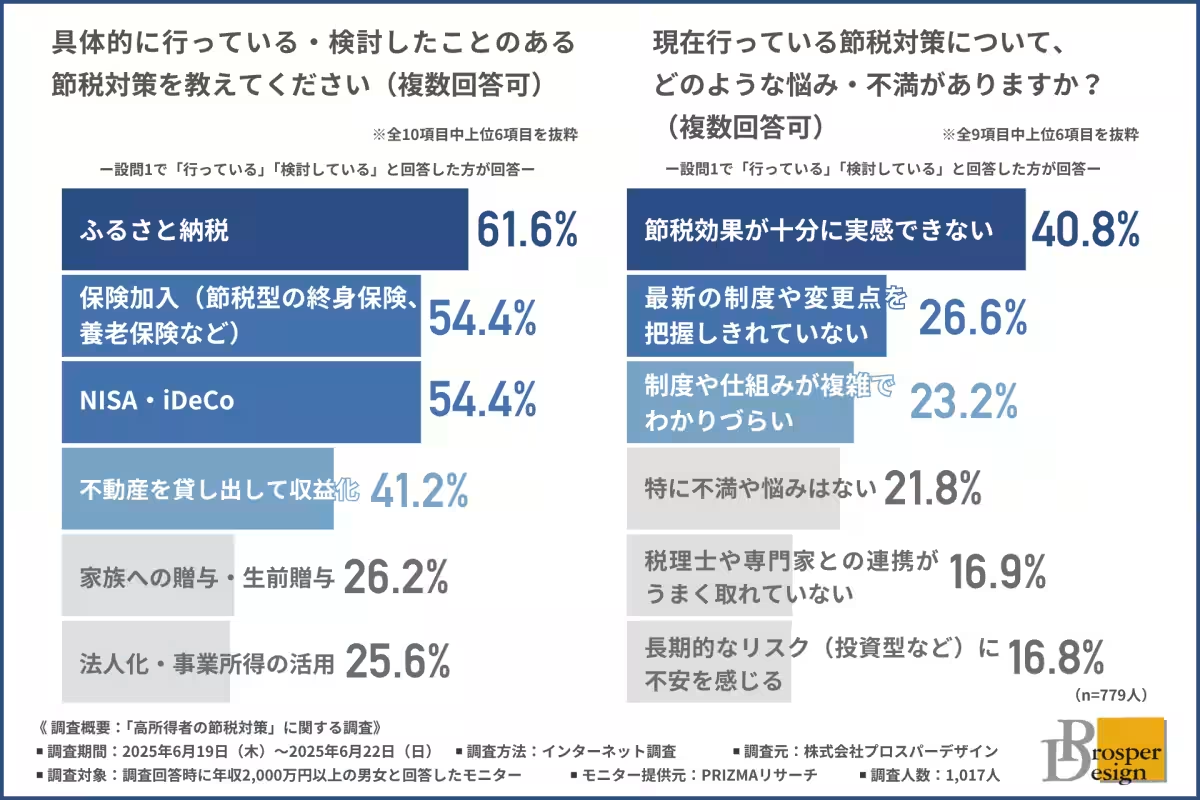

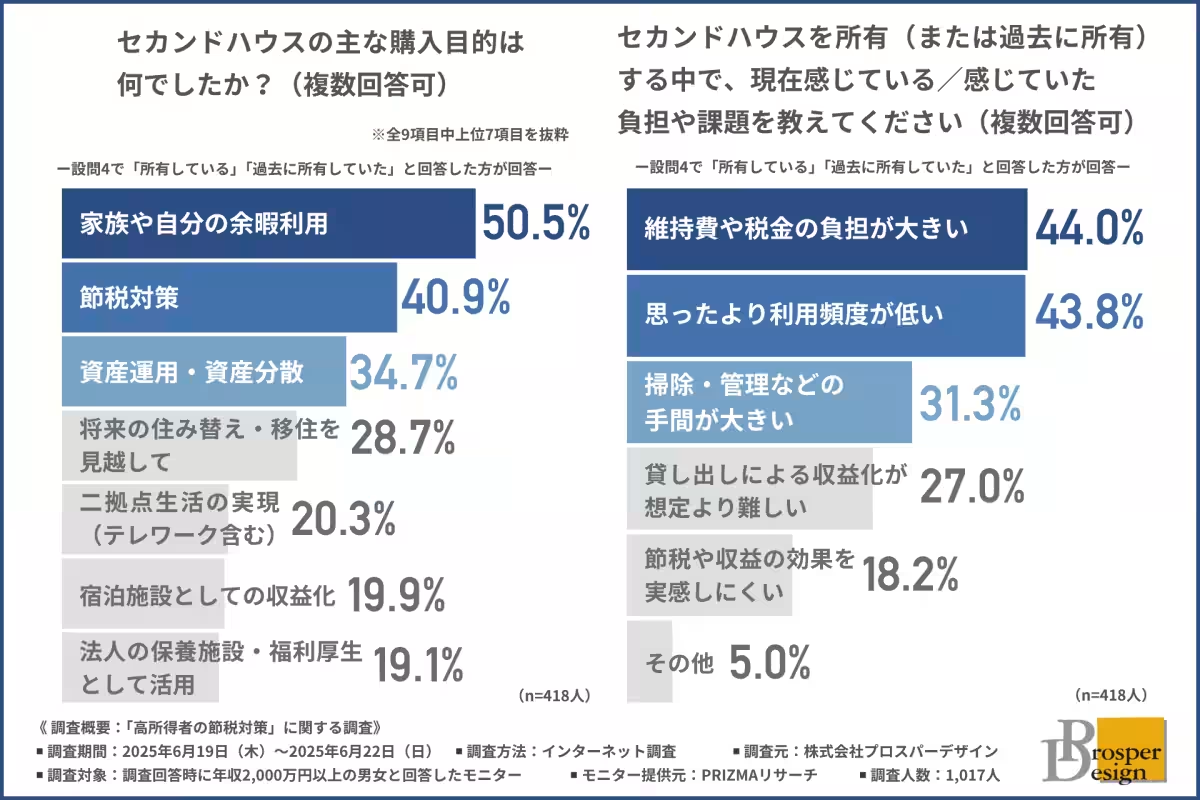

Another focal point of the research was the ownership of second homes. Approximately 31.4% of high-income earners own a second home, with another 9.7% having owned one in the past. The primary reasons for purchasing second homes included family leisure use (50.5%) and tax savings (40.9%). This clearly shows that for many high earners, second homes serve the dual purpose of providing recreational opportunities while also acting as a financial strategy.

Challenges of Owning a Second Home

Despite the benefits, owning a second home comes with its set of challenges. Roughly 44% of current or former owners reported issues with maintenance costs and property taxes. Additionally, the low frequency of use (43.8%) and the effort involved in managing these properties can deter individuals from considering the purchase of a second home.

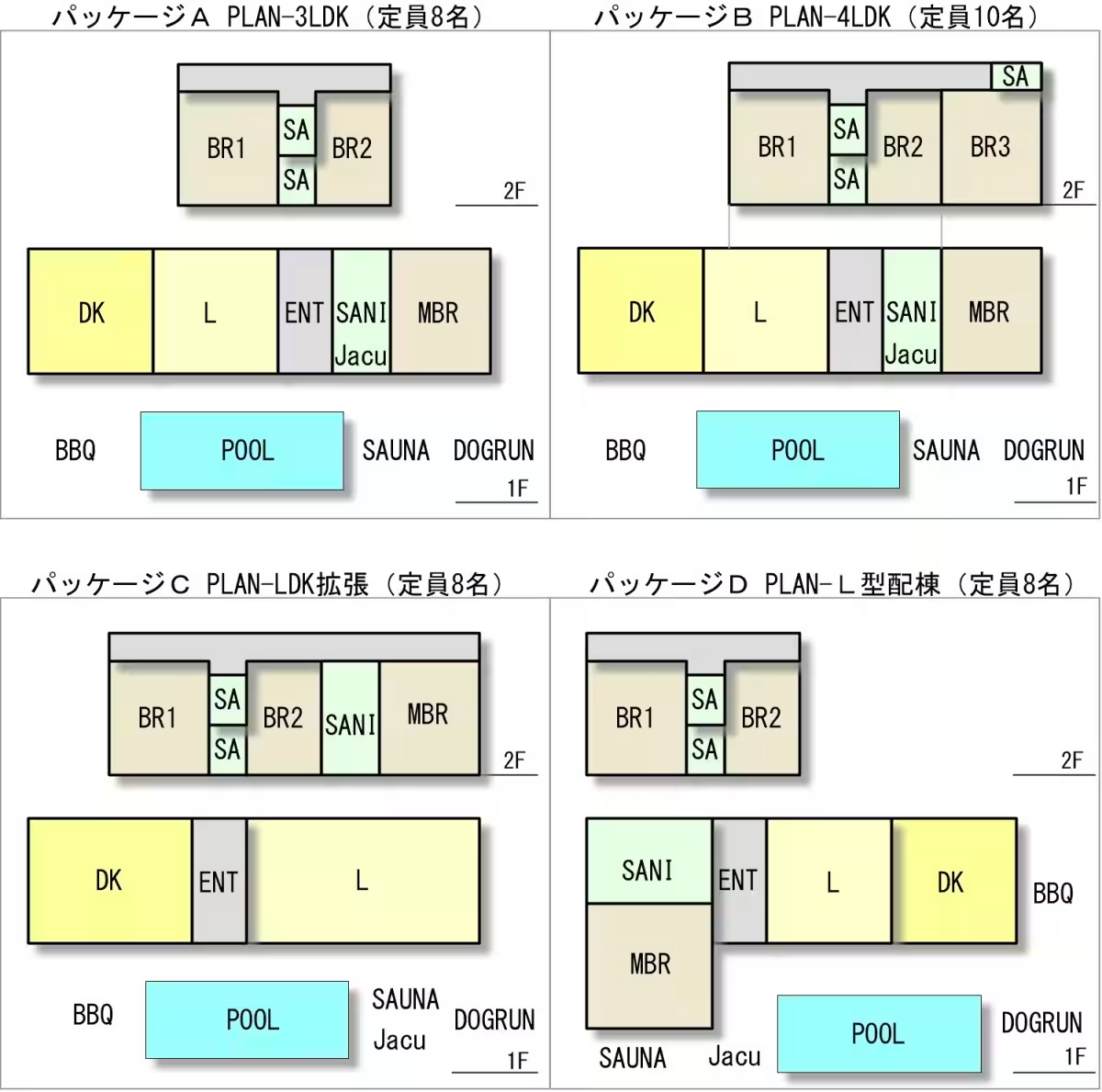

Preferences in Property Selection

Survey participants indicated their most critical considerations when selecting second homes, primarily focusing on easy access to urban centers (32.1%). Equally important were the prospects of enjoying natural beauty and environments conducive to relaxation (27.7%). This interest indicates that high earners desire properties that not only provide tax benefits but also enrich their personal lifestyles.

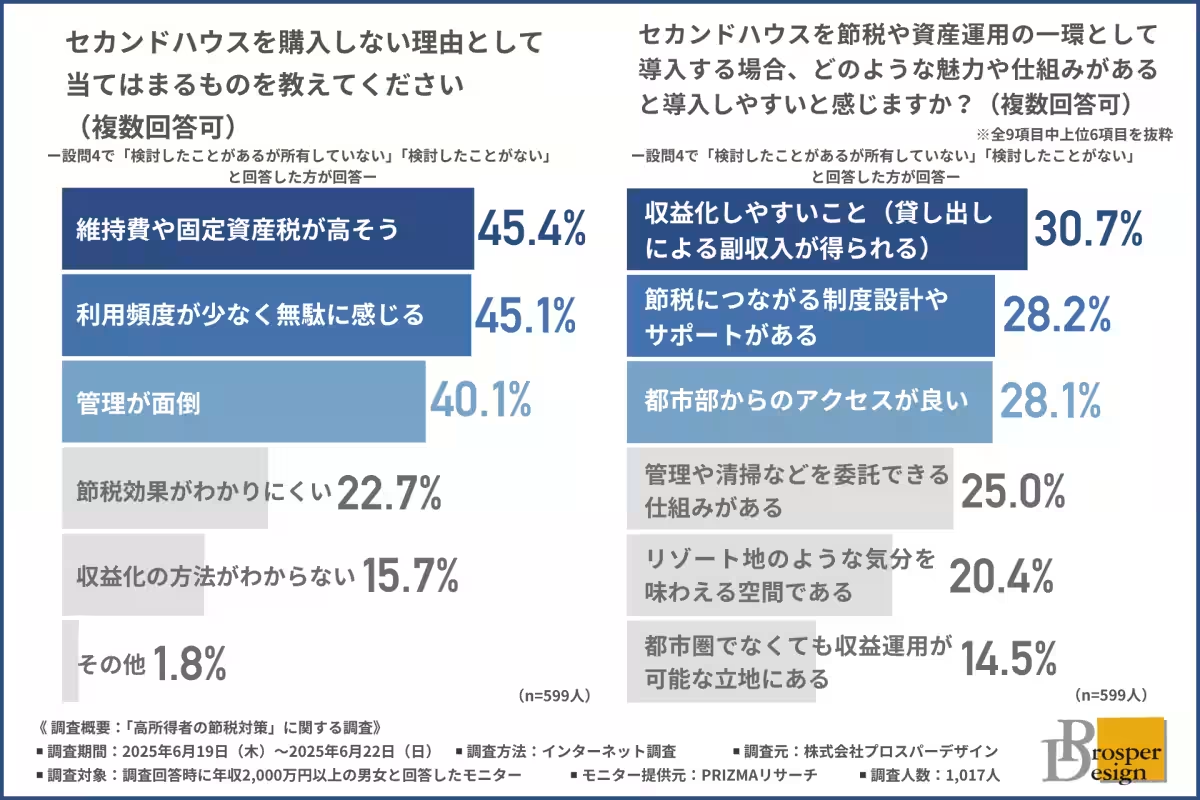

Barrriers to Acquisition

On the other hand, individuals who have not purchased second homes primarily cited concerns over high maintenance fees (45.4%) and perceived issues with low utilization rates (45.1%). For many, the idea of managing a second property seems daunting, underscoring the demand for structures that facilitate easier engagement with real estate.

Seeking Effective Solutions

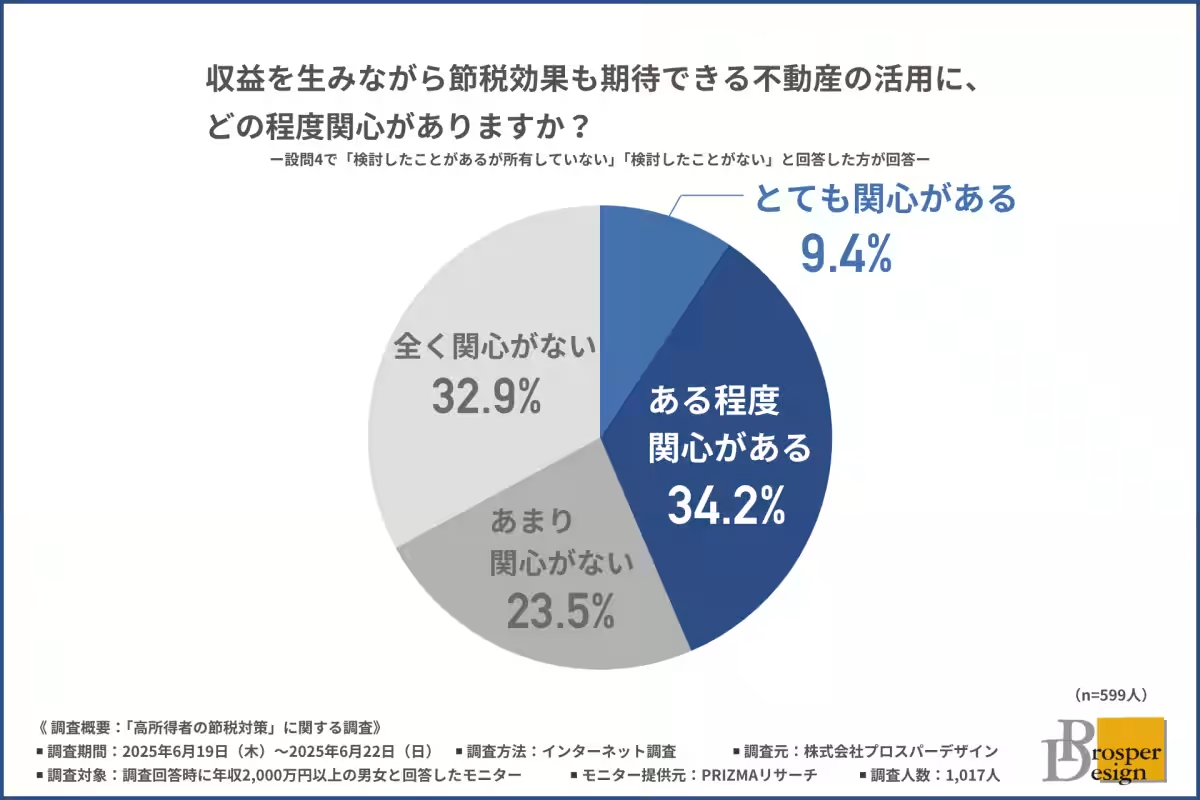

Looking ahead, there is a noticeable desire for better support systems that simplify property investment. Participants in the survey suggested that properties should come with specific benefits, such as ease of rental income generation and streamlined management processes. The respondents emphasized a preference for a solutions-oriented approach to tax savings and real estate investment, noting the potential of systems that support their needs without requiring excessive effort on their part.

The Future of Tax Savings and Real Estate

With around 40% of survey participants expressing interest in harnessing the tax benefits of real estate investments, it’s evident that combining physical assets with efficient legislative frameworks and support services can create sustainable tax-saving opportunities. As high earners continue to adapt their strategies in response to changing circumstances, the interplay between real estate investments and tax benefits stands to play an increasingly critical role.

In conclusion, high-income earners are in search of multi-faceted strategies to optimize their tax savings. While current methods such as hometown donations and investment in insurance remain prevalent, the potential of real estate—particularly in the context of second homes—offers avenues worth exploring. By addressing the barriers of ownership, including management and maintenance aspects, it will be possible to unlock the value of real estate as an effective tool for tax savings.

Topics Financial Services & Investing)

【About Using Articles】

You can freely use the title and article content by linking to the page where the article is posted.

※ Images cannot be used.

【About Links】

Links are free to use.